There was little in 2025 to suggest travel demand was weakening.

What did change was how selectively people travelled, and what they were prepared to tolerate in the process.

What follows is a synthesis of those signals. Here are 10 vacation rental trends that will shape the market in 2026.

1. Everyone Chases Luxury, Because It Looks Like the Safest Bet

If there was one segment of travel that felt relatively insulated in 2025, it was luxury. While broader travel demand shifted, softened, or became more volatile depending on market and season, higher-end stays continued to attract travelers willing to spend.

According to WATG Research, high-end tourism is already a $1.38 trillion market, and is expected to grow faster than any other luxury segment through 2028.

That resilience matters, because platforms and brands don’t respond to sentiment; they respond to where revenue feels least fragile.

In 2025, Airbnb made a decisive move by reintroducing hotels. It’s not unreasonable to expect a similar proper relaunch of Airbnb Luxe in 2026, less as a hidden tier, and more as a visibly elevated category within the core experience .

What “luxury” actually signals in 2026

Booking.com and Expedia are moving in parallel directions, emphasizing curated, high-quality stays and leaning into language around intentional travel and “travel on your terms” rather than volume or deals . At the same time, advisor-led and concierge-style travel planning is regaining relevance at the high end, reinforcing the idea that luxury is as much about certainty and ease as it is about aesthetics.

2. Asia’s Travel Momentum Becomes Impossible to Ignore

While regulatory pressure and market maturity slowed growth across parts of Europe and the U.S. in 2025, Asia emerged as the clearest area of momentum, both as a source of outbound travelers and as a fast-growing regional travel market in its own right.

Airbnb, Booking.com, and Expedia all reported strong gains across Asia last year, and not by accident. Platforms have been investing heavily in localization across the region: language support, regional payment systems, local partnerships, and inventory expansion.

Why growth is shifting east

Asia’s rise coincides with growing friction elsewhere. Higher visa fees, stricter entry requirements, and longer processing times in the U.S., combined with regulatory tightening in parts of Europe, are subtly reshaping travel flows.

Cultural fluency, clarity, and trust signals will increasingly shape who captures this demand.

3. Travel Reroutes Around Friction Not Desire

One of the most consistent themes across travel reporting in 2025 was not fatigue with travel itself, but fatigue with friction.

Travelers still want to move. What they increasingly resist are unpredictable borders, opaque rules, administrative burden, and unnecessary stress layered onto the journey.

This has direct implications for 2026, particularly in a year defined by major global events. The FIFA World Cup, for example, will generate massive international demand, but not all host cities or countries will benefit equally.

Why “easy” is winning

Where comparable experiences exist, travelers may gravitate toward locations that feel easier to enter, easier to navigate, and easier to understand. Canada or Mexico hosting World Cup matches may capture demand from international travelers who would otherwise default to the U.S., simply because the process feels smoother.

This pattern extends well beyond mega-events. As trips become shorter and booking windows compress, travelers have less tolerance for complexity. When faced with two similar destinations, ease becomes a deciding factor.

4. Sporting Events Become the Spine of Travel Planning

Sports tournaments, music residencies, and large-scale cultural events are no longer isolated reasons to travel. They’re shaping how people travel: following a team across cities, catching multiple tour dates, or extending trips to turn a single event into a broader journey.

Looking elsewhere, even Pinterest’s 2025 trend data points in this direction, highlighting rising interest in football tournaments, auto racing, river rafting, and adrenaline-led travel experiences.

What makes 2026 different is scale and predictability. The FIFA World Cup 2026 across the U.S., Mexico, and Canada, and the Winter Olympics in Milan, alongside countless regional athletic events. Expedia’s 2026 outlook reflects this shift as well, framing events as catalysts for multi-city and multi-country travel rather than single-destination spikes.

5. Last-Minute Demand Grows

Travelers aren’t less interested in travel. They’re just less willing to commit early.

Throughout 2025, booking windows continued to shorten across markets, a pattern confirmed by RSU’s own multi-country analysis and echoed in platform reporting. More than a temporary reaction to a single disruption,this data reflects a broader reality: schedules are fluid, costs are volatile, and many travelers now wait until plans feel locked before they book.

