So, the U.S. government is shut down. What does that mean for your dream of buying a home or refinancing your current one? It’s a question many are asking right now. The short answer, and it’s a bit of a mixed bag: government shutdowns can lead to a drop in mortgage rates, but they can also create frustrating delays in the homebuying process. This isn’t some abstract economic theory; it’s about how fear and uncertainty in Washington ripple down to affect real people’s finances and biggest purchases.

Will Mortgage Rates Go Down After the US Government Shutdown?

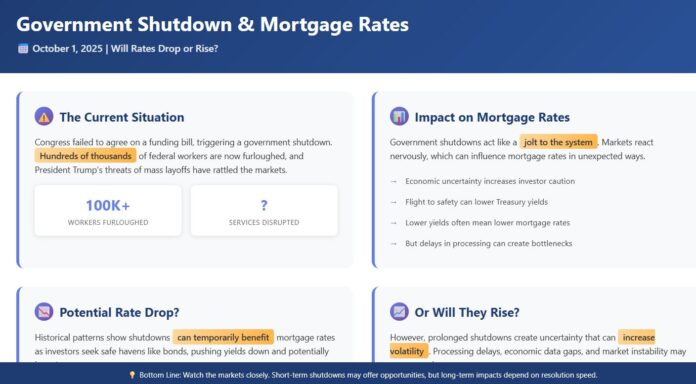

As of October 1, 2025, we find ourselves in this situation because Congress couldn’t agree on a funding bill. This impasse, coupled with President Trump’s bold threats of mass federal layoffs, has sent a nervous tremor through the markets. Hundreds of thousands of federal workers are now furloughed, and essential services are facing disruptions. For us on the ground, especially those of us looking at homes or thinking about our mortgages, understanding these shifts is crucial.

In my years following these economic tides, I’ve observed that these shutdowns often act like a jolt to the system. Sometimes, that jolt can be a small benefit for mortgage rates, and sometimes it’s just a headache. Let’s break down exactly why this happens and what it means for you.

What Triggered the 2025 Shutdown and Why Should We Care?

Think of a government shutdown like a pause button being hit on non-essential government operations. It happens when the people in charge of spending the country’s money – Congress and the President – can’t agree on how much money to give to different departments for the upcoming year. This time around, the disagreements seem particularly tough, involving spending levels and even things like health insurance costs for federal employees.

What makes this shutdown different and potentially more concerning is President Trump’s talk of preparing “reduction in force” (RIF) notices. This isn’t just about a temporary “see you next week” furlough; it sounds like they’re gearing up for permanent job cuts. We’re talking about potentially hundreds of thousands of federal workers being directly affected, and that doesn’t even count the ripple effect on the private companies that do work for the government.

From an economic standpoint, these shutdowns aren’t ideal. When parts of the government aren’t operating, certain economic activities slow down. Experts estimate that every week the government is shut down, it can shave about 0.1% to 0.2% off our nation’s overall economic growth (our Gross Domestic Product, or GDP). Now, if it’s a short shutdown, like a week or two, the economy usually bounces back pretty quickly. But longer ones, like the marathon shutdown that lasted over a month back in 2018-2019, can really start to weigh on everyone’s confidence and slow things down.

And here’s a weird twist for 2025: the shutdown means we won’t be getting some key economic reports, like the all-important jobs report that usually comes out in early October. When the Federal Reserve – the folks who set interest rates – are trying to figure out how strong or weak the economy is, these reports are like their eyes and ears. Without them, they’re basically flying blind, which adds another layer of uncertainty to their decisions about interest rates.

A Look Back: How Have Shutdowns Hit Mortgage Rates Before?

