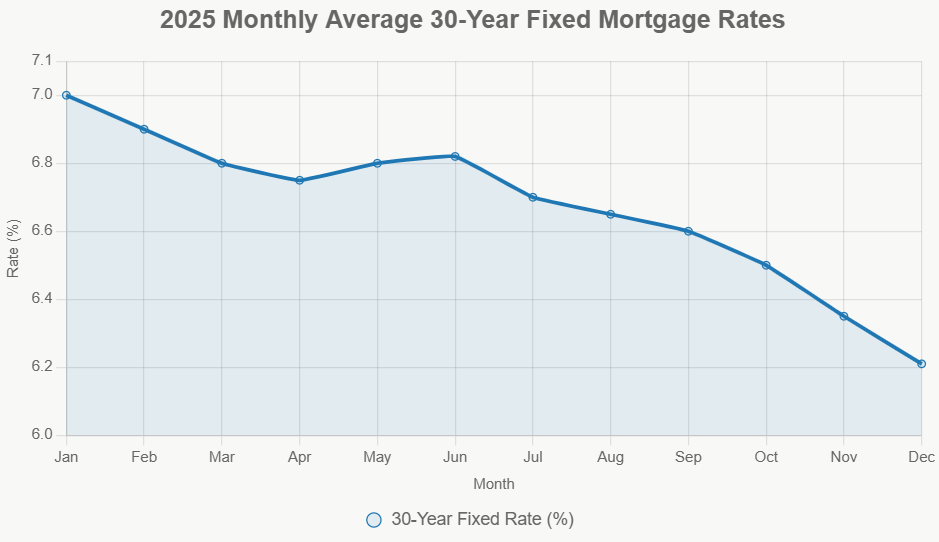

2025 has been a transitional year for mortgage rates. We observed a welcome, albeit cautious, descent in mortgage rates, which started above 7% and gradually settled near 6.2% as the year is about to end, signaling a potential easing of affordability pressures for homebuyers. It wasn’t the dramatic drop in rates that some might have dreamed of, but it was a crucial step towards a more stable and balanced housing market.

It reminded us that while interest rates are a major piece of the puzzle for accessing homeownership, the strength of our economy and smart financial decisions are key to achieving the American Dream.

The 2025 Mortgage Rates Timeline: From 7% Highs to 6.2% Lows

A Year of Slow But Steady Progress for Mortgage Rates

Let me tell you, as someone who’s seen a few market cycles, 2025 felt like a year of holding your breath, then exhaling a little. We started the year with the shadow of those 7% mortgage rates looming, a stark reminder of the economic challenges we’d been facing. But as the months ticked by, we began to see a glimmer of hope. It wasn’t a sudden freefall, mind you.

It has felt more like a slow, steady climb down a hill, with only a few minor bumps along the way. As December draws to a close, the average 30‑year fixed mortgage rate is hovering near 6.2%. While that may still sound high compared to the historically low rates of just a few years ago, for many borrowers it marks a meaningful improvement — and a chance to finally step into the housing market or refinance existing, more expensive loans.

The Rate Rollercoaster: January to December

So far, 2025 has unfolded in distinct phases for mortgage rates. Rather than moving in a straight line downward, the path has been jagged, with a clearer downward trend beginning to take shape in the latter half of the year.

Here’s a breakdown of how the average 30-year fixed mortgage rate played out month by month:

| Month | Average Rate (%) | High (%) | Low (%) | Key Notes |

|---|---|---|---|---|

| January | 7.00 | 7.04 | 6.95 | Kicked off the year over 7% due to ongoing inflation worries. |

| February | 6.90 | 6.95 | 6.85 | A slight easing as the Federal Reserve started signaling support. |

| March | 6.80 | 6.85 | 6.75 | Continued to drop as job market data showed cooling signs. |

| April | 6.75 | 6.80 | 6.70 | Average for Q2 started at 6.79%, reflecting balanced economic news. |

| May | 6.80 | 6.85 | 6.75 | A minor bump up due to persistent wage growth. |

| June | 6.82 | 6.87 | 6.77 | Rates stayed steady as the second quarter wrapped up. |

| July | 6.70 | 6.75 | 6.65 | Rates softened a bit during the summer slowdown. |

| August | 6.65 | 6.70 | 6.60 | Global worries caused a brief pause in the downward trend. |

| September | 6.60 | 6.65 | 6.55 | The Fed’s rate cut in September really got things moving downward. |

| October | 6.50 | 6.55 | 6.45 | Continued to decrease following more Fed actions. |

| November | 6.35 | 6.40 | 6.30 | A noticeable dip, partly driven by post-election optimism. |

| December | 6.21 | 6.25 | 6.17 | Ended the year at its lowest point after the December Fed cut. |

The journey from 7.04% in January to around 6.17% in December reflects a clear downward trend. The most notable declines have taken place in the latter half of the year, especially as the Federal Reserve began making proactive moves to adjust interest rates.”

The “Why” Behind the Rate Changes: More Than Just Numbers

It’s easy to get lost in the percentages, but what actually causes these mortgage rates to move? Think of it like a complex recipe where several ingredients need to be just right.

Federal Reserve’s Hand on the Wheel

The Federal Reserve (the Fed) played a starring role in 2025. They are like the central bank of the U.S., and their main job is to keep the economy healthy – not too hot, not too cold. In 2025, they continued the rate-cutting approach they started in late 2024. By cutting their target interest rate, they essentially make it cheaper for banks to borrow money. This, in turn, tends to push down other interest rates, including the ones for mortgages. The Fed’s decision to cut rates in September, October, and December was a major driver of the rate decreases we saw late in the year. Their goal was to gently stimulate the economy without letting inflation run wild.

Inflation: The Balancing Act

Inflation, which is basically how fast prices are rising for goods and services, is a huge factor. When inflation is high, the Fed often raises interest rates to cool things down. When inflation starts to cool, they can afford to lower rates. In 2025, we saw inflation, measured by the Consumer Price Index (CPI), average around 2.5% for the year. This was down from the previous year, and this cooling inflation gave the Fed the green light to ease up on interest rates. However, certain costs, like housing and rent, remained stubbornly high, which prevented rates from dropping even further.

The Job Market’s Influence

The health of the job market also matters a lot. A strong job market with lots of people employed means people have money to spend, which can sometimes push up inflation. As 2025 progressed, we saw some signs of the job market cooling slightly, with unemployment ticking up to around 4.2% by November. This cooling was actually good news for mortgage rates because it relieved some of the pressure on wages and inflation, allowing for those rate cuts.

Global Calm (Mostly)

Economic stability around the world also plays a part. In 2025, while there were still some global tensions, things were generally more stable than in previous years. This global calm made investors more confident, and they tend to buy bonds when they feel secure. When demand for bonds goes up, their yields go down. Since mortgage rates are closely tied to the yields on long-term government bonds, this trend also helped keep mortgage rates lower.

The “Lock-In Effect” and Affordability Hurdles

Now, it’s crucial to understand that while rates were coming down, they were still nowhere near the historic lows of 2020 and 2021. This meant that many homeowners who had refinanced into ultra-low rates during that period were still reluctant to sell or refinance again. This is known as the “lock-in effect,” and it kept many potential sellers on the sidelines. For new buyers, even with slightly lower rates, the overall high cost of homes meant that affordability remained a significant challenge.

How Mortgage Rates Affect the Housing Market: Ripples and Waves

Changes in mortgage rates don’t just affect the numbers on a piece of paper; they send ripples through the entire housing market.

A Boost for Buyers (Eventually)

As the year went on and rates eased, we started to see a positive impact on buyer activity. Purchase applications, which is a good indicator of how many people are trying to buy homes, saw a 10% increase year-over-year by December. This was a direct result of borrowers being able to afford more or seeing that their monthly payments would decrease compared to earlier in the year. For instance, someone who had a mortgage at 7% could now potentially get one closer to 6.2%, saving them a good chunk of money each month.

Home Prices: Slowing the Surge

The rapid price increases we saw during the pandemic started to moderate in 2025. Home prices saw an 7.8% rise year-over-year through September, which is a much more sustainable pace than the double-digit surges we’d witnessed. This slowdown was partly due to the higher interest rates making buying less accessible and partly because more homes started to come onto the market.

Inventory: A Slow Trickle into a Steady Flow

The number of homes for sale, or inventory, also saw some changes. While it didn’t suddenly explode, we did see a modest increase throughout the year, especially as rates began to fall in the latter half. This was welcome news for buyers who had been struggling to find properties.

Refinancing: A Second Wind

For homeowners with existing mortgages carrying higher interest rates (say, above 6.5%), the drop in rates in the fall and winter offered a chance to refinance and lower their monthly payments. We saw a 20% surge in refinances in the fourth quarter. While not everyone qualified due to equity requirements or closing costs, it provided significant savings for many who could take advantage of it.

Different Loan Types, Different Journeys

It’s not just the standard 30-year fixed mortgage that’s important. Other loan types also saw shifts in 2025:

- 15-Year Fixed Mortgages: These continued to be attractive for those who wanted to pay off their homes faster and build equity more quickly. While the rates were lower than 30-year, they offered higher monthly payments.

- 5/1 Adjustable-Rate Mortgages (ARMs): We saw a slight uptick in the use of ARMs, which offer a fixed rate for the first five years and then adjust based on market conditions. Some borrowers, sensing that rates might continue to fall, opted for ARMs to get a lower initial rate, hoping to refinance into a fixed rate later if rates dropped further or to take advantage of short-term investment strategies (like flipping houses).

Here’s a quick look at how these loan types performed:

| Loan Type | 2025 Avg. Rate (%) | Change from 2024 | Market Share (%) | Affordability Impact |

|---|---|---|---|---|

| 30-Year Fixed | 6.70 | -0.02 | 85 | Modest improvement; payments down $100/mo on median home |

| 15-Year Fixed | 5.90 | -0.05 | 10 | Strong for equity builders; faster payoff appeal |

| 5/1 ARM | 5.80 | +0.10 | 5 | Uptick in use for short-term flips amid rate uncertainty |

Looking Towards 2026: What’s Next?

So, what does all of this mean for the future? As we close the books on 2025, the general forecast for 2026 suggests rates might settle in the 6.0% to 6.5% range. This is based on the assumption that the Fed will continue to ease interest rates and keep inflation under control.

However, as the past few years have taught us, nothing is ever guaranteed. Unexpected global events or changes in economic policy could always throw a curveball.

For anyone looking to buy a home: If you’re seeing rates dip into the 6.2% range or lower, it might be a good time to lock in a rate, especially if you plan to stay in your home for a while.

For those looking to refinance: If you have a mortgage with a rate significantly higher than what’s currently available (think 6.5% or more), it’s definitely worth exploring refinancing to save money on your monthly payments. Just remember to factor in the closing costs and make sure you plan to stay in your home long enough to recoup those expenses.

🏡 Which Rental Property Would YOU Invest In?

Cullman, AL

🏠 Property: Dryden St SE

🛏️ Beds/Baths: 3 Bed • 2 Bath • 1337 sqft

💰 Price: $229,900 | Rent: $1,595

📊 Cap Rate: 6.0% | NOI: $1,148

📅 Year Built: 2025

📐 Price/Sq Ft: $172

🏙️ Neighborhood: B+

Lebanon, TN

🏠 Property: Baltusrol Lane #852

🛏️ Beds/Baths: 4 Bed • 2.5 Bath • 2011 sqft

💰 Price: $369,990 | Rent: $2,400

📊 Cap Rate: 5.8% | NOI: $1,789

📅 Year Built: 2024

📐 Price/Sq Ft: $184

🏙️ Neighborhood: B

Two solid options: Alabama’s affordable new build with steady returns vs Tennessee’s larger home with higher cash flow. Which fits YOUR investment strategy?

📈 Choose Your Winner & Contact Us Today!

Talk to a Norada investment counselor (No Obligation):

(800) 611-3060

Invest in Fully Managed Rentals for Smarter Wealth Building

With mortgage rates dipping to their lowest levels in months, savvy investors are seizing the opportunity to lock in financing.

By securing favorable terms now, you can also maximize immediate cash flow while positioning yourself for stronger long‑term returns.

Norada Real Estate helps you seize this rare opportunity with turnkey rental properties in strong markets—so you can build passive income while borrowing costs remain historically low.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060