If you’re thinking about buying a home or refinancing an existing mortgage, you’re likely wondering what November 2025 will bring. Well, I’ve got some insights for you. Based on the latest economic signals and expert forecasts, it looks like mortgage rates for 30-year fixed loans are likely to settle in the 6.0% to 6.2% range in November 2025. This comes after the Federal Reserve’s decision to lower interest rates, a move that’s sending ripples through the financial world. It’s a small bit of relief, but it’s important to understand all the pieces that make up this complex puzzle.

Mortgage Rates Predictions for Next Month: November 2025

The Fed’s Latest Move and Why It Matters

You may have heard the news: the Federal Reserve made a move on October 29, 2025. They trimmed their benchmark federal funds rate by 25 basis points, bringing it down to a range of 3.75% to 4.00%. This is the second time they’ve done this this year. Why do they do this? Think of the Fed as the economy’s thermostat. When things are getting a little too hot (inflation is high), they turn up the heat (raise rates) to cool things down. When the economy feels a bit sluggish, like the job market is slowing down, they turn down the heat (lower rates) to give it a boost.

This latest cut is a signal that they’re keeping an eye on employment and trying to keep inflation from getting too out of hand. While inflation is still a bit higher than their 2% target, it’s showing signs of cooling down. Now, here’s the key thing: mortgage rates don’t always follow the Fed’s moves one-for-one. They are influenced by a lot of other factors, but the Fed’s actions definitely set the stage.

What the Experts Are Saying: Predictions for November 2025

So, with the Fed’s cut out of the way, what does this mean for actual mortgage rates next month? I’ve been digging into what the big players in the housing and economic world are predicting.

- Fannie Mae, a major player in the mortgage market, recently updated its outlook. They expect rates to continue a gentle downward trend, suggesting that November could see averages around 6.1% to 6.2% for a 30-year fixed loan. They believe the Fed’s action will help, but they also point out that inflation can be “sticky,” meaning it’s hard to get rid of completely, which might stop rates from falling much lower.

- The Mortgage Bankers Association (MBA) is also weighing in. They’re forecasting the average rate for the fourth quarter of 2025 to be around 6.2%. For November specifically, they’re putting it right around 6.15%. They also mentioned that they don’t expect rates to drop significantly below 6% for the rest of the year.

- Freddie Mac, another key institution, often publishes data on mortgage rates. Their latest thoughts suggest rates will likely hover between 6.0% and 6.3% as we move through the end of the year. They see the recent bond market shifts as supportive of slightly lower rates.

Looking at all these forecasts, there seems to be a pretty strong consensus. The most likely scenario for a 30-year fixed mortgage in November 2025 is somewhere between 6.05% and 6.20%. This means we could see a small dip, maybe 10 to 30 basis points (that’s just fancy talk for a small percentage point drop) from where we are now.

Key Factors Shaping Mortgage Rates: It’s More Than Just the Fed!

While the Federal Reserve’s rate cuts are a big deal, they are just one piece of a much larger economic puzzle. Here are the other major forces at play that will influence mortgage rates in November 2025 and beyond:

- Treasury Yields: When you borrow money, there’s always a cost attached. For mortgages, a really important benchmark is the yield on U.S. Treasury bonds, especially the 10-year Treasury. Think of it this way: investors lend money to the government by buying Treasury bonds. The interest rate the government pays on these bonds gives us clues about borrowing costs for everyone else. After the Fed’s cut, the 10-year Treasury yield did dip, which you’d expect to help lower mortgage rates. However, the bond market can be a bit jumpy. Things like election results, which could signal changes in government spending or taxes, can make these yields go up or down pretty quickly.

- Inflation and Jobs: We’ve talked about inflation. Even though it’s cooling, it’s still above that 2% target the Fed is aiming for. This is especially true for things like housing costs, which are a big part of the inflation picture. On the job front, the economy still added a good number of jobs in October (around 254,000, according to some reports). This shows the economy isn’t in a recession, which is good news, but it also means the Fed might not feel the need to slash rates too aggressively. If inflation unexpectedly jumps up again, or if the job market shows surprising strength, rates could actually go back up.

- Housing Supply and Demand: Even if mortgage rates drop a bit, the price of homes still plays a huge role in how affordable buying is. We’ve seen housing inventory increase by about 15% compared to last year. That’s a good sign for buyers because it means there are more homes on the market, which can help ease some of the price pressure. However, the median home price is still hovering around $420,000. This is still a big number for many families, and it means that even with slightly lower rates, buying a home might still feel out of reach for some.

