If you’ve been dreaming of owning your own home, this is fantastic news you won’t want to miss. The 30-year fixed mortgage rate has seen a dramatic drop of 78 basis points compared to this time last year, according to the latest figures released by Freddie Mac. This isn’t just a small blip; it’s a substantial decrease that translates into real savings for millions of potential homebuyers.

30-Year Fixed Mortgage Rate Drops Sharply by 78 Basis Points Annually

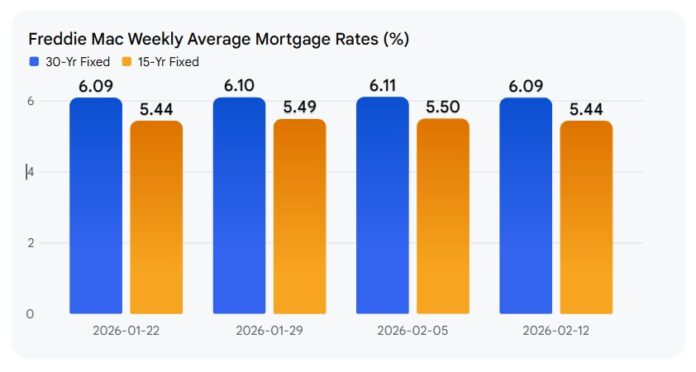

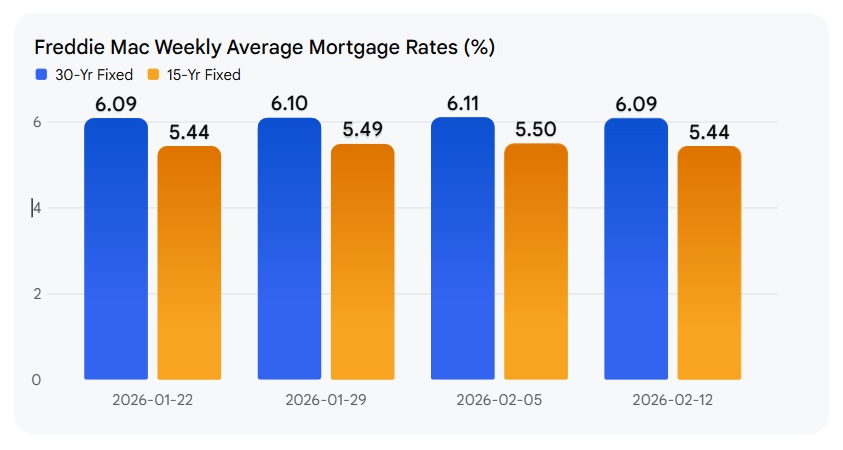

This latest report from Freddie Mac, released on February 12, 2026, shows the average 30-year fixed-rate mortgage (FRM) now sitting at 6.09%. While that’s a tiny dip from last week’s 6.11%, the real story is the significant drop from the 6.87% we saw a year ago. This substantial annual decline means a much more manageable monthly payment and a lower total cost of borrowing if you’re looking to purchase a home this year.

What Does This Mean for You? Let’s Break Down the Savings.

It’s easy to get lost in the numbers, so let’s put this into perspective. A basis point is simply one-hundredth of a percent. So, a drop of 78 basis points means your interest rate has gone down by 0.78%. When you’re talking about mortgages, even small changes in interest rates can add up to thousands of dollars over the life of a loan.

Let’s look at the numbers Freddie Mac provided in their Primary Mortgage Market Survey for the week ending February 12, 2026:

| Mortgage Type | Current Rate (02/12/2026) | 1-Week Change | 1-Year Change | Monthly Average | 52-Wk Average | 52-Week Range |

|---|---|---|---|---|---|---|

| 30-Year FRM | 6.09% | -0.02% | -0.78% | 6.1% | 6.49% | 6.06% – 6.89% |

| 15-Year FRM | 5.44% | -0.06% | -0.65% | 5.47% | 5.7% | 5.38% – 6.04% |

The Power of a Lower Rate: Real-World Impact

Imagine you’re looking to buy a $300,000 home with a 30-year mortgage.

- At last year’s rate of 6.87%: Your estimated monthly principal and interest payment would be around $1,969.

- At the current rate of 6.09%: Your estimated monthly principal and interest payment drops to about $1,822.

That’s a difference of $147 per month! Over 30 years, that’s a savings of over $52,900! That’s a significant amount of money that could go towards home improvements, savings, or simply enjoying life a little more.

Even the 15-year fixed-rate mortgage has seen a welcome decline, averaging 5.44%, down 0.65% from a year ago. This makes paying off your home faster even more appealing.

Why Are Rates Dropping So Significantly? It’s All About the Economy.

Freddie Mac’s Chief Economist, Sam Khater, hit the nail on the head when he mentioned that housing affordability continues to measurably improve. This isn’t a fluke; it’s a direct result of a strong economy and a robust labor market. When the economy is doing well, and people have jobs, lenders tend to feel more confident, which can lead to lower borrowing costs.

It’s fascinating to see these rates holding near their lowest levels in three years. This is a sweet spot for anyone thinking about making a move. The market has been a bit unpredictable, and seeing this kind of sustained affordability improvement is a breath of fresh air.

What This Means for Buyers (and Sellers!)

For Prospective Homebuyers:

- Increased Buying Power: With lower interest rates, your monthly payment goes further. This means you can potentially afford a slightly more expensive home than you could a year ago, or you can enjoy a lower monthly payment on the same priced home.

- More Options: As affordability improves, more people can enter the market. This can lead to a healthier inventory of homes for sale, giving buyers more choices. Freddie Mac specifically noted that purchase application activity has driven higher than a year ago, which is a strong indicator of buyer interest.

- Refinancing Opportunities: If you already own a home and have an existing mortgage with a higher interest rate, this could be a prime time to consider refinancing. Locking in a lower rate can significantly reduce your monthly expenses.

- Reduced Stress: Let’s be honest, buying a home is a big deal. Knowing you’re securing a loan at a favorable rate can reduce some of that financial anxiety.

For Home Sellers:

- More Motivated Buyers: With increased affordability and buyer interest, sellers can expect to see more qualified buyers actively looking.

- Potentially Faster Sales: A strong buyer pool can lead to quicker sale times.

- Competitive Market: While rates are low, they are still subject to market fluctuations. This current dip may not last forever, encouraging buyers to act sooner rather than later.

Beyond the Rate: Economic Factors at Play

It’s interesting to note how these rates are moving even with some market wobbles. Despite a strong jobs report that might typically cause some bond market volatility, mortgage rates have dipped. Freddie Mac pointed out that the 10-year Treasury yield, which mortgage rates typically follow, was down from the previous week. This shows that while the job market might be strong, other financial forces are also at play, pushing borrowing costs down.

My Takes from the Trenches

Having followed the housing market for years, I can tell you that these kinds of annual declines are significant. We haven’t seen this sustained level of affordability improvement in quite some time. The three-year lows are a big deal, and it’s a testament to a period of economic stability that benefits consumers directly. It’s not just about the headline number; it’s about the cumulative effect of these lower rates making the dream of homeownership more attainable for many families.

I believe this trend is encouraging for the broader housing market. When more people can afford to buy, it stimulates local economies, supports construction jobs, and builds wealth for individuals and families. It’s a win-win-win.

Looking Ahead

While this is fantastic news, it’s always wise to remember that mortgage rates are influenced by many factors and can change. My advice is always to talk to a trusted mortgage professional. They can help you understand your specific situation, explore your options, and guide you through the process of securing the best possible rate for your dream home. Don’t let this opportunity pass you by! This is a significant moment for homebuyers, and capitalizing on these lower rates could make a world of difference to your financial future.

🏡 Two Turnkey Investment Opportunities With Strong Cash Flow

Bessemer, AL

🏠 Property: Blue Jay Cir

🛏️ Beds/Baths: 4 Bed • 2 Bath • 1610 sqft

💰 Price: $282,000 | Rent: $1,885

📊 Cap Rate: 6.4% | NOI: $1,500

📅 Year Built: 2023

📐 Price/Sq Ft: $176

🏙️ Neighborhood: A-

Lebanon, TN

🏠 Property: Baltusrol Lane #852

🛏️ Beds/Baths: 4 Bed • 2.5 Bath • 2011 sqft

💰 Price: $369,990 | Rent: $2,400

📊 Cap Rate: 5.8% | NOI: $1,789

📅 Year Built: 2024

📐 Price/Sq Ft: $184

🏙️ Neighborhood: B

Alabama’s newer A- rental vs Tennessee’s larger property with higher NOI. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Speak to a Norada Investment Counselor (No Obligation):

(800) 611-3060

Build Passive Income & Wealth with Turnkey Rentals

Mortgage rates remain high in 2026, but rental properties continue to deliver strong cash flow and appreciation. Savvy investors know that turnkey real estate is the path to passive income and long‑term wealth.

Norada Real Estate helps you secure turnkey rental properties designed for immediate cash flow and appreciation—so you can invest smartly regardless of interest rate trends.

🔥 HOT INVESTMENT Properties JUST ADDED! 🔥

Request a Callback / Fill Out the Form Online