Airbnb’s 2026 predictions hint at this behavioral shift from another angle, pointing to shorter, more spontaneous trips – including 1–2 day international city breaks – especially among younger travelers. Expedia and Booking.com similarly emphasize flexibility and traveler control as defining themes, reinforcing the idea that certainty increasingly arrives late in the decision process.

6. Demand Splits Between Rest and Thrill

One of the more interesting contradictions in travel right now is that people seem to want opposite things at the same time.

On one end of the spectrum, there’s a growing appetite for rest, recovery, and neurological reset. Booking.com and Airbnb have both leaned heavily into themes of sleep quality, quiet, nature, and stepping away from constant stimulation. The language of travel increasingly overlaps with the language of wellness.

On the other end, interest in adrenaline, challenge, and intensity is rising just as fast. Pinterest’s data shows increased engagement with adventure-led travel – from water sports to motorsports – where the activity isn’t an add-on, but the reason for the trip.

Recovery on one end, adrenaline on the other

What’s disappearing is the expectation that one trip should do everything. Instead of balanced itineraries, demand is polarizing. Travelers are choosing trips that are clearly about rest or clearly about thrill, often within shorter timeframes and with fewer compromises.

For vacation rentals, this matters because ambiguity no longer converts as well. Properties that try to be everything to everyone risk blending into the background.

This polarization also intersects with last-minute behavior. When people book late, they’re not browsing abstract possibilities. They’re solving a specific need: recovery or release. In 2026, the clearer a property is about which need it serves, the more likely it is to be chosen.

7. Regulation Stops Being a Shock and Starts Acting Like Gravity

By 2025, regulation was no longer an episodic risk for short-term rentals. It had become a structural force, and one that increasingly favors operators with scale, systems, and staying power.

New licensing regimes, registration requirements, tax reclassifications, and enforcement mechanisms did not arrive uniformly, but their cumulative effect was consistent: operating informally became more expensive, more time-consuming, and more fragile. Compliance stopped being a one-time hurdle and started behaving like ongoing overhead.

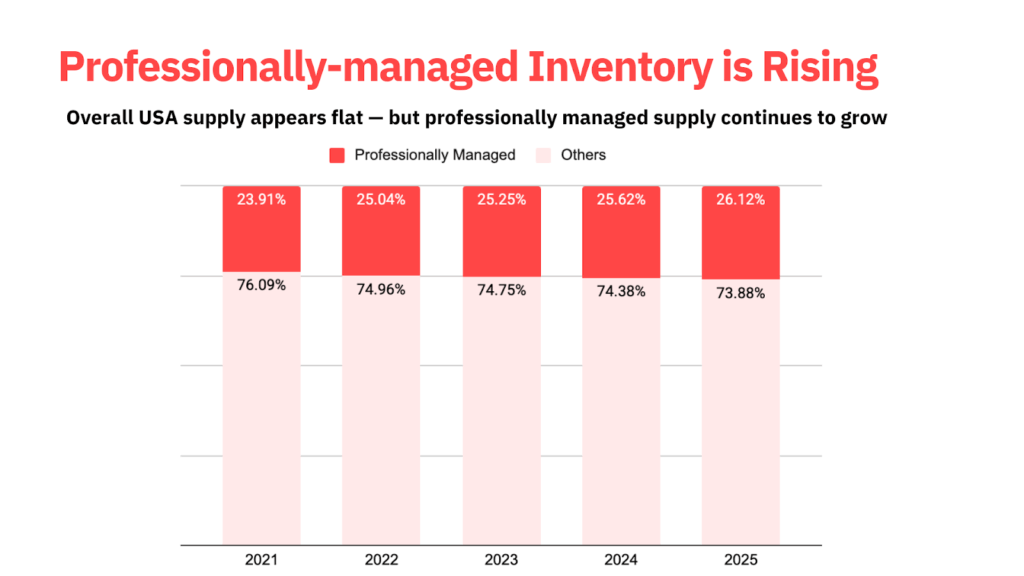

One of the clearest signals of how this is reshaping the market comes from RSU’s 2025 data analysis across multiple countries. While overall supply growth slowed in many markets, property managers with portfolios of 100+ listings continued to grow faster than the market average.

