The homeownership dream feels increasingly out of reach for many newcomers to the housing market, even as a surge of wealthy, cash-rich buyers snaps up properties. This stark division, painting a picture of a market split between two distinct groups, is the defining characteristic of real estate right now.

Housing Market 2025 Splits Between Wealthy Buyers and First-Timers

The National Association of REALTORS®’ (NAR) newly released 2025 Profile of Home Buyers and Sellers report lays bare these extremes, highlighting how affordability challenges are sidelining aspiring owners while those with substantial equity and cash reserves are calling the shots.

It’s a situation that feels personal to me, having spent years working in this industry. I see firsthand the frustration of young couples or individuals trying to save that elusive down payment, their hopes dashed by rising prices and interest rates.

Then, I see the seasoned buyers, often older and with significant equity from previous sales, swooping in with all-cash offers that are nearly impossible to compete with. This isn’t just a statistic; it’s a reality that’s reshaping who can afford to own a home and for how long.

Key Takeaways from the NAR 2025 Profile of Home Buyers and Sellers

| Category | Trend | Significance |

|---|---|---|

| First-Time Buyers | At an all-time low (21% of market); median age is a record 40. | Indicates significant barriers to entry, impacting wealth building for younger generations. |

| All-Cash Buyers | At an all-time high (26% of market). | Demonstrates financial strength of some buyers, allowing them to bypass mortgages and gain a competitive edge. |

