Sonder, once one of the most heavily funded “tech-enabled hospitality” startups, has announced it will immediately wind down operations and enter Chapter 7 liquidation in the United States, with insolvency proceedings planned internationally. The announcement came through an investor notice and marked an abrupt end for a company that set out to reinvent hospitality by blending hotel consistency with short-term rental flexibility.

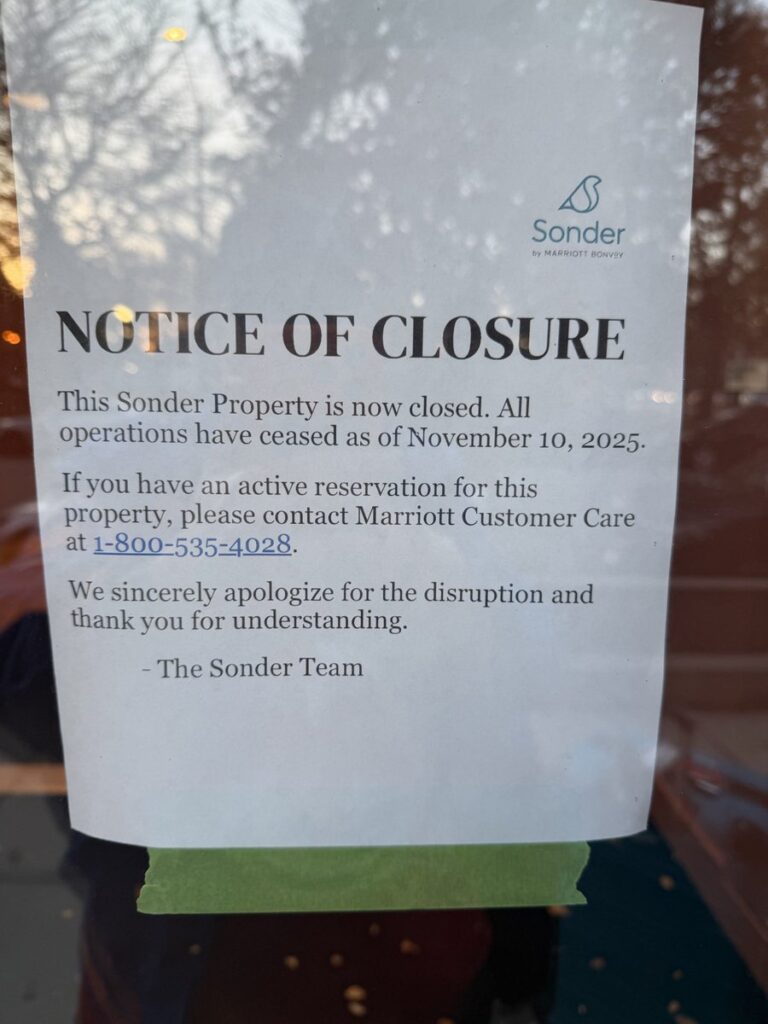

For both employees and guests, the shutdown does not appear to have unfolded gradually. It seems to have happened almost overnight.

What Sonder Actually Announced

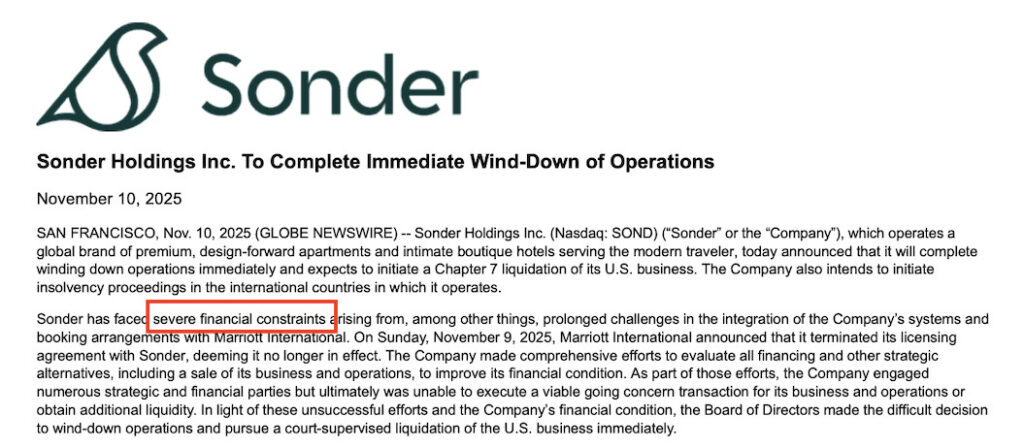

In its investor statement, Sonder said it faced “severe financial constraints” and had no viable path forward except an immediate wind-down. The shutdown follows Marriott’s termination of its licensing agreement with the company—an agreement that once represented Sonder’s most significant attempt at stabilization after years of financial strain.

The company’s Chapter 7 liquidation means:

- U.S. operations cease immediately

- A court-appointed trustee will handle asset sales and creditor claims

- International subsidiaries will enter local insolvency processes

- There is no restructuring process ahead, only full dissolution

This is as final as a corporate ending gets.

What Guests and Employees Experienced

Guests

Major U.S. news outlets, including Today, reported that some guests were asked to leave mid-stay, in certain cases receiving only a sign on the door as notice. Guests also shared concerns about holiday travel in cities like New York, where last-minute rebooking is costly.

