It’s the question on everyone’s mind in the housing market: will 30-year fixed mortgage rates slide below the psychologically significant 6% mark by the end of 2025? My read of the current economic currents and expert forecasts suggests that while rates are certainly heading in a hopeful direction, a definitive drop below 6% by that specific date in December 2025 is unlikely. We’re more likely to see rates hovering in the mid-6% range, with a more solid chance of dipping below 6% sometime in early to mid-2026.

Will the 30-Year Mortgage Rate Drop Below 6% Before 2026?

The Current Pulse: Where Rates Stand Today

As I’m writing this, the news is actually pretty good. The average 30-year fixed-rate mortgage is sitting around 6.19%. This is a welcome drop, marking four consecutive weeks where rates have been moving downward. This is largely thanks to the Federal Reserve’s recent decision to cut the federal funds rate by 25 basis points, bringing it to a range of 4.0%-4.25%.

For those looking to refinance or perhaps buy a slightly smaller home, the 15-year fixed rate is even more appealing, currently at about 5.44%. However, for the majority of homebuyers seeking that long-term stability of a 30-year fixed mortgage, rates are still sitting just above our magic number.

It’s important to remember that these are averages. Your actual rate will depend on factors like your credit score, loan-to-value ratio, and the specific lender you choose. Borrowers with excellent credit scores (think 760 and above) might shave off another quarter-percent or so from these averages, which can make a significant difference over the life of a loan.

A Journey Through Time: What the Past Tells Us

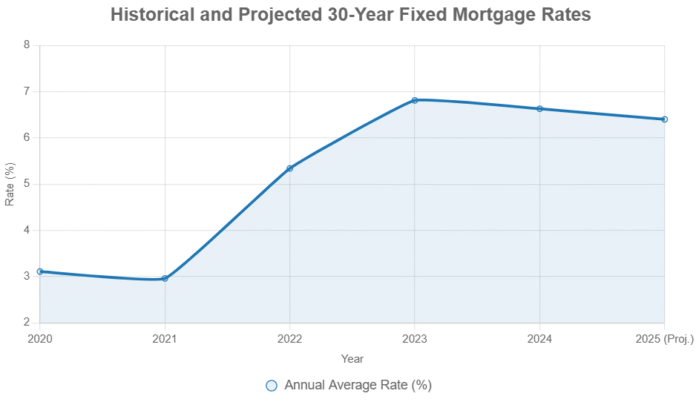

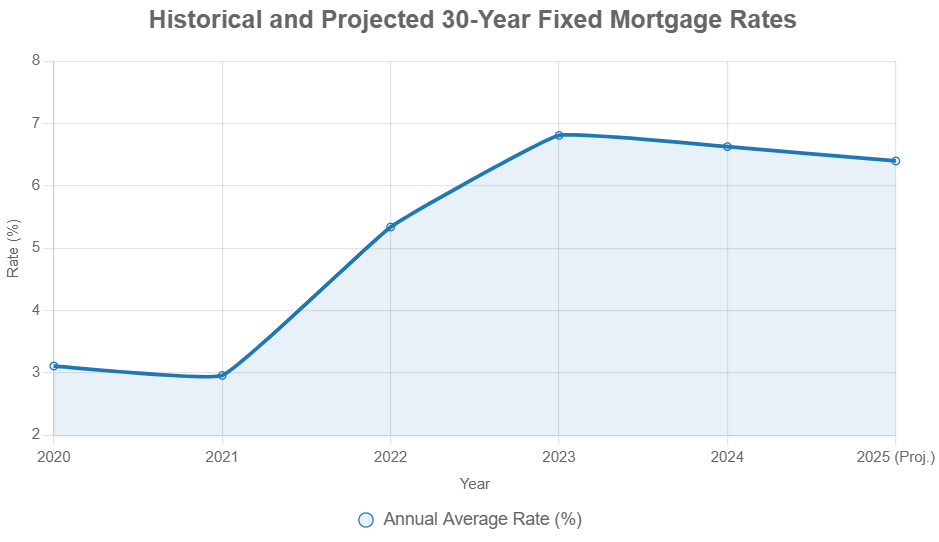

To understand where we might be going, it’s crucial to look at where we’ve been. The last few years have been a wild ride for mortgage rates. We saw them plummet to historic lows, below 3%, during the height of the COVID-19 pandemic in 2020 and 2021. This fueled an incredible buying spree, with many people jumping into the market, often making offers well above asking price.

Then, as inflation surged unexpectedly, the Federal Reserve began aggressively hiking interest rates to try and cool things down. This sent mortgage rates soaring, climbing above 7% in 2022 and 2023. It was a tough period for homebuyers, as monthly payments became much more expensive, and many potential buyers were priced out of the market altogether.

Here’s a look at how average annual rates have played out:

| Year | Average 30-Year Fixed Rate (%) | Key Events |

|---|---|---|

| 2020 | 3.11 | Pandemic starts, Fed slashes rates to near zero to support the economy. |

| 2021 | 2.96 | Record low rates, housing market frenzy, inventory shortages begin. |

| 2022 | 5.34 | Inflation spikes, Fed begins rapid rate hikes. |

| 2023 | 6.81 | Rates reach over 7% at their peak, affordability crisis deepens. |

| 2024 * | 6.63 (estimated) | Rates begin to stabilize in the mid-6% range. |

| 2025 * | 6.40 (projected) | Fed rate cuts resume, but inflation remains slightly above target. |

- (Estimates and projections based on current trends and forecasts)

The record lows of 2020-2021 made it difficult for many homeowners to sell, as they didn’t want to give up their incredibly low interest rates – a phenomenon often called “rate lock-in.” This has significantly contributed to the low inventory we’ve seen in many areas. While rates in 2025 are trending downwards from the peaks of 2023, we’re not quite at the levels that would unlock the market for everyone.

The Economic Engine: What Really Drives Mortgage Rates?

It’s easy to think of mortgage rates as just a number, but they’re deeply connected to the much larger economic picture. The 10-year U.S. Treasury yield is a major benchmark that mortgage rates tend to follow, with a typical spread of about 1.5% to 2% added on top for things like lender risk and profit. So, what influences the Treasury yield and that spread?

- The Federal Reserve’s Game Plan: The Fed’s main job is to keep prices stable (control inflation) and help as many people as possible have jobs. They do this by adjusting short-term interest rates. Right now, the Fed is projecting its federal funds rate to be around 3.6% by the end of 2025, down from where it started the year. This indicates they plan to make more cuts if inflation behaves. However, they’ve stressed repeatedly that they’ll only act based on what the economic data shows, so we can’t assume these cuts are guaranteed.

- The Inflation Challenge: Even with recent cooling, inflation is still a concern. The Fed’s target is 2%, and forecasts for 2025 often put it around 3.0%. Things like lingering supply chain issues and potential new tariffs being put in place could keep prices rising faster than we’d like. This persistent inflation makes the Fed hesitant to cut rates too aggressively, which in turn keeps mortgage rates from dropping dramatically.

- Jobs and Economic Growth: We’re seeing some signs of cooling in the job market, with unemployment ticking up to around 4.5%. This can be a good sign for the Fed, as it means the economy isn’t overheating, and they might feel more comfortable cutting rates. However, if economic growth slows down too much, heading towards a recession, that could also lead to lower rates, but it would be a more concerning reason.

- Global and Government Factors: Things happening around the world, like conflicts in the Middle East, can create uncertainty and cause investors to seek safer havens, which can sometimes push longer-term Treasury yields up. Domestically, the government’s debt levels and spending plans can also influence interest rates.

- Lender and Buyer Specifics: It’s not just the big picture. Your own financial situation matters a lot. How good is your credit score? How much income do you have compared to your debts (your debt-to-income ratio)? These factors determine the specific rate you’ll be offered by a lender. We’re also seeing more people opt for Adjustable-Rate Mortgages (ARMs) because their initial rates are lower, but these come with the risk that your payments could go up significantly later.

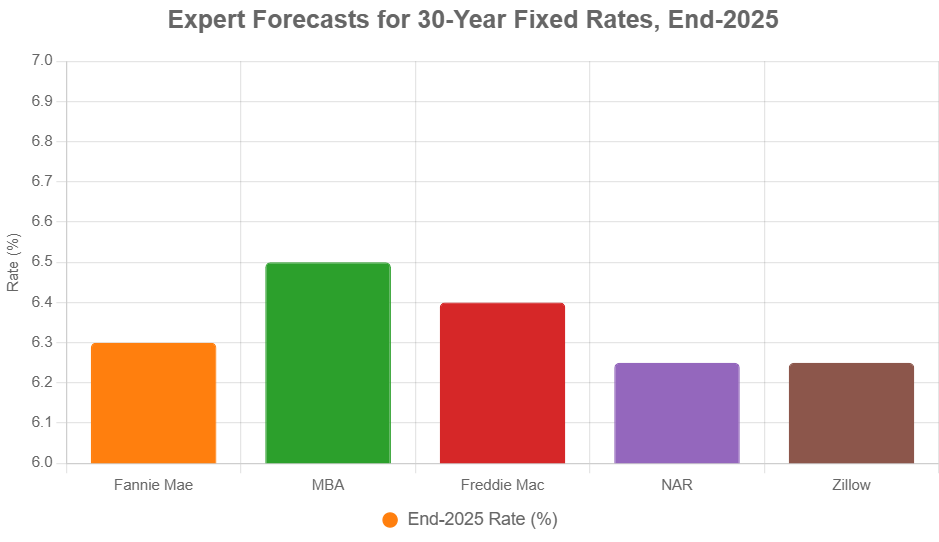

Expert Crystal Ball: What the Forecasters Are Saying

When I look at the major housing and economic institutions – like Fannie Mae, the Mortgage Bankers Association (MBA), Freddie Mac, and the National Association of Realtors (NAR) – they all seem to be in agreement, albeit with slight variations. The general consensus is that rates will likely continue to trend downwards in 2025, but not quite dip below 6% by the end of December. Most projections place the average 30-year fixed rate somewhere between 6.3% and 6.5% by the close of 2025.

Here’s a snapshot of what some key players are predicting:

| Forecaster | Predicted End-2025 Rate (%) | Main Reason for Prediction |

|---|---|---|

| Fannie Mae | 6.3 | Inflation continues to cool, leading to more Fed cuts. |

| Mortgage Bankers Assoc. (MBA) | 6.5 | Potential tariffs and government debt may limit rate drops. |

| Freddie Mac | 6.4 | Modest Fed easing, with housing supply improvements helping. |

| NAR | Mid-6% (6.25 avg.) | Steady market recovery, increase in available homes. |

| Zillow | Mid-6% | Regional differences will be key, some areas may soften more. |

This forecast cluster comfortably above 6% tells me that a significant majority expect rates to tease that 6% mark but ultimately stay a bit higher by year-end 2025. While a few optimistic voices might see it dipping lower if inflation falls dramatically and the Fed makes more aggressive cuts, the risks of inflation sticking around or new economic headwinds emerging keep most forecasts tempered.

Here’s a visual representation of those end-of-year 2025 rate predictions:

Broader Ramifications: Who Wins, Who Waits?

So, what does this mean for people looking to buy or sell?

- First-Time Buyers: If rates hover around 6.5%, the affordability challenge remains. For example, on a $400,000 loan, your monthly payment (principal and interest) would be roughly $2,528 at 6.5%. Compare that to $1,760 at 4% back in 2021 – that’s a huge difference. This means many buyers will continue to need larger down payments or will look for more affordable housing options. First-time buyer programs and FHA/VA loans, which often offer slightly lower rates, become even more critical.

- Refinancers: For those who managed to lock in rates below 4% a few years ago, there’s likely not much incentive to refinance right now. However, as rates come down into the 5% and low 6% range, we could see a more significant wave of refinancing activity, especially for those looking to convert from an ARM to a fixed rate or tap into some home equity.

- Sellers: The market is still a bit tricky for sellers. While there’s more demand than supply in many areas, the higher interest rates mean buyers often have less purchasing power. In some regions, especially where prices rose dramatically, we might see modest price drops or homes sitting on the market longer.

The Road Ahead: Scenarios and Strategies

Based on my understanding of the markets and expert opinions, I see a few potential paths forward:

- The Most Likely Scenario (Around 70% Probability): Rates end 2025 in the 6.3% to 6.5% range. We’ll see continued volatility, with weekly economic reports causing small ups and downs, but the overall trend will be downward but not quite breaking the 6% barrier by year-end. If this is the case, I’d advise buyers to get pre-approved now, understand their budget, and be ready to lock in a rate when it moves into their target range.

- The Optimistic Scenario (Around 20% Probability): Inflation takes a sharper turn downwards, hitting the Fed’s 2.5% target or lower, and the Fed decides to cut rates more aggressively in the latter half of 2025. This could realistically push 30-year fixed rates below 6% before December 31, 2025. In this scenario, we might see a surge in homebuying activity in early to mid-2026.

- The Less Likely, But Possible, Scenario (Around 10% Probability): Unexpected economic shocks, like ongoing geopolitical issues or a significant increase in tariffs, could re-ignite inflation fears. This would force the Fed to pause or even reverse course on rate cuts, pushing mortgage rates back up towards the 6.8% to 7.0% range. If this happens, those planning to buy might need to delay their plans or significantly adjust their expectations.

Ultimately, the housing market is a complex entity. While the desire for sub-6% mortgage rates by the end of 2025 is strong, the data and expert opinions suggest a more gradual descent. We’re definitely moving in the right direction, and a dip below 6% is highly probable in the not-too-distant future, likely in 2026. For now, patience, preparation, and smart shopping are key for anyone navigating the mortgage market.

Grab the Deals—Turnkey Properties That Deliver Monthly Returns

As mortgage rates remain high, savvy investors are locking in properties that deliver consistent rental income and long-term appreciation.

Work with Norada Real Estate to find turnkey, cash-flowing homes in stable markets—helping you grow wealth no matter which way rates move.

HOT NEW INVESTMENT PROPERTIES JUST LISTED!

Speak with a seasoned Norada investment counselor today (No Obligation):

(800) 611-3060