The question on everyone’s mind, especially if you’re dreaming of homeownership or looking to refinance: what will mortgage rates do by 2026? Based on current economic indicators and expert analysis, mortgage rates in 2026 are expected to see a modest decline, likely hovering between 5.9% and 6.5% for a 30-year fixed loan. While a significant drop below 6% isn’t a certainty, this anticipated easing offers a glimmer of hope for a more accessible housing market.

Mortgage Rate Predictions for 2026: A Gradual Thaw in a Cooling Economy

As I look at the data and speak with folks who follow this stuff closely, it feels like we’re moving from a period of significant upward pressure on rates to a more stable, slowly descending path. It’s not a freefall, mind you, but it’s definitely a move in the right direction after the highs we’ve seen. This isn’t just about numbers; it’s about how people can afford their homes, build equity, and participate in the American dream.

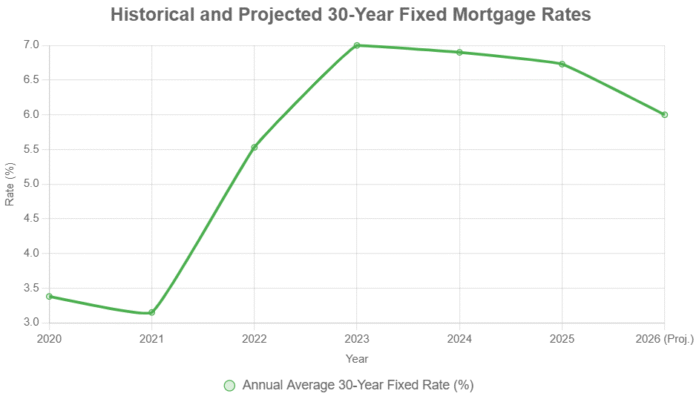

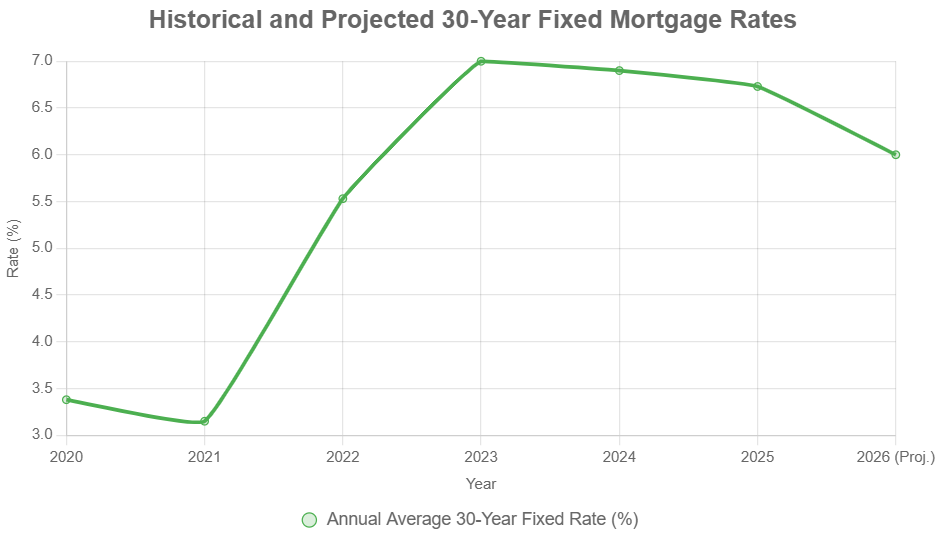

The Road Behind Us: From Pandemic Perks to Pricey Mortgages

To understand where we’re headed, we have to look back at how we got here. Remember those unbelievably low mortgage rates around 2021? A 30-year fixed-rate mortgage averaged a stunning 3.15%. It was a golden age for home buyers and refinancers!

Then, as we all know, the economy started to heat up fast. Inflation, which had been pretty quiet, suddenly surged. To try and tame it, the Federal Reserve started raising interest rates pretty aggressively. This “interest rate hike” cycle meant mortgage rates shot up, hitting a peak near 7% in 2023. Ouch. For anyone trying to buy a house, that meant much higher monthly payments. It also created a “lock-in effect” where homeowners with super-low rates weren’t selling their homes, leading to less inventory.

Now, as we stand in late 2025, rates have stabilized a bit, mostly hovering in the 6.2% to 6.7% range. This is still high compared to a few years ago, but it’s a welcome pause after the rapid increases.