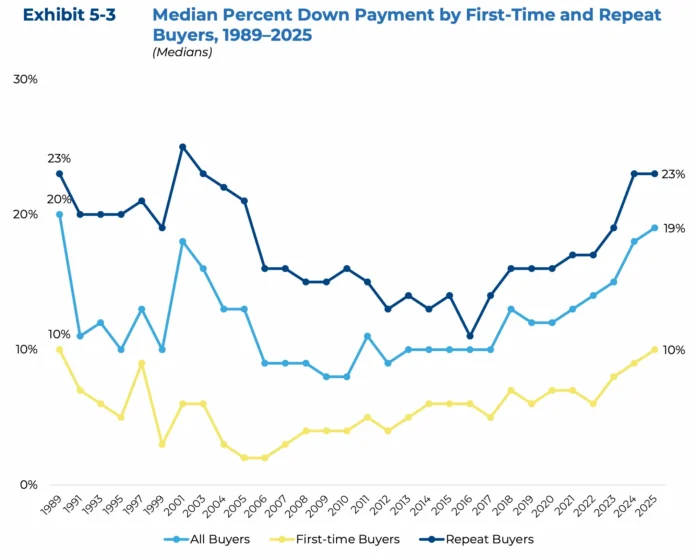

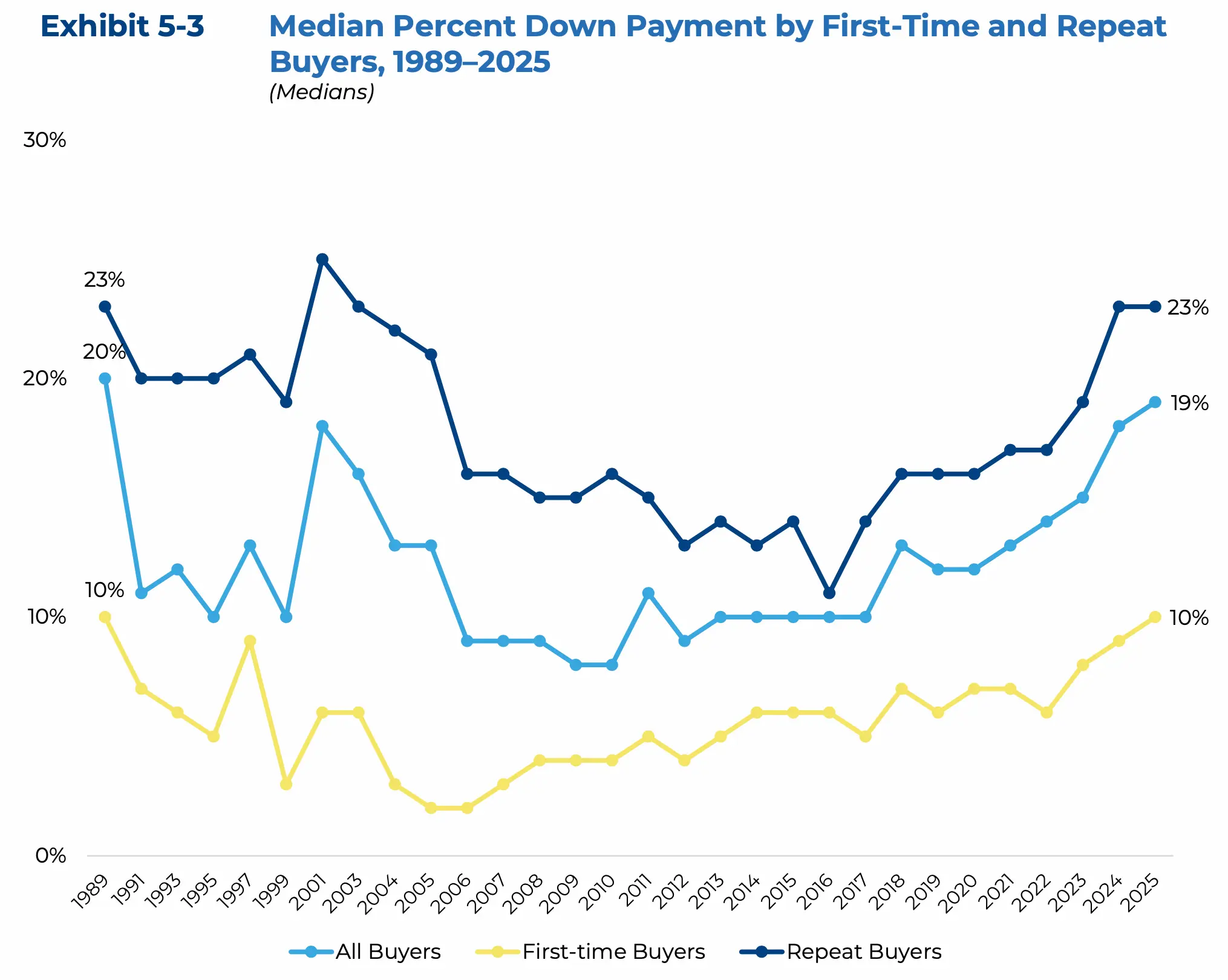

| Down Payments | Median down payment is 19% (10% for first-timers, 23% for repeat buyers)—record highs. | Requires larger initial capital, further straining affordability for newcomers. |

| Age of Buyers/Sellers | Median age of first-time buyers is 40; repeat buyers 62; sellers 64. | Reflects an aging population increasingly dominating the market, often with greater financial resources. |

| Agent Importance | 88% of buyers and 91% of sellers used agents; deemed essential for navigation. | Shows that professional guidance is highly valued in a complex market. |

| Homeownership Tenure | Median expected tenure is 15 years; sellers held homes for a record 11 years. | Indicates a shift towards longer-term investment and stability rather than frequent moving. |

First-Time Buyers Facing Historically Low Numbers

One of the most alarming trends from the NAR report is the record low percentage of first-time buyers—a mere 21% of the market. Think about that for a moment: since NAR started tracking this back in 1981, we’ve never seen so few people entering the market for the first time. Before 2008, that number was hovering around 40%.

“The historically low share of first-time buyers underscores the real-world consequences of a housing market starved for affordable inventory,” states Jessica Lautz, NAR’s deputy chief economist.

It’s not just that fewer people are buying for the first time; those who are buying are older. The median age for a first-time buyer has climbed to a record 40 years old. Growing up, I always heard about people buying their first homes in their late twenties or early thirties. Now, that feels like ancient history.

Saving for a down payment is incredibly difficult with high rents and the persistent burden of student loan debt. Shannon McGahn, NAR’s executive vice president and chief advocacy officer, rightly points out, “For generations, access to homeownership has been the primary way Americans build wealth and the cornerstone of the American dream.” She adds that delaying this by a decade could mean missing out on approximately $150,000 in equity from a typical starter home.

Key Factors for First-Time Buyers:

- High rents making saving difficult.

- Significant student loan debt.

- Difficulty qualifying for mortgages.

- Intense competition from cash buyers.

While government-backed loans like FHA and VA, which often require lower or no down payments, have been vital for millions, their usage has decreased. The report shows FHA loan usage dropping significantly since 2009. NAR is advocating for policy changes to increase housing supply, streamline building regulations, and modernize construction to make homes more affordable. Without more homes at accessible price points, this generation of potential first-time buyers will continue to face an uphill battle.

The Rise of the All-Cash Buyer

On the flip side, we’re witnessing an unprecedented surge in all-cash home purchases. Averaging 26% of all transactions over the past year, this is a huge jump from the less than 10% seen between 2003 and 2010. These buyers aren’t just using equity from selling another home; they are often bypassing the mortgage process altogether. With interest rates being higher and lending conditions tight, an all-cash offer is incredibly powerful. It’s a sign of financial strength and a way to avoid the complexities and potential rejections that come with mortgage pre-approvals.

Down Payments Are Getting Bigger for Everyone

Regardless of whether you’re a first-timer or a seasoned homeowner, the amount of money needed for a down payment is climbing. This is true for both groups, hitting levels not seen in decades. In 2025, the median down payment jumped to 19% for all buyers. For first-time buyers, it was 10%, and for repeat buyers, it was a hefty 23%. For first-time buyers, this is the highest median down payment since 1989, and for repeat buyers, it’s the highest since 2003.

