As of late 2025, with the Federal Reserve having already dialed back its benchmark interest rate and bracing for another cut at its upcoming meeting, the real question on everyone’s mind is: what’s next for interest rates over the coming three years? We’re looking at a gradual easing path, with the Fed’s own projections pointing towards the federal funds rate settling around 3.1% by the end of 2027. This isn’t a sudden drop, but a measured unwind as the economy continues to cool and inflation inches closer to the Fed’s 2% target.

Fed Interest Rate Predictions for the Next 3 Years: 2025-2027

Stepping back from the data for a moment, I’ve been watching the economic tea leaves for a long time, and this current period feels like a significant pivot. We’ve moved beyond the aggressive hiking cycle that was designed to slam the brakes on rampant inflation. Now, the challenge is to guide the economy back to a stable, sustainable growth path without tipping it into a full-blown recession. It’s a delicate dance, and the Fed’s “dot plot” – those anonymous projections from Fed officials – offers a valuable, albeit evolving, glimpse into their strategy.

The Fed’s Game Plan: What the “Dots” Are Telling Us

The Federal Open Market Committee (FOMC), the Fed’s main policy-setting group, releases its economic projections four times a year. The most recent update in September 2025 painted a picture of continued, but slow, rate reductions.

The median expectation, which is essentially an average of what each Fed official predicts, suggests the federal funds rate will move from its current mid-4% range down to about 3.6% by the close of 2025. Looking further out, they see it dipping to 3.4% in 2026 and then 3.1% in 2027.

What’s interesting is that they also predict a “longer-run neutral rate” of 3.0%. This is the rate they believe neither stimulates nor slows down the economy. So, the projections suggest they’ll end up settling near that 3% mark by 2027, a level that should support steady, non-inflationary growth.

Even when you take out the most optimistic and pessimistic predictions (the top and bottom three projections), the range for 2025 still hovers around 3.6%-4.1%. This tells me there’s a general agreement on moving rates lower, but some FOMC members are definitely more cautious than others, keeping a close eye on any signs of inflation picking back up.

Wall Street’s Whispers: Market Rates and What They Mean

The financial markets are always trying to get ahead of the Fed’s moves, and you can see this clearly in tools like the CME FedWatch Tool. As of mid-October 2025, this tool shows an overwhelming 99.3% chance of a 25-basis-point rate cut at the upcoming FOMC meeting.

That would bring the federal funds rate to 3.75%-4.00%. Looking ahead to December 2025, there’s an 89.9% probability that rates will be between 3.50% and 3.75%. This means the markets are largely in sync with the Fed’s expectation of roughly two more rate cuts by the end of the year.

As we look into 2026 and 2027, market-implied probabilities suggest a continued downward trend. By the end of 2026, the market is essentially pricing in rates around 3.25%-3.50%, and by 2027, it’s nudging closer to the 3.0% mark.

These expectations are built on the assumption that inflation will continue to ease, with core PCE (a key inflation gauge) projected to be around 2.6% in 2026. Of course, if economic data takes an unexpected turn – say, the October jobs report is surprisingly strong or weak – these market probabilities can shift quite rapidly.

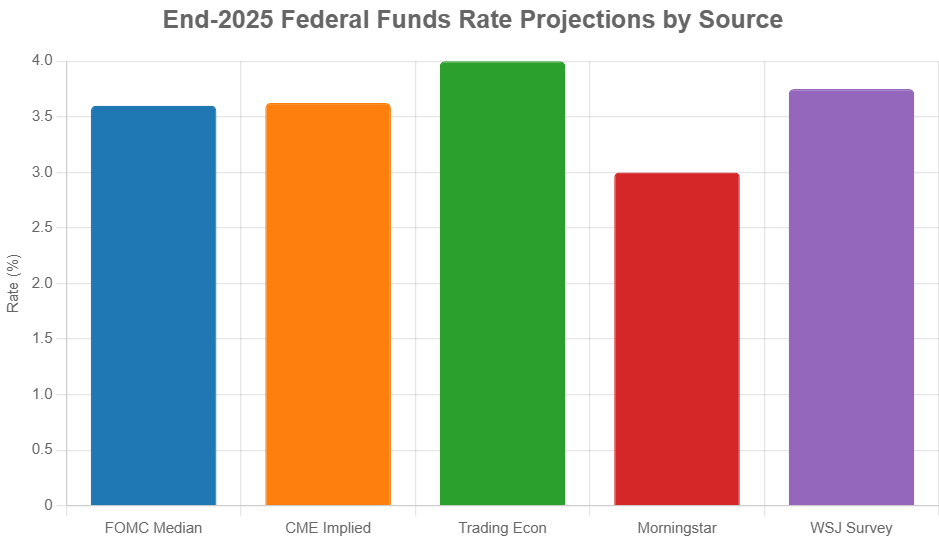

Beyond the Fed: What Other Experts Are Saying

It’s not just the Fed and the markets. A wide range of economists and financial institutions also weigh in with their forecasts. Generally, there’s a consensus that rates will come down, but the pace of those cuts is where opinions diverge.