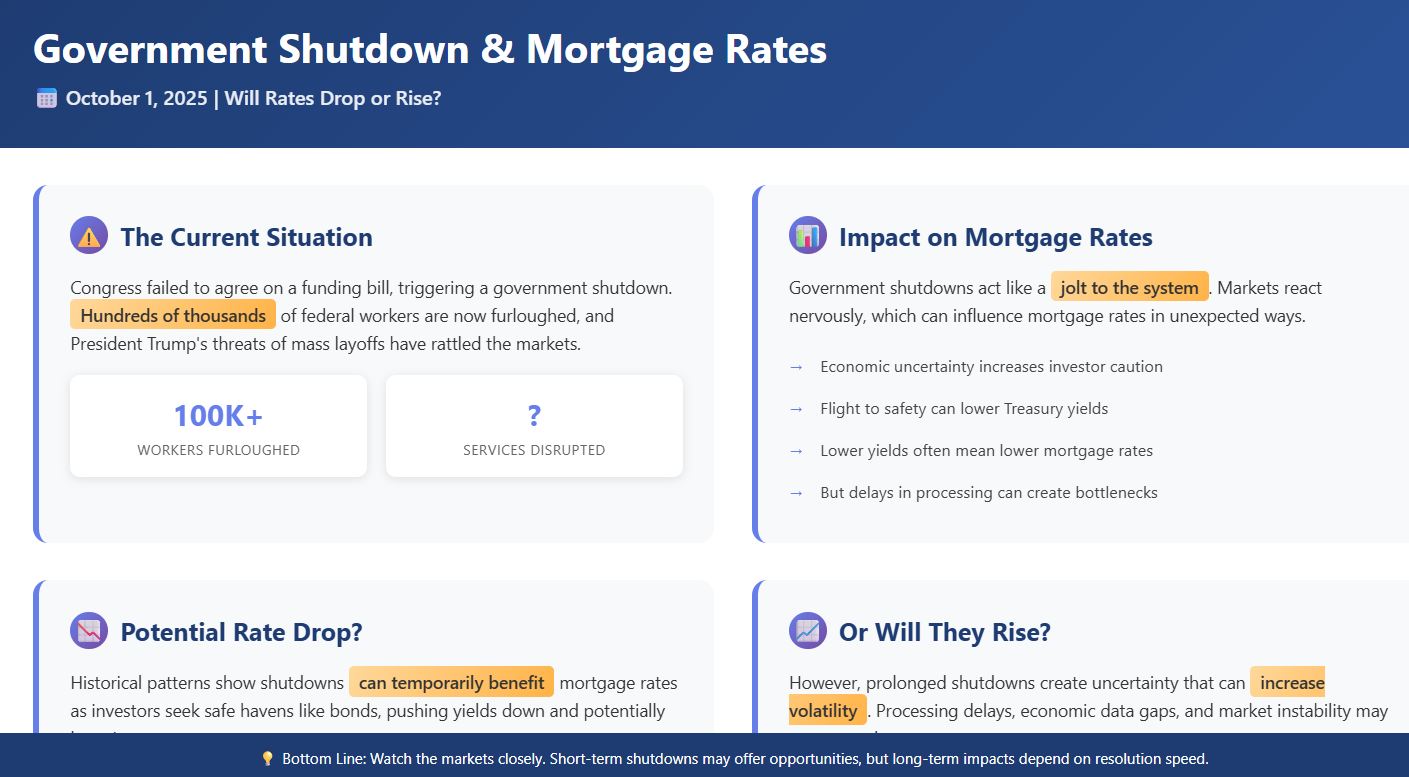

This isn’t the first time we’ve seen a government shutdown, and looking at history often gives us clues about what might happen. The interesting thing is that government shutdowns can actually lower mortgage rates, at least for a while.

Here’s how it usually works: When there’s political or economic uncertainty, investors tend to get nervous. They want to put their money somewhere safe. A lot of times, they’ll rush to buy U.S. Treasury bonds, which are considered one of the safest investments out there. When more people buy bonds, the price of those bonds goes up, and their yield (which is like the return an investor gets) goes down.