Here’s a quick look at how rates have moved:

| Year | Average 30-Year Fixed Rate (%) | Key Reason |

|---|---|---|

| 2020 | 3.38 | Pandemic stimulus, low inflation |

| 2021 | 3.15 | Continued Fed support, record-low yields |

| 2022 | 5.53 | Inflation starts to rise, Fed hikes begin |

| 2023 | 7.00 | Aggressive Fed action to curb inflation |

| 2024 (Estimate) | 6.90 | Inflation slows, Fed begins cuts |

| 2025 (Estimate) | 6.73 | More rate cuts, mortgage rates stabilize |

| 2026 (Projection) | ~5.9% – 6.5% | Further easing, economic moderation |

This table shows just how much rates can swing based on what the economy is doing.

What’s Driving the 2026 Forecasts? It’s All About Balance

The predictions for 2026 mortgage rates aren’t pulled out of thin air. They’re based on careful analysis of what drives these costs. Think of it like a delicate balancing act between a few key economic forces:

- Fighting Inflation: The Federal Reserve’s main goal has been to get inflation back down to their target of around 2%. If they succeed, and inflation stays down, it gives the Fed room to lower its own key interest rates. Lower short-term rates from the Fed generally lead to lower long-term rates, including mortgage rates.

- The Economy’s Health: Is the economy humming along nicely without overheating? Or is it slowing down too much, perhaps heading towards a recession? Forecasters are hoping for a “soft landing”—where the economy cools down just enough to curb inflation without crashing. If the economy weakens significantly, the Fed might cut rates more, pushing mortgage rates down faster. But if it stays surprisingly strong and inflation proves stubborn, rates might stay higher for longer.

- Treasury Yields: Mortgage rates are closely tied to the yields on U.S. Treasury bonds, particularly the 10-year Treasury. When investors demand higher yields on these safe investments (meaning they can get more for their money), mortgage lenders also have to charge more. Factors like government spending, international demand for U.S. debt, and general economic sentiment all influence Treasury yields.

- Job Market Stability: A strong job market usually means people have money to spend and borrow, which can sometimes fuel inflation. If job growth slows down considerably, it might signal a weaker economy, which again could lead to lower interest rates.

My take on this? From what I’ve seen, the Fed has made real progress on inflation. Core inflation (which strips out volatile food and energy prices) is still a bit sticky, but I’m optimistic it will continue its downward trend. This should give the Fed the confidence to continue cutting rates, which should translate to lower mortgage rates in 2026. However, I don’t see us returning to the sub-4% rates of the early 2020s anytime soon. Those were truly extraordinary times.

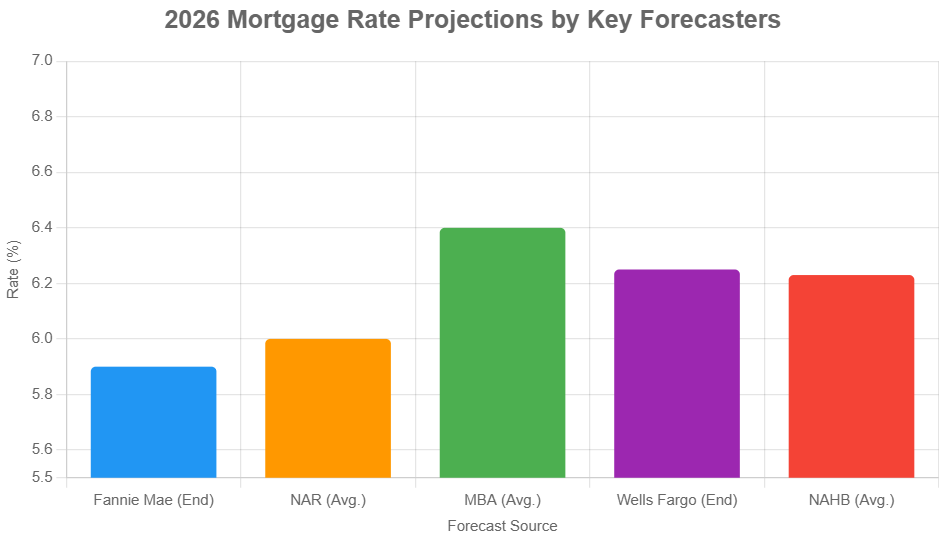

What the Experts Are Saying: A Range of Views

You’ll find a spectrum of opinions when you look at mortgage rate predictions for 2026. This isn’t a bad thing; it actually highlights the uncertainties involved.

- Fannie Mae, a big player in the mortgage market, expects rates to end 2026 around 5.9%. They’re betting on the Fed making a couple more moves to lower rates.

- The Mortgage Bankers Association (MBA), on the other hand, sees things as a bit more stable. They predict rates to be around 6.4% for the year. They seem to think things like wage growth might keep some pressure on yields.

- The National Association of Realtors (NAR) has a slightly more optimistic outlook, anticipating an average rate around 6.0%. They believe better affordability will boost home sales.