This suggests that even as regulatory pressure caps or slows total inventory growth, larger professional operators are still expanding, often by absorbing supply that smaller, less-resourced operators are no longer able or willing to manage.

This isn’t simply a story about ambition or better tooling. It reflects how regulation redistributes opportunity. Operators with legal support, standardized processes, and the ability to absorb administrative costs are better positioned to adapt. Others may exit, sell, or consolidate.

8. Generic Rentals Fade as Identity Takes Center Stage

As supply has expanded and platforms have converged, one thing has become increasingly clear: being “nice” is no longer enough.

Travelers today are confronted with endless choice. Airbnb, Booking.com, and Expedia all offer overlapping inventories that include vacation rentals, hotels, and experiences side by side. In that environment, neutrality feels forgettable.

Identity as a conversion lever

This is where broader cultural signals become relevant. Pinterest’s trend reporting highlights a growing appetite for expressive aesthetics, regional character, and spaces that feel curated rather than standardized. The same shift appears in travel media, where interest in place-driven narratives, salvaged buildings, and culturally specific stays continues to grow.

The infamous “Airbnb aesthetic” – light wood, beige palettes, generic art – isn’t disappearing entirely. It still works in some contexts, especially functional, business-oriented travel. But for a growing share of leisure demand, identity alignment is the differentiator. Travelers increasingly want spaces that reflect values, taste, or a sense of place they recognize themselves in.

9. AI Personalization Becomes the Gatekeeper to Visibility

Airbnb, Booking.com, and Expedia now all position themselves as end-to-end travel platforms. Flights, hotels, vacation rentals, experiences, and even events increasingly live in the same interface. That breadth creates choice overload, and AI-driven personalization is the solution platforms are betting on.

All three major players have been explicit about this direction. Airbnb has discussed natural-language search and more personalized discovery paths. Booking.com and Expedia have emphasized using their booking data to surface more relevant options faster. The underlying logic is the same: conversion depends on showing fewer, better-matched results, not more options.

Clarity matters more than ever

This has two important consequences. First, platforms with rich first-party booking data gain an advantage over external AI answer engines, which may understand intent but lack transaction history. Second, listings themselves need to become more legible, to machines as well as humans.

10. Hello Pricing Psychology!

For a long time, pricing in short-term rentals was treated as a technical problem. Get the math right, follow the market, adjust for seasonality, and the bookings would follow. By 2025, that assumption was already cracking.

Now, travelers are not just asking how much a stay costs, they are asking whether the price makes sense.

This shift has been brewing for years, but several developments brought it into focus. All-in pricing requirements, greater fee transparency, and changes to how platforms present prices have trained travelers to scrutinize value more closely. Airbnb’s host-only fee rollout in 2025 is a clear example: in many cases, the underlying economics didn’t change dramatically, but guest perception did. The same stay, framed differently, suddenly felt more expensive – or more honest – depending on how it was presented.

When math isn’t enough

This is where pricing psychology overtakes pricing mechanics. In a world of choice, guests want to understand why a stay costs what it does. What are they paying for? What makes this place different? What experience does the price unlock?

For vacation rental managers, this changes how pricing strategy needs to be communicated. Price needs narrative support. That support can come from many places: proximity to a major event, a unique location, a design story, exceptional rest and quiet, or deep local integration. The point isn’t to justify every euro or dollar line by line, but to make the overall number feel coherent.

The Bottom Line

Taken together, these trends point to a more selective vacation rental market.

Demand is arriving later, clustering around specific moments, and rewarding operators who are clear about what they offer and who they’re for. Platforms are converging. Regulation is no longer episodic. Travelers are more decisive, but less forgiving of ambiguity.

The throughline across 2026 is coherence. Listings that tell a consistent story, in positioning, pricing, experience, and operations, are easier for platforms to surface and easier for guests to choose. Those that rely on broad appeal, vague value, or inherited assumptions will struggle to convert, even in strong markets.

Uvika Wahi is the Editor at RSU by PriceLabs, where she leads news coverage and analysis for professional short-term rental managers. She writes on Airbnb, Booking.com, Vrbo, regulations, and industry trends, helping managers make informed business decisions. Uvika also presents at global industry events such as SCALE, VITUR, and Direct Booking Success Summit.