Mortgage rates are closely tied to the yields on these Treasury bonds, especially the 10-year Treasury note. So, when bond yields drop, mortgage lenders often follow suit, lowering their rates. It’s a bit of a strange phenomenon: bad news in Washington can sometimes be good news for people looking to borrow money for a house.

Let’s look at some past examples:

| Shutdown Period | Duration | Approximate 30-Year Fixed Rate Change | Key Observations |

|---|---|---|---|

| October 2013 | 16 days | Drop of about 0.20% | Mortgage applications dipped due to processing worries, but bond yields fell significantly. |

| December 2018 – Jan 2019 | 35 days | Initial drop of about 0.25% | The longest shutdown. Saw a temporary dip in rates, but they started to stabilize as the shutdown dragged on. Home sales also took a hit. |

| Overall Average (Past) | Varies | Drop of ~0.125% to 0.25% | Generally, bond yields would soften by about 0.60% during periods of shutdown-induced uncertainty. |

We can visualize this (imagine a graph here): Typically, right when a shutdown begins, mortgage rates might dip a bit, shown by a downward tick. But if the shutdown drags on, the effect might lessen, and rates could steady out or even creep back up depending on other economic news.

It’s not always a slam dunk for lower rates, though. Some experts point out that if there isn’t other bad economic news to go along with the shutdown (like a really weak jobs report), the drop in rates might be smaller. And in 2025, with the jobs report delayed, the market might not get the signal it expects about economic weakness, potentially limiting how much rates can fall.

The “How-To”: Why Shutdowns Affect Rates and Processing

So, we know rates might drop. But what else happens? It’s a bit like a coin with two sides.

- The Good Side (Potentially Lower Rates): As I mentioned, the uncertainty often drives investors to the safety of Treasury bonds. This push down on bond yields is a direct signal for mortgage lenders to adjust their pricing. This is likely why, as of today, October 1, 2025, we’re already seeing 30-year fixed rates tick down to around 6.125%, according to reports from sources like NerdWallet. This can be a welcome relief for borrowers, especially in a market that’s been sensitive to rate fluctuations.

- The Not-So-Good Side (Processing Headaches): This is where things get tricky for many hopeful homebuyers. Not all loans are created equal when the government is operating on a skeleton crew.

- Government-Backed Loans: Loans like FHA, VA, and USDA loans are directly tied to government agencies. While FHA loans are seeing some continuity with emergency staffing, the VA (for veterans) and USDA (for rural development) are pausing new commitments. This means if you were counting on one of these loans, you might face significant delays.

- Conventional Loans: These are loans from private banks and lenders, like those backed by Fannie Mae and Freddie Mac. They are generally less affected. However, they still sometimes need verifications from government agencies, like checking your tax records with the IRS or verifying your Social Security information. These small delays can add up.

- Flood Insurance: This is a big one for people buying homes in flood-prone areas. During a shutdown, the National Flood Insurance Program (NFIP) stops issuing new policies. Since most mortgages require flood insurance in designated zones, this can bring a home sale to a complete halt. Reports suggest this can affect about 10–15% of mortgages in areas like Florida.

- The Bigger Housing Picture: The housing market has already been dealing with its own set of challenges, like limited housing inventory. Adding a government shutdown and loan processing delays on top of that can further slow down sales. And if those mass layoffs President Trump is talking about actually happen? That means fewer people have verifiable income, which makes it harder to get approved for a mortgage. It’s a cascade of potential slowdowns.

My feeling is that while the headline might be about potentially lower rates, the operational disruptions are what people are really going to feel day-to-day. I’ve heard from people who work in the mortgage industry, and they’re already bracing for longer closing times and chasing down missing pieces of information. It adds stress when you’re already dealing with one of the biggest financial decisions of your life.

What Does This All Mean for You? Advice and What Experts Are Saying

Let’s cut through the noise and get to what you might want to do.

For Potential Homebuyers and Refinancers:

- Lock it Down? If you’re seeing a drop in rates and you’re ready to move forward, consider locking in your rate. This protects you if rates were to unexpectedly rise again later.