- Other institutions like Wells Fargo and the National Association of Home Builders (NAHB) are looking at rates in the 6.2% to 6.25% range. They often point to ongoing costs in building homes and labor market tightness as factors that could keep rates from falling too much.

Here’s a visual of those different predictions:

While the exact numbers vary, the general trend points towards lower rates than we have right now, but likely not dramatically lower.

How Will This Affect You? Breaking Down the Impact

So, what does a potential drop in mortgage rates mean for different people?

- For Homebuyers: Even a half-percentage-point drop can make a big difference. On a $400,000 mortgage, a rate of 6.0% instead of 6.5% could save you roughly $120 per month and nearly $43,000 over the life of the loan. For first-time buyers struggling with affordability, this easing can be crucial. However, home prices are also expected to continue rising, albeit at a slower pace (around 1.3%–2.5%). So, while rates might improve, the overall cost of buying could still be a challenge.

- For Refinancers: If you have a mortgage with a rate above 6.5% or 7%, a move down towards 6% could finally make refinancing worthwhile. Many homeowners have been stuck with their existing low-rate mortgages (the “lock-in effect”). A decrease could prompt a wave of refinancing, allowing people to lower their monthly payments by a couple of hundred dollars.

- For Sellers: With potentially more buyers able to afford homes, the housing market could become more active. This could lead to quicker home sales and a modest increase in prices. However, more inventory might also mean less intense bidding wars compared to the frenzied market of a few years ago.

- For the Economy: Increased home sales and refinancing activity generally give the economy a boost. More construction means more jobs, and people who can lower their monthly payments have more money to spend elsewhere.

Here’s a simple table summarizing the potential benefits:

| Group | Benefit of ~0.5% Rate Drop | Potential Hurdle |

|---|---|---|

| Homebuyers | Lower monthly payments, improved affordability | Still-rising home prices, down payment challenges |

| Refinancers | Reduced mortgage payments, cash savings | Need to qualify for new loan, appraisal values |

| Sellers | Faster sales, potentially higher prices | Increased competition, property taxes |

| Overall Economy | Stimulus via construction and consumer spending | Inflation risks, global economic shifts |

The Wildcards: What Could Throw a Wrench in the Works?

No prediction is foolproof. There are always risks that could push mortgage rates in unexpected directions:

- Stubborn Inflation: What if inflation doesn’t cool down as expected? If it stays stubbornly above 2%, the Fed might have to hold off on rate cuts for longer, or even consider raising them again. This would likely keep mortgage rates higher than predicted, possibly edging back towards 6.8% or 7%.

- Economic Shocks: A sudden recession, a major geopolitical event (like a new conflict impacting oil prices), or unexpected supply chain issues could send shockwaves through the economy. A severe downturn might force the Fed to cut rates aggressively, dropping mortgage rates significantly, perhaps to the 5.5% range. On the flip side, surprisingly strong economic growth could keep rates elevated.

- Government Spending/Debt: High levels of government borrowing can sometimes put upward pressure on interest rates as the government competes for funds in the bond market.

Given these uncertainties, I always advise people to prepare for a range of possibilities. Don’t bet your entire financial plan on rates dropping dramatically. Consider your own timeline and financial situation when making housing decisions.

My Own Thoughts: Patience and Preparedness

From my perspective, the 2026 mortgage rate predictions suggest a market that is gradually becoming more accessible. The days of 3% rates are likely behind us for the foreseeable future, but the peak of 7%+ seems to be receding. This middle ground, the mid-6% range, offers a more balanced environment.

For those looking to buy, my advice is to focus on what you can control:

- Improve your credit score: A higher score gets you better rates.

- Save for a solid down payment: This reduces your loan amount and can sometimes open up better loan options.

- Get pre-approved for a mortgage: This gives you a clear picture of what you can afford and shows sellers you’re a serious buyer.

- Shop around for lenders: Don’t just go with the first one you talk to. Rates and fees can vary.

For those looking to refinance, keep a close eye on rates. If we see a sustained drop of 0.5% or more from your current rate, it might be time to explore your options.

The housing market is a complex beast, influenced by so many factors. While we can analyze trends and listen to expert opinions, life often throws curveballs. The key is to stay informed, be prepared, and make decisions that align with your personal financial goals, not just chase the latest rate prediction.

In essence, 2026 looks set to be a year of cautious optimism for the housing market, driven by a slow and steady easing of mortgage rates. It won’t be a return to the wild lows of the pandemic era, but it should be a welcome improvement for many aiming to achieve homeownership or financial flexibility through refinancing.

Want Stronger Returns? Invest Where the Housing Market’s Growing

Turnkey rental properties in fast-growing housing markets offer a powerful way to generate passive income with minimal hassle.

Work with Norada Real Estate to find stable, cash-flowing markets beyond the bubble zones—so you can build wealth without the risks of ultra-competitive areas.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060