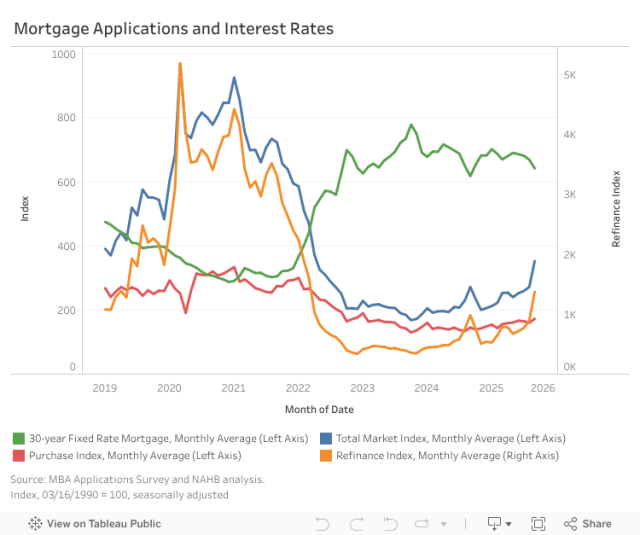

Refinancing activity surged in September, marking the largest monthly increase since the COVID-era of ultra-low interest rates. This increase followed mortgage rates dropping below 6.5% for the first time since October 2024 in anticipation of rate cuts that ultimately materialized.

The Mortgage Bankers Association’s (MBA) Market Composite Index, a measure of total mortgage application volume, rose 29.7% from August on a seasonally adjusted basis and was 29.6% higher than a year ago, the sharpest monthly gain since 2020.

The average contract interest rate for 30-year fixed mortgages fell 27 basis points to 6.42%, the lowest in one year. Amid lower borrowing costs, homeowners seized the opportunity to refinance, driving a 54.2% increase in refinancing activity. Purchase applications also increased 7.7% month-over-month. Compared to a year ago, purchase and refinance applications were up 18.6% and 39.8%, respectively.

Lower rates are unlocking activity in the housing market, reflected by these increases in mortgage activity.

Alongside the jump in refinancing activity, the average refinance loan size increased 22.3% to $410,000, the largest monthly increase since the MBA began tracking in 2011. These coincided with one another, as homeowners with larger loans were the first to take advantage of these lower rates.

Purchase loan sizes also increased 1.6% over the month to $436,000, and adjustable-rate mortgage (ARM) loans increased 4.0% to $984,000. The average loan amount across all loan types increased 9.2% to $423,000.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.