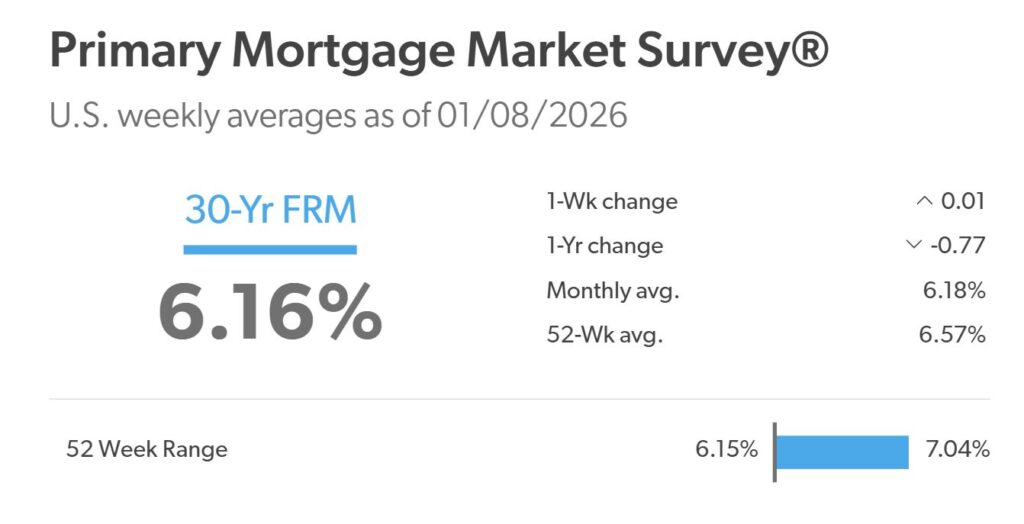

Exciting news for anyone dreaming of homeownership! The average 30-year fixed mortgage rate has dropped a significant 77 basis points over the past year, bringing it down to a much more manageable 6.16% as of January 8, 2026, according to Freddie Mac’s latest Primary Mortgage Market Survey®. This substantial decrease is making homebuying more accessible and is already breathing new life into the housing market.

As a longtime observer of the mortgage industry, I’ve seen rates fluctuate quite a bit. But this kind of year-over-year drop is something homeowners and aspiring buyers will definitely want to pay attention to. It’s not just a small blip; it’s a meaningful shift that can translate into real savings for families.

30-Year Fixed Mortgage Rate Drops by 77 Basis Points Since Last Year

What Does a 77 Basis Point Drop Really Mean?

Let’s break this down. A basis point is essentially one-hundredth of a percentage point. So, a 77 basis point drop means rates have fallen by 0.77%. While that might sound small on paper, when you’re talking about mortgage loans, which are typically for hundreds of thousands of dollars and paid back over decades, it makes a huge difference.

Think about it this way: imagine you’re buying a $300,000 home.

- A year ago, when rates were around 6.93%, your monthly principal and interest payment (not including taxes and insurance) would have been roughly $1,970.

- Today, with rates at 6.16%, that same payment drops to about $1,833.

That’s a monthly savings of nearly $137. Over the life of a 30-year loan, that adds up to over $49,000! That’s a significant amount of money that can go towards home improvements, saving for retirement, or simply easing your overall budget. It’s these kinds of tangible benefits that I always emphasize when discussing mortgage rate movements with my clients.

A Closer Look at the Numbers: The Freddie Mac Survey

Freddie Mac’s survey is a key indicator of mortgage rate trends, and their latest report paints a clear picture.

Table: U.S. Weekly Average Mortgage Rates (as of 01/08/2026)

| Mortgage Type | Current Average (01/08/2026) | 1-Week Change | 1-Year Change | 52-Week Average |

|---|---|---|---|---|

| 30-Year Fixed FRM | 6.16% | +0.01% | -0.77% | 6.57% |

| 15-Year Fixed FRM | 5.46% | +0.02% | -0.68% | 5.76% |

As you can see, both the 30-year fixed and 15-year fixed mortgage rates have seen substantial decreases compared to this time last year. The 30-year fixed rate’s 77 basis point drop is particularly noteworthy, as it’s the go-to choice for many homebuyers looking for stability and predictable monthly payments. The 15-year fixed rate has also fallen by 68 basis points, offering an even lower rate for those who can manage higher monthly payments in exchange for paying off their home faster and saving more on interest overall.

Why Are Rates Dropping? Unpacking the Factors

Several forces are at play behind this encouraging decline.

- Slower Inflation: While not explicitly stated in the provided data, general economic trends suggest a cooling of inflation. When inflation is under control, it removes pressure on the Federal Reserve to raise interest rates, and can even lead to rate cuts. This is a crucial factor I’m always monitoring.

- Economic Growth: The Freddie Mac report mentions “solid economic growth.” This might seem counterintuitive, as strong economies sometimes lead to higher rates. However, in this context, it likely means the economy is growing without overheating, which is the ideal scenario the Fed aims for. It signals stability rather than a need for aggressive rate hikes.

- Market Expectations: Mortgage rates are heavily influenced by the bond market, particularly the yield on 10-year Treasury notes. When investors anticipate lower inflation or a slowing economy, they tend to buy more bonds, driving yields down, which in turn pulls mortgage rates lower.

- Federal Reserve Policy (Indirect Influence): While the Fed doesn’t directly set mortgage rates, its decisions on the federal funds rate (its benchmark interest rate) have a significant ripple effect. A stable or predictable Fed policy usually translates into more stable mortgage rates.

The Ripple Effect: More Than Just Savings

This drop in mortgage rates isn’t just about saving money for individuals; it’s creating a positive feedback loop in the housing market.

- Improved Affordability: As I touched on earlier, lower rates directly boost affordability. The median U.S. monthly housing payment has fallen to a two-year low. This crucial point means more people can qualify for a mortgage and afford to buy the home they want. For many, it’s the tipping point they’ve been waiting for.

- Rising Purchase Demand: It’s no surprise, then, that purchase applications have surged. Freddie Mac notes a more than 20% increase in purchase applications compared to a year ago. This is a strong indicator that buyers are actively returning to the market, encouraged by the more favorable borrowing costs. I’m seeing this firsthand; my inbox has been buzzing with more inquiries lately.

- Increased Inventory (Potential): As demand rises, it can also incentivize more homeowners to sell. Those who might have been reluctant to trade their current low-rate mortgage for a new, higher one might now feel more comfortable listing their homes, potentially leading to a healthier inventory of homes for sale.

What Does This Mean for You?

If you’ve been on the fence about buying a home, this is a fantastic time to seriously consider making a move. The 77 basis point drop in 30-year fixed rates represents a significant opportunity.

Here’s my advice:

- Get Pre-Approved: Don’t wait! Understanding what you can afford is the first step. A pre-approval will give you a clear picture of your borrowing power and strengthen your offer when you find your dream home.

- Shop Around: This is absolutely critical. Even with these favorable rates, lenders will offer different terms. Comparing offers from multiple lenders—banks, credit unions, and mortgage brokers—is the best way to secure the absolute best rate for your specific situation. Don’t settle for the first offer you get. I always recommend using comparison tools or speaking with a few different loan officers.

- Consider Your Financials: Remember, while the average rate has dropped, your personal rate will still depend on your credit score, down payment size, and debt-to-income ratio. Improving these aspects can further enhance your borrowing power and lead to even better rates.

- Don’t Forget the 15-Year Option: If your budget allows, explore the 15-year fixed mortgage. While the monthly payments are higher, you’ll pay significantly less interest over the life of the loan and build equity much faster.

Looking Ahead: What to Watch

While current trends are positive, the market is dynamic. Experts anticipate that rates will likely remain relatively stable in the near term, staying in the low 6% range. However, unexpected news, particularly from upcoming job reports, could cause fluctuations.

The key factors that will continue to influence mortgage rates are:

- Inflation Data: The government’s inflation reports are closely watched.

- Federal Reserve’s Stance: Any hints about future monetary policy will impact borrowing costs.

- 10-Year Treasury Yields: This remains a strong indicator of where mortgage rates are heading.

For now, though, the message is clear: the lowered mortgage rates are making a real difference, opening doors for more Americans to achieve homeownership. It’s an exciting time to be in the market!

🏡 Which Rental Property Would YOU Invest In?

Lebanon, TN

🏠 Property: Baltusrol Lane #852

🛏️ Beds/Baths: 4 Bed • 2.5 Bath • 2011 sqft

💰 Price: $369,990 | Rent: $2,400

📊 Cap Rate: 5.8% | NOI: $1,789

📅 Year Built: 2024

📐 Price/Sq Ft: $184

🏙️ Neighborhood: B

San Antonio, TX

🏠 Property: Salz Way

🛏️ Beds/Baths: 3 Bed • 2 Bath • 2330 sqft

💰 Price: $384,999 | Rent: $2,375

📊 Cap Rate: 4.1% | NOI: $1,324

📅 Year Built: 2019

📐 Price/Sq Ft: $166

🏙️ Neighborhood: A

Tennessee’s balanced rental vs Texas’s larger home with lower cap rate. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Talk to a Norada investment counselor (No Obligation):

(800) 611-3060