- Trading Economics aggregates various forecasts and suggests a similar path to the Fed, with rates potentially reaching 3.50% by the end of 2026 and 3.25% in 2027. Their view seems to be supported by the idea that consumer spending will remain relatively robust.

- However, some, like Morningstar, are predicting a more aggressive easing cycle. They envision cuts that could bring rates down to around 2.25%-2.50% by 2027. This more dovish stance is contingent on economic growth slowing down significantly, potentially even dipping below 1.5% if the job market weakens more than expected.

- Others, like Deloitte, in their Q3 2025 forecast, highlight the influence of government spending and deficits. They anticipate only about 50 basis points of total cuts by the end of 2025 and see longer-term rates remaining elevated due to these fiscal factors.

- Even institutions like BlackRock tend to echo the Fed’s projections closely, emphasizing a gradual unwind and advising on portfolio adjustments in anticipation of falling yields.

Here’s a quick look at how these different perspectives stack up for the end of 2025:

| Source | Projected End-2025 Rate (Midpoint Midpoint %) | Key Factor Driving Their View |

|---|---|---|

| FOMC Median | 3.6 | Maturing inflation, sustainable growth, balanced risks |

| CME FedWatch Implied | ~3.625 | Market pricing based on futures contracts |

| Trading Economics | ~4.0 | Consensus aggregation, stable consumer spending |

| Morningstar | ~3.0 | Deeper cuts if economic growth falters significantly |

| Deloitte (Q3 2025) | ~3.625 | Influence of fiscal policy and deficits, slower initial easing |

| WSJ Survey (Oct 2025) | ~3.75 | Anticipates faster easing with two additional 2025 cuts |

You can clearly see that while everyone agrees on some easing, there’s a debate about how much and how fast. This range of views highlights the inherent uncertainty in any economic forecast.

The Economic Engine Room: Growth, Inflation, and Jobs

The Fed’s decisions are fundamentally tied to its dual mandate: keeping inflation in check and maximizing employment. The projections for the next three years are based on a specific economic outlook:

- Economic Growth: The FOMC expects GDP growth to moderate. After a certain pace in 2025, they see it picking up slightly to around 1.8% in 2026 and 1.9% in 2027. This is generally considered a healthy, sustainable rate of growth that doesn’t overheat the economy. This assumes consumer spending and business investment will continue, but perhaps at a more measured pace than we saw post-pandemic.

- Inflation: This is the big one. The projections show inflation continuing its downward trend. From around 3.0% for PCE in 2025, they expect it to ease to 2.6% in 2026 and finally reach their 2% target in 2027. Core inflation (which strips out volatile food and energy prices) is expected to follow a similar path. This cooling of inflation is crucial for justifying rate cuts. Even with supply chains normalizing, wage growth, projected at around 3.5%, remains a factor the Fed watches closely.

- Unemployment: The job market is expected to remain relatively strong, but perhaps with a slight tick up. The FOMC projects unemployment to rise modestly to around 4.5% in 2025, before settling at a long-run rate of about 4.2%. This is often referred to as a “soft landing” scenario – where inflation is cooled without causing a significant spike in job losses.

What This Means for You, Me, and the Markets

These Fed rate predictions aren’t just abstract numbers. They have real-world consequences for all of us:

- Borrowing Costs: Lower interest rates generally mean it becomes cheaper to borrow money. Think mortgages, car loans, and credit card interest rates. If rates fall as predicted, 30-year mortgage rates could potentially dip back below the 6% mark by mid-2026, making homeownership more accessible for some. Businesses might also find it cheaper to take out loans for expansion.

- Savings and Investments: On the flip side, for those who rely on interest income, lower rates mean lower returns on savings accounts, certificates of deposit (CDs), and even short-term government bonds. Investors in the stock market might see a boost, as lower borrowing costs can sometimes translate into higher corporate profits and increased investor appetite for riskier assets like stocks. We’ve already seen the S&P 500 rally on expectations of these cuts.

- The Dollar: A Fed that is cutting rates while other countries might not be could lead to a weaker U.S. dollar. This can make American exports cheaper for foreign buyers but make imports more expensive for us.

- The Global Picture: For international markets, a weaker dollar can be a boon for emerging economies, making their debts easier to repay. However, it can create challenges for countries with their own currencies, impacting their trade balances.

The Unknowns: Risks That Could Change Everything

Predicting the future is always a gamble, and economic forecasting is no different. There are several potential curveballs that could derail the Fed’s projected path for interest rates:

- Inflation Surprises: The biggest risk is that inflation proves stickier than expected. If new tariffs are imposed (perhaps due to shifts in global trade policy), or if oil prices spike due to geopolitical events, inflation could re-accelerate. In such a scenario, the Fed might have to pause its rate cuts or, in a worst-case scenario, even consider raising rates again – a prospect few are currently pricing in.

