Yield on Cost (sometimes called return on cost) is especially useful in development and value-add scenarios. It tells you what your expected return will be based on the cost to acquire, develop, or improve a property, rather than basing it on its market value.

Formula:

To repeat: Cap rate measures income in relation to the value of a property. Yield on cost measures income in relation to the total cost of the property.

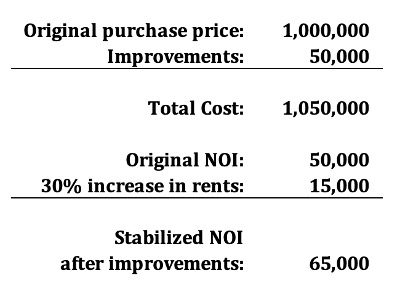

For example, you decide you’re going to buy a property today for $1 million because the NOI is $50,000 and the market cap rate of 5% (i.e., 50,000 divided by 5% cap = $1 million value). Your plan is to upgrade the property and raise the rents.

You’ll spend $50,000 on improvements so you can bump up rents by 30%. Let’s see how that looks:

Now you have a new total cost for the property of $1,050,000 – the purchase price plus the improvements — and a stabilized NOI that’s 30% higher than before, or $65,000. Let’s use the Yield on Cost formula, which basically looks a lot like the cap rate formula:

YOC = stabilized NOI / total cost

YOC = 65,000 / 1,050,000 = 6.19%

You notice that the yield on cost is higher than the cap rate—which leads us to another metric that often lives below the radar.