Visualizing the Trends: Historical Context

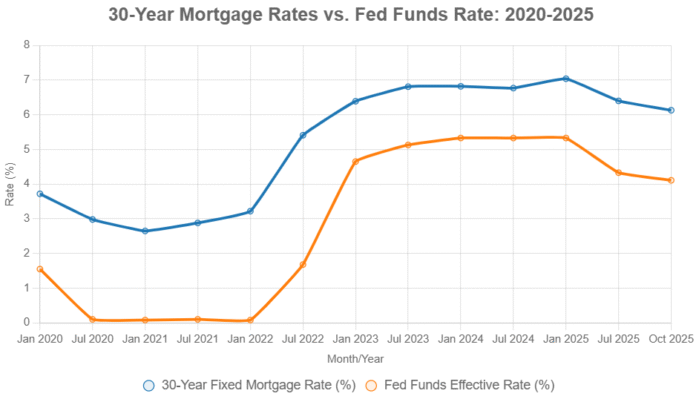

To illustrate the relationship between Fed policy and mortgage rates, consider this line chart tracking monthly averages from January 2020 to October 2025. Data sourced from FRED (St. Louis Fed) shows how pandemic-era lows gave way to 2022-2023 hikes, with recent cuts beginning to unwind the climb—yet mortgage rates lag the fed funds rate by 150-200 basis points.

![]()

Opportunities and Risks for Homebuyers and Refinancers

So, what does this potential shift in mortgage rates mean for you?

For Homebuyers:

- Improved Affordability (Slightly): A mortgage rate of 6.1% on a $400,000 loan means about a $2,430 monthly payment (principal and interest only). If rates were at 6.5%, that payment would be around $2,530. That’s a savings of $1,200 per year without even considering taxes and insurance! This small decrease in rates could make a big difference, especially for first-time homebuyers who often have tighter budgets.

- Potential for More Sales: With rates nudging lower, we might see a small bump in home sales, possibly between 5% to 8% in the last quarter of the year.

For Refinancers:

- Savings Potential: If you have a mortgage with a rate significantly higher than what’s predicted for November, now might be a good time to look into refinancing. Many homeowners who locked in rates above 7% could potentially see monthly savings of $100 to $200 on a $300,000 loan by refinancing into a lower rate.

- “Last Chance” Window?: Some experts believe that while rates might continue to ease into 2026, they might not drop drastically below 6% for quite some time. This makes November a potentially good window to lock in a rate if it works for your financial situation.

The Risks to Watch Out For:

- Unexpected Economic Shocks: The economy is a fluid thing. If there’s a sudden spike in inflation or a major shift in the job market that catches everyone off guard, mortgage rates could climb back up. For instance, if the Fed decides against another rate cut in December (which some market indicators are currently showing a decent chance of happening), it could put upward pressure on rates.

- Regional Differences: It’s important to remember that mortgage rates aren’t always the same everywhere. Areas with higher costs of living or different market dynamics might see rates move differently than the national average.

A Peek at the Numbers: What You Might See

To give you a clearer picture, let’s look at some projected numbers. Keep in mind these are averages and your actual rate will depend on your credit score, loan type, and lender.

| Loan Type | Current Rate (as of Oct 30, 2025) | Predicted Nov Avg Range (2025) | Potential Monthly Savings on a $300K Loan* |

|---|---|---|---|

| 30-Year Fixed | 6.13% | 6.05% – 6.15% | $50 – $100 |

| 15-Year Fixed | 5.39% | 5.25% – 5.35% | $30 – $60 |

| 5/1 ARM (Intro) | 5.75% | 5.60% – 5.80% | Variable post-introductory period |

Note: These savings are estimated compared to average October rates on a $300,000 loan, excluding taxes and insurance.

As you can see, the savings might not be huge, but every bit counts when you’re talking about decades of mortgage payments.

Making Your Move: What I’d Do

From where I stand, monitoring the mortgage market isn’t just about watching the Fed’s announcements. It’s about understanding the symphony of economic forces playing out.

If you’re looking to buy or refinance, my advice is to be proactive. Don’t wait until the last minute.

- Shop Around: I can’t stress this enough. The difference in rates between lenders can be significant. Get quotes from at least three to five different lenders. This simple step can save you thousands over the life of your loan.

- Consider a Rate Lock: If you find a rate you’re happy with in November, and it’s within the predicted range you’re comfortable with, consider locking it in. A rate lock, typically good for 30 to 60 days, protects you if rates suddenly decide to go up. It gives you peace of mind.

- Boost Your Credit Score: Even a small improvement in your credit score can qualify you for a better interest rate. If you have a few months before you plan to lock in, see if you can pay down some debt or address any lingering issues on your credit report.

- Understand the Long Game: Mortgage rates aren’t going to dramatically drop to the 3% levels we saw a few years ago anytime soon, according to most experts. They might not even get consistently below 6% until maybe 2026 or later. So, focus on what’s achievable and smart for your financial situation right now.

November 2025 is shaping up to be a period where a modest downward trend in mortgage rates could offer a bit of breathing room for borrowers. It’s not a cliffhanger, but a gradual shift that requires informed decisions. By staying on top of the economic news and understanding these influencing factors, you can make the best choices for your homeownership dreams.

Want Income Stability in Uncertain Times? Go Turnkey

Savvy investors are locking in properties that deliver consistent passive rental income and long-term appreciation.

Work with Norada Real Estate to find turnkey, cash-flowing homes in stable markets—helping you grow wealth no matter which way rates move.

HOT NEW INVESTMENT PROPERTIES JUST LISTED!

Speak with a seasoned Norada investment counselor today (No Obligation):

(800) 611-3060