While not every individual account is verifiable, the fact that mainstream broadcast media are covering guest displacement indicates that disruptions were widespread enough to reach public attention.

Employees

Across LinkedIn, former employees describe:

- Being laid off without advance communication

- Learning of the shutdown at the same moment as the public

- Sudden loss of access to systems and workspaces

These posts are consistent across multiple regions and seniority levels. They collectively confirm that the internal shutdown was as abrupt as the public one.

The Website Tells Its Own Story

Sonder’s website remains live, but its functionality is gone.

Searches for stays—tested in multiple cities—redirect automatically to Marriott.com, where the results show “0 properties” and an ad for Homes & Villas by Marriott Bonvoy appears below the empty listings.

There is:

- No banner explaining the shutdown

- No guest advisory

- No link to the investor notice

- No post on Sonder’s blog or social channels

To a casual visitor, the homepage looks normal. The moment they search for a stay, they reach a dead end.

This gap between front-end appearance and operational reality is uncommon in hospitality, where guest communication is usually immediate during disruptions.

How Sonder Reached This Point

To understand the collapse, it’s helpful to step back and look at the company’s trajectory.

1. The SPAC Era

Sonder went public in 2022 via a SPAC—an investment vehicle that allowed companies to bypass the traditional IPO process.

During the SPAC boom, several hospitality brands, including Vacasa, positioned themselves as “technology companies” rather than hospitality operators. This framing often resulted in higher valuations, even when the underlying business depended on physical operations and real estate commitments.

2. The Master-Lease Model

Sonder’s core model involved signing long-term leases and operating buildings like hotels.

This approach works only when demand is strong and capital is cheap. It becomes fragile when travel softens, costs rise, or financing becomes harder to secure. Several companies with similar structures — including Lyric, Stay Alfred, and Zeus Living (before its pivot) — ran into the same structural limits.

3. The Marriott Partnership

In 2024, Sonder signed a 20-year licensing agreement to bring thousands of units into the Marriott Bonvoy network. Sonder later cited complex technical integration and lower-than-expected performance through the partnership as contributors to financial strain.

However, Marriott publicly disputed this characterization, stating via Skift that it did not agree with Sonder’s description of the integration issues and emphasized that Sonder’s business decisions were independent. Marriott said it worked “tirelessly” to support guests after the termination.

The full picture of what unfolded internally is not yet clear, but both companies confirm the relationship ended immediately.

4. The Final Year

By early 2025, Sonder faced:

- Repeated warnings about potential NASDAQ delisting

- Shrinking cash reserves

- Layoffs across teams

- Difficulty raising new capital

Once Marriott terminated the agreement, Sonder no longer had a distribution or stabilization mechanism. The liquidation request followed almost immediately.

Why This Matters for the STR and Hybrid-Hospitality Industry

Sonder wasn’t simply a hospitality brand. For many in the industry, it symbolized:

- The possibility of a tech-driven alternative to hotels

- a new way of designing and managing inventory

- a venture-backed path to scale

Its collapse underscores several lessons:

1. Hospitality Is Not Software

Even the most elegant tech stack cannot offset the realities of:

- leasing costs

- cleaning

- maintenance

- guest service

- seasonal demand

When the cost of operations is fixed and revenue is variable, companies are exposed in every downturn.

2. The Master-Lease Model Is Structurally Fragile

If a company carries the downside risk but does not own the upside (i.e., the real estate), its margins will always be thin. The pandemic exposed this weakness. Rising costs and investor slowdown finished the job.

3. SPAC Valuations Created Unrealistic Expectations

Sonder went public at a valuation disconnected from its operational fundamentals. When the hype faded, the mismatch became impossible to bridge.

4. The Human Impact Should Not Be Lost

Thousands of people built careers at Sonder. Many believed in the mission and the product.

Whatever the financial trajectory, the way the shutdown unfolded — sudden, opaque, and disruptive — is a reminder of who ultimately absorbs the impact when models fail.

Where the Market Goes From Here

A key question is whether traditional hotel groups will fill the vacuum left by Sonder.

Marriott Homes & Villas is already visible on redirected search pages. Other operators with mixed hotel–STR models may try to position themselves as the more stable alternative.

But one thing is clear: Sonder’s rise and fall will influence how the market thinks about hybrid hospitality for years. Investors, operators, and real estate partners will reassess what is sustainable—and what depends too heavily on optimistic forecasts.

Conclusion

Sonder’s shutdown is not just the end of a company. It’s the end of a chapter in hospitality’s long experiment with tech-led, asset-light, design-centric brands built on heavy lease commitments.

It’s also a reminder that hospitality succeeds when execution meets economics—and struggles when the story becomes bigger than the structure behind it.

This is a moment for the industry to absorb the lessons, acknowledge the people affected, and consider what a more resilient model looks like moving forward.

Uvika Wahi is the Editor at RSU by PriceLabs, where she leads news coverage and analysis for professional short-term rental managers. She writes on Airbnb, Booking.com, Vrbo, regulations, and industry trends, helping managers make informed business decisions. Uvika also presents at global industry events such as SCALE, VITUR, and Direct Booking Success Summit.