So, where is this money coming from?

- Personal Savings: Remain the top source for first-time buyers (59%).

- Financial Assets: Tapping into 401(k)s, IRAs, or stocks (26% for first-timers).

- Gifts/Loans from Family & Friends: A significant boost for 22% of first-timers.

- Equity from Previous Home Sale: The primary source for over half of repeat buyers (54%).

This directly ties back to the growing equity and wealth accumulated by long-term homeowners.

Why Real Estate Agents Are More Crucial Than Ever

Despite the rise of online tools, real estate agents remain essential. The NAR report shows that a staggering 88% of buyers worked with an agent, making them the most trusted source of information, outranking online listings. Buyers lean on agents for help finding the right home, negotiating terms, and navigating the mountain of paperwork. It’s particularly reassuring for first-time buyers, with 76% crediting their agent with helping them understand the complex process.

Sellers, too, are overwhelmingly relying on agents, with 91% using one. Their priorities are clear: getting help marketing their home effectively, pricing it competitively, and securing a sale within their desired timeframe. As Lautz says, “Real estate agents remain indispensable in today’s complex housing market.” They provide not just expertise and negotiation skills but also crucial emotional support during what is often the biggest financial decision someone makes.

I’ve seen it myself. An agent’s ability to spot potential issues in a home, their knowledge of the local market, and their skill at negotiating can make or break a deal, especially when you’re up against tough competition.

FSBOs Hit an All-Time Low: A Sign of the Times

Following on the heels of the agent’s importance, the report highlights that For Sale By Owner (FSBO) sales have hit an all-time low of just 5%. Homes sold with agent assistance fetched a median price of $425,000, significantly higher than the $360,000 for FSBO homes. While some owners might try to save on commission fees or sell to someone they know, the data suggests that the expertise and market reach of an agent lead to better outcomes.

Repeat Buyers: Exercising Their Financial Muscle

Repeat buyers are truly flexing their financial power. With a median down payment of 23% and nearly one in three paying all cash, they are in a strong position to compete. Years of rising home values have built substantial wealth for these homeowners. The average seller has now owned their home for a record 11 years, accumulating significant equity—an average of $140,900 gained in the last five years alone, according to NAR’s research. This allows them to make larger down payments, avoid financing contingencies, and often secure their next home with less stress than a first-time buyer.

Fewer Families with Children Entering the Market

A noticeable shift in the profile of home buyers is the decline in households with children under 18. This group now makes up just 24% of recent buyers, a stark contrast to 58% in 1985. This trend is likely a result of declining birth rates and the increasing age of repeat buyers. Additionally, the high cost of childcare presents yet another hurdle for families trying to save for a down payment.

This demographic shift also means there’s a move away from the traditional family household. The share of married couples buying homes has also decreased, while single buyers, particularly single women, are gaining ground. This points to a more diverse range of individuals and household structures becoming homeowners.

The Aging of Home Buyers and Sellers

It’s not just first-time buyers getting older; the entire cohort of buyers and sellers is aging. We’ve already seen the median age for first-time buyers hit 40, but repeat buyers are now a median age of 62, and the typical home seller is 64 years old—both record highs. This coincides with other NAR research indicating that Baby Boomers, now in their late 60s and 70s, are the largest group of both buyers and sellers. Their financial stability often allows them to navigate the market more easily than younger generations.

Buying for the “Forever Home” Mentality

The idea of a “starter home” seems to be fading. Home buyers today are planning to stay put for much longer. The median expected tenure in a purchased home is now 15 years, with many (28%) considering it their “forever home” and having no intention of moving. This is a dramatic shift from the early 2000s when homeowners typically stayed in their homes for just six years. The median time a homeowner has been in their current home before selling is now a record 11 years. This longer-term outlook applies to both first-time and repeat buyers, suggesting a desire for stability and a less transient approach to homeownership.

New Construction Sees a Slight Uptick

While existing homes still dominate sales, there’s been a slight increase in new home purchases, reaching 16%—a level not seen since 2006. Builders have been offering incentives like price reductions and mortgage rate buydowns to attract buyers. Those opting for new construction often cite the desire to avoid renovations and repairs and the ability to customize their living space. On the other hand, buyers who prefer existing homes often point to perceived better value, lower prices, and the unique charm and character of older properties.

This polarization of the housing market is a complex issue with no easy answers. The gap between those who can afford to buy and those who are priced out is widening, creating significant challenges for economic mobility and the fulfillment of the American dream for a new generation.

Want Stronger Returns? Invest Where the Housing Market’s Growing

Turnkey rental properties in fast-growing housing markets offer a powerful way to generate passive income with minimal hassle.

Work with Norada Real Estate to find stable, cash-flowing markets beyond the bubble zones—so you can build wealth without the risks of ultra-competitive areas.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More About the Housing Market Trends?

Explore these related articles for even more insights: