Refinance to a Shorter Loan Term and Break Free Faster

Still on a 30-year mortgage? You might be overpaying in interest by hundreds of thousands. Here’s how to fix it.

When most Australians get a home loan, they lock in a 30-year term without a second thought. It feels normal. But normal isn’t always smart—especially when your goal is to pay your home off fast.

Refinancing to a shorter loan term—like 25, 20, or even 15 years—is one of the most aggressive yet effective ways to accelerate your path to financial freedom. And for many ADF members and veterans, this strategy fits perfectly with career milestones, family planning, and long-term goals.

In this post, we’ll explore how this powerful move works, what to consider, and why it might be the game-changer you’ve been looking for.

Why Shorter Loan Terms Work

When you refinance to a shorter loan term:

- You reduce your total interest paid.

- You pay off your home faster.

- You build equity quicker, which opens up investment options.

- You take control of your financial future sooner.

Yes, the repayments are higher—but for many ADF members with regular income, allowances, and DHOAS benefits, that’s not only manageable—it’s smart.

How Much Could You Save?

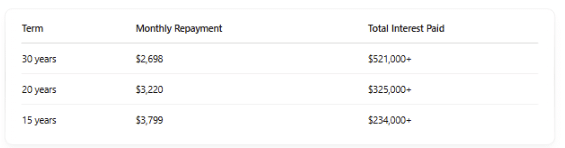

Let’s compare a $450,000 home loan at 6% interest:

Drop to 15 years and you could save nearly $300,000 in interest. That’s not a typo.

What Makes This Ideal for ADF Members?

- Your income is regular and stable. Perfect for higher repayments.

- You may already receive DHOAS subsidies. That’s extra money to help cover the cost.

- You’re used to budgeting and discipline. You’ve got what it takes to stick with a structured plan.

Plus, if you’re still in service, chances are your living costs are lower, meaning now’s the ideal time to ramp up your financial strategy.

When to Refinance to a Shorter Term

Refinancing works best when:

- Your income has increased or your budget has room.

- You’ve paid down some of your loan and can handle a slightly higher repayment.

- You’re motivated to be mortgage-free before retirement or transition out of the ADF.

Life hack: If you’re 35 now and move to a 15-year term, you could be mortgage-free by 50—while your mates are still locked in for another decade.

Worried About the Higher Repayments?

Here’s the workaround: you don’t have to refinance to benefit.

Instead, keep your 30-year loan but pay it like it’s a 15-year one.

- Set your repayment to match a 15- or 20-year term.

- Make extra repayments weekly or fortnightly.

- Automate it, and don’t touch the surplus.

This gives you flexibility (you can reduce the payment if needed) but still delivers most of the savings.

Steps to Refinance the Right Way

- Speak to a mortgage broker who understands ADF needs (we can connect you).

- Review your existing loan and interest rate.

- Assess your financial position—allowances, bonuses, DHOAS, and other obligations.

- Compare loan products across multiple lenders.

- Choose a term (e.g. 20 or 15 years) that fits your lifestyle and goals.

Bonus Tip: Combine with Equity Access

If you’ve had your property for a few years, it’s likely grown in value. Use that equity:

- To refinance at a better rate.

- To fund another investment.

- Or simply reduce your loan balance and restructure it smarter.

Conclusion: Pay Your Home Off on Your Terms

Refinancing to a shorter loan term is a bold, strategic move that separates the financially free from the financially stuck. If you’re serious about ditching your mortgage early, it’s one of the smartest decisions you can make.

You don’t need to be a financial guru. You just need to make the choice—and get the right team behind you.

Need a Broker Who Understands Defence?

We’ve helped thousands of ADF members and veterans refinance smarter, structure better, and pay off their homes sooner—without sacrificing lifestyle.

Book a free consultation with our expert team today:

🔗 https://www.integritypropertyinvestment.com.au/property-investing-for-adf/

Or get our ultimate guide:

📈 Wealth Through Property

🔗 https://www.integritypropertyinvestment.com.au/wealth-through-property/

🎓 Join our free ADF Property Investing Webinar

🔗 Click here to register