- Build in Extra Time: Be prepared for delays. While conventional loans might be less affected, government-backed loans and especially flood insurance issues can add weeks to your closing timeline. Talk to your lender about potential bottlenecks now.

- Federal Employees: If you’re a federal worker, your income verification might be tricky. Document your furlough status carefully. While back pay is usually arranged after the fact, lenders need to see current, verifiable income.

For Those Concerned About the Economy:

- Short Shutdowns are Usually Okay: Most analyses, like those from the Brookings Institution, suggest that brief shutdowns (under two weeks) have pretty minor impacts on the overall economy.

- Longer Shutdowns = Bigger Risks: If this shutdown drags on, the economists are more worried. The GDP growth could be noticeably impacted, consumer spending might fall (especially if federal workers and contractors have less money to spend), and it makes the Fed’s job of setting interest rates even harder without crucial data.

- The Layoff Factor: The talk of mass layoffs is the wild card. It’s different from past situations and could have a more significant chilling effect on consumer confidence and spending than a simple furlough.

The Debate and Different Perspectives:

It’s important to remember that not everyone agrees on the impact. Some see shutdowns as fiscal responsibility in action, while others view them as harmful political stunts that hurt everyday workers. Economists at places like Al Jazeera often point out that historically, the market often shrugs off short-term shutdowns. However, the unique circumstances of 2025 – the layoff threats and the data blackout – mean we can’t just assume history will repeat exactly.

In my opinion, the most important takeaway is to stay informed and be proactive. Don’t just assume the news headlines tell the whole story. Talk to your lender, understand the specific requirements for your loan type, and keep an eye on reliable financial news sources.

Looking Ahead: Potential Economic Ripples

To give you a clearer picture of what longer shutdowns could mean, here’s a general idea of the economic drag we might see, based on analyses from various economic think tanks:

| Estimated Shutdown Duration | How Much GDP Growth Could Slow Weekly | Total Impact on Late 2025 Growth | What This Might Mean for You |

|---|---|---|---|

| 1 Week | Around -0.1% | Very Small | Mortgage rates might dip slightly; minimal disruption for most. |

| 2 to 4 Weeks | Around -0.15% per week | Noticeable Slowdown | Processing delays become more common; slight dip in home sales. |

| More Than 4 Weeks | Around -0.2% per week | Significant Slowdown | Layoffs could hit hard; consumer confidence drops; increased market jitters. |

(This is a simplified representation, as actual economic effects depend on many factors.)

Imagine this visually: a series of bars, each getting taller as the shutdown gets longer, representing the negative impact on the economy. The longer the shutdown, the higher the bar, signifying greater economic pain.

The key is that while a short shutdown might offer a fleeting benefit of lower mortgage rates, a prolonged one poses significant risks to the broader economy, which can indirectly affect housing demand and affordability in the longer run.

Final Thoughts: Navigating the Uncertainty

So, will a government shutdown affect mortgage rates? Yes. Will they drop? Likely, at least in the short term, due to the “flight to safety” in the bond market. Will this be a smooth ride for everyone trying to buy a home? Probably not. The processing delays, especially for government-backed loans and flood insurance, are real and can cause significant frustration.

As someone who has followed these markets for a while, I’ve learned that political events often have unintended consequences. The hope is that Congress and the President can find a resolution quickly. Until then, my best advice is to be prepared, stay calm, and communicate closely with your lender. This shutdown might offer a temporary mortgage rate discount for some, but it also serves as a stark reminder of how interconnected our financial lives are with the decisions made in Washington.

Do You Want to Invest in Real Estate Without Any Stress?

Government shutdowns create uncertainty for markets—and mortgage rates can react quickly to the headlines. Whether rates dip or spike, having a clear investment plan matters.

Norada helps you navigate volatility by connecting you with turnkey, cash-flowing rental properties in resilient markets—so you can protect purchasing power and pursue steady income regardless of short-term rate moves.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060