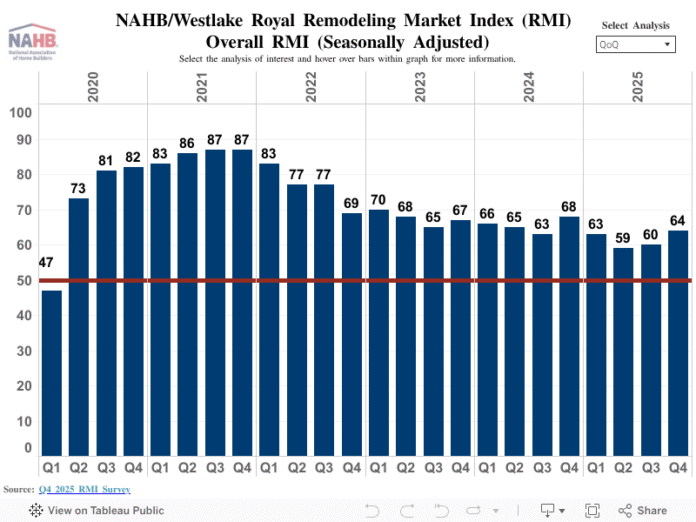

In the third quarter of 2025, the NAHB/Westlake Royal Remodeling Market Index (RMI) posted a reading of 64, increasing four points compared to the previous quarter.

Most remodelers are finding reasonably strong market conditions, even with the normal seasonal slowdown during the holidays. The major headwinds the industry is experiencing continue to be rising costs and potential customers hesitating due to policy and economic uncertainty. Demand for remodeling is being supported by an aging housing stock, strong homeowner equity and increasing need for aging-in-place improvements.

The RMI is based on a survey that asks remodelers to rate various aspects of the residential remodeling market “good”, “fair” or “poor.” Responses from each question are converted to an index that lies on a scale from 0 to 100. An index number above 50 indicates a higher proportion of respondents view conditions as good rather than poor.

Current Conditions

The Remodeling Market Index (RMI) is an average of two major component indices: the Current Conditions Index and the Future Indicators Index.

The Current Conditions Index is an average of three subcomponents: the current market for large remodeling projects ($50,000 or more), moderately-sized projects ($20,000 to $49,999), and small projects (under $20,000). In the fourth quarter of 2025, the Current Conditions Index averaged 71, increasing three points from the previous quarter. All three components increased quarter-over-quarter and remained above the break-even point of 50. Large remodeling projects saw the largest increase, rising five points to 69, followed by small remodeling projects adding two points to 73, and moderately-sized projects, inching up one point to 70.

Future Indicators

The Future Indicators Index is an average of two subcomponents: the current rate at which leads and inquiries are coming in, and the current backlog of remodeling projects.

In the fourth quarter of 2025, the Future Indicators Index averaged 56, up four points from the previous quarter. Both components increased quarter-over-quarter and are above the break-even point of 50. The component measuring the current rate at which leads and inquiries are coming in rose five points to 54 while the component measuring backlog of remodeling jobs added two points to 58.

For the full set of RMI tables, including regional indices and a complete history for each RMI component, please visit NAHB’s RMI web page.