- Economic Slowdown or Recession: On the other hand, the economy might falter more than anticipated. While the Fed aims for a soft landing, there’s always a chance that higher rates for longer – or other economic shocks – could push the economy into a recession. If recession odds increase, the Fed might feel compelled to cut rates more aggressively, perhaps by larger increments than the current 25 basis points.

- Geopolitical Instability: Events in regions like the Middle East, or any number of other global flashpoints, can have ripple effects on energy prices, supply chains, and overall economic sentiment. A significant disruption could easily impact the Fed’s decisions.

- Fiscal Policy: Government spending and debt levels also play a role. Large fiscal deficits can sometimes put upward pressure on interest rates, creating a tug-of-war with the Fed’s policy.

The Fed itself acknowledges these uncertainties. In the FOMC’s September meeting minutes, for example, discussions revealed a split on the vote for the last rate cut, indicating that some participants were more concerned about inflation risks than others.

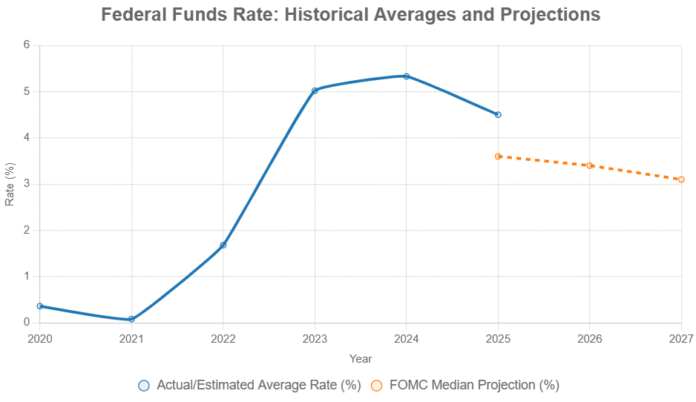

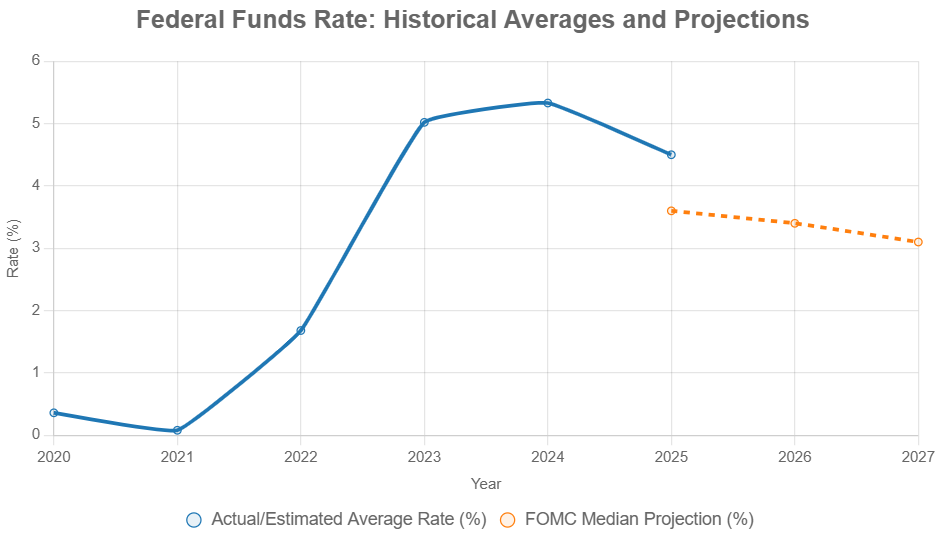

Visualizing the Interest Rate Journey

To put these predictions into context, let’s visualize it. To contextualize, the following chart traces annual average federal funds rates from 2020 onward, blending historical data with FOMC median projections. Note the sharp 2022-2023 ascent and anticipated glide path. We can see the dramatic rise in rates to combat inflation, followed by the expected gradual decline.

And here’s a quick comparison of where different forecasters see us ending 2025:

Putting It All Together

For the next three years, the most likely scenario is a measured descent in interest rates. The Fed seems committed to a path of gradual cuts, aiming to bring inflation down without derailing economic growth. This means we’ll likely see rates move from their current mid-4% range down towards the 3% mark by 2027.

However, it’s crucial to remember that this is a forecast, not a guarantee. Economic data is constantly changing, and unforeseen events can quickly alter the trajectory. Staying informed about inflation reports, employment numbers, and Fed statements will be key for anyone trying to navigate these evolving interest rate predictions.

Capitalize on Easing Fed Rates with Strategic Real Estate Investments

As the Federal Reserve signals a gradual path toward lower rates—projected to reach around 3.1% by 2027—now is the time to position yourself for long-term real estate gains.

Work with Norada Real Estate to lock in opportunities in high-performing markets that thrive as borrowing costs ease—boosting your cash flow and wealth-building potential.

HOT PROPERTIES LISTED NOW!

Speak with a seasoned Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More About Interest Rates?

Explore these related articles for even more insights: