Mortgage brokers love to tell you they can lower your mortgage payment by refinancing your rental property.

Sometimes, they actually can.

But is it worth refinancing, even then?

Before rushing into a rental property refinance, understand the true costs.

Why Investors Refinance Rental Property

A lower monthly payment means stronger cash flow on your rental property. All investors love passive income — it’s why people become landlords in the first place.

Perhaps the mortgage lender offers to refinance you at a lower interest rate. Or perhaps you want to switch from a 30-year mortgage to a 15-year loan or vice versa.

And, of course, some lenders tempt you with cash out. You start drooling over all the uses you could put that money toward, from new rental property down payments to renovations to personal uses like home remodeling.

Some investing strategies revolve around refinancing. For example, it’s a crucial step in the BRRRR method of real estate investing. Refinancing creates the possibility of infinite returns on real estate investments.

Not all investors have a choice, either. If you borrow a balloon mortgage, you must pay it off before the term expires. That means either selling, refinancing, or finding creative financing.

Here’s a quick run-down of all common benefits of refinancing.

| Benefit | Description |

|---|---|

| Lower Interest Rates | Reduces monthly payments and total interest over the life of the loan. |

| Switch Loan Types | Allows transitioning from an adjustable-rate to a fixed-rate loan for stability. |

| Access to Equity (Cash-Out) | Extracts built-up equity for renovations or purchasing additional properties. |

| Shorten Loan Term | Refinancing into a shorter term helps build equity faster and reduces interest. |

| Increase Cash Flow | Lower payments improve cash flow, increasing profitability and flexibility. |

| Debt Consolidation | Combines multiple loans into one, simplifying management and potentially lowering costs. |

| Portfolio Growth | Frees up capital for expanding rental portfolios without depleting savings. |

The Downsides to Refinancing

You should not take refinancing lightly. Before signing on any dotted lines, consider these drawbacks to refinancing an investment property.

High Closing Costs

Refinancing is expensive. According to LendingTree, the average mortgage refinance costs $4,345 for homeowners borrowing cheaper mortgages.

Can you think of a few things you’d rather do with that money? I can, and they don’t involve handing it to 25-year-old mortgage bankers to blow on a wild weekend in Vegas.

Your loan officer will quickly assure you they’ll roll all closing costs into the loan. That doesn’t make the costs disappear; it just means you can pay interest on their fees.

So your first question must be, “How many years will it take me to recover the closing costs of the refinance in monthly savings?” The answer probably won’t make you happy.

But that’s just the tip of the iceberg.

Restarting Your Amortization Schedule

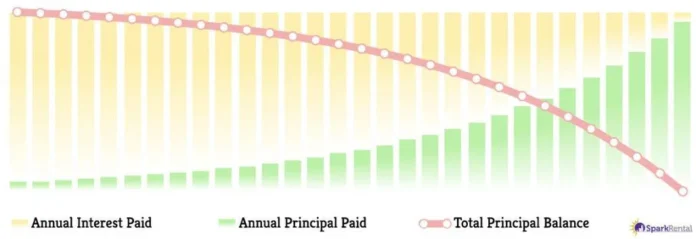

A higher portion of your monthly payment goes toward paying down your principal balance each month in your current loan. The principal paydown schedule is based on what mortgage bankers call “simple interest amortization.”

And there’s nothing simple about it.

The first mortgage payment is always the worst: most of the payment goes to interest for the bank, and a tiny fraction goes toward paying down your principal balance. The next month, slightly less goes to interest, and a little more goes toward principal. This change is gradual initially, then starts picking up speed in the second half of your loan.

Banks never want to see borrowers get to this point in their mortgage payments. They want you to keep refinancing so that they can charge you more up-front fees and keep your monthly payment mostly interest.

It’s in the bank’s best interest (pun intended) to keep refinancing you so that you never get far enough into your loan to really start paying down your balance.

So, the further you get in your loan, the more aggressively they’ll push refinance offers.

Use our free loan amortization calculator to view the full amortization schedule for any loan before signing on the dotted line.