Printed on September seventeenth, 2024

By Kwame Donaldson

Over the previous yr, a stunning sense of steadiness has settled over the multifamily rental market. Be part of us for a data-backed dive into the forces at play and the methods this might all change.

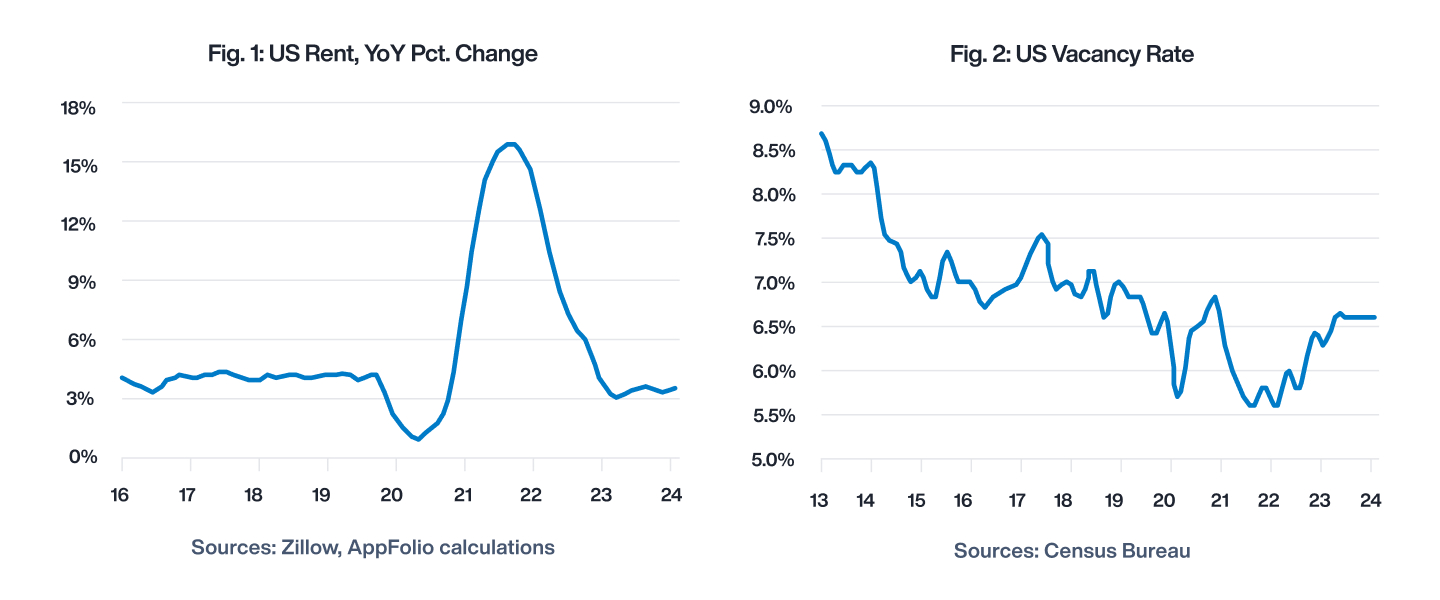

Historically risky indicators of the residential rental market have held regular by the primary half of 2024. Yr-over-year lease development — after hovering to almost 16% in 2022 — has settled between 3.4% and three.5% for every of the final 10 months, and the rental emptiness charge has locked in at 6.6% for every of the final 4 quarters, the longest interval of stability within the 68-year historical past of the collection.

Renters and condo homeowners throughout the USA are the beneficiaries of a Goldilocks situation: A file variety of multifamily properties are being accomplished simply as elevated immigration ranges, a big inhabitants of twentysomethings, and better housing prices are boosting the demand for condo items.

However this equilibrium possible received’t final. Knowledge from the US Census Bureau reveals a double-digit decline within the variety of rental properties at present below development, which implies that provide will quickly retreat from this yr’s near-record ranges. Adjustments in demand are more durable to forecast, however they need to additionally decline because the Fed eases rates of interest, housing affordability improves, and a few renters transition into homeownership. Demand is prone to decline additional as immigration to the US recedes from the 21-year excessive that it reached final yr. Whether or not nationwide rents and emptiness charges transfer greater or decrease finally is determined by whether or not the pullback in provide will probably be better than the slowdown in demand.

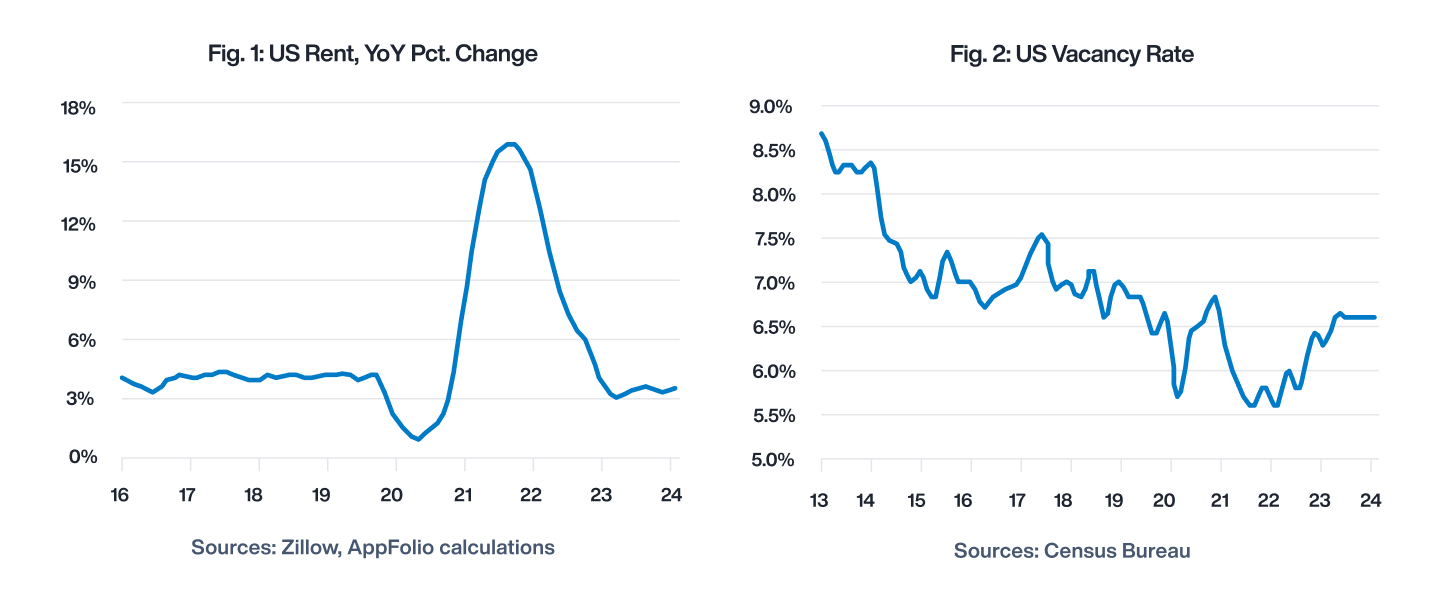

Current indicators usually are not the one signal of nationwide stability within the rental market. Based on the Census Bureau, the variety of renters who moved within the earlier 12 months has held regular for 3 consecutive years after being slashed by one-third between 2011 and 2021.

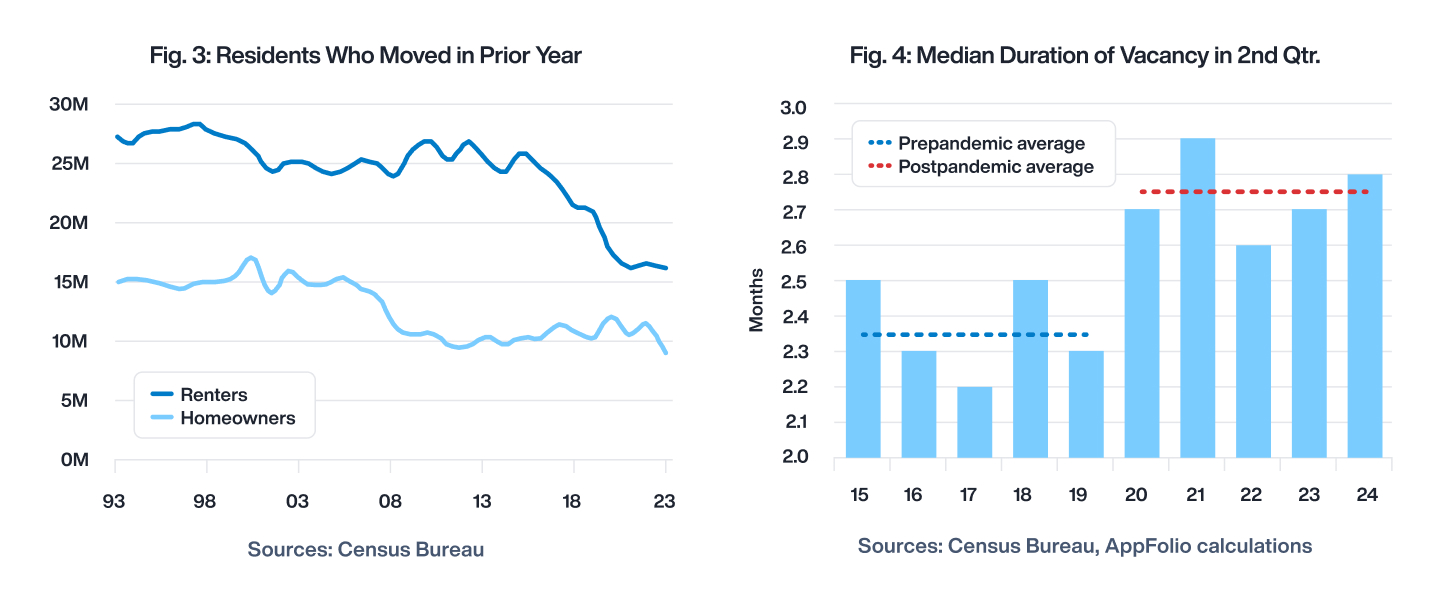

Moreover, the median period of rental unit emptiness within the second quarter of 2024 was 2.8 months, simply two days longer than the common over the past 5 years.

Whereas many particular person markets might outperform or underperform these indicators, nationwide steadiness is nice for the residential market normally. When provide and demand develop in tandem, renters have extra choices, and their relocation choices usually are not annoyed by lack of alternative. Property homeowners have a predictable earnings stream, which makes their belongings much less dangerous and extra precious. Orders for rental items are synchronized with vacancies, so planning to fill them is less complicated for property managers.

This welcome stability is the results of market forces which are expiring. As an example, at the moment’s regular renter turnover charge is because of the current slide within the variety of first-time homebuyers. Sky-high mortgage charges and rock-bottom housing provide have brought on residence gross sales to slide and house owner turnover to dip to an all-time low (Fig. 3). The longer-term slide in renter move-in exercise will resume when housing affordability improves and extra renters graduate to homeownership.

Equally, the median emptiness period stays elevated attributable to lingering pandemic results. Since 2020, the variety of days a typical vacant rental property is unoccupied has elevated by 12 days (Fig. 4). Precautions that homeowners and renters instituted within the wake of COVID-19 could also be extending the time it takes to modify between occupants. Ultimately, these pandemic results will dissipate, and the rental market will take pleasure in shorter turnover occasions. As these non permanent forces wind down, typical financial developments will regain prominence and nudge the rental market towards its long-run equilibrium.

In mild of those developments, and particularly attributable to elevated relocation selections for renters, resident retention has develop into extra essential than ever. Property administration firms might want to prioritize renters’ preferences as a way to meet their expectations all through their complete resident journey — from their preliminary inquiry to maneuver out and each second in between.

The 2024 AppFolio Property Supervisor Renter Preferences Report will enable you perceive precisely what your present and future renters anticipate so you possibly can surpass their expectations and stand out in a aggressive rental panorama. Try the report right here.