It’s a question on the minds of many looking to buy a home or refinance: will mortgage rates finally dip back into the coveted 5% range in 2026? While a definitive “yes” is still elusive, the signs are growing more optimistic, with projections leaning towards rates potentially approaching or even dipping below 6% and flirting with the 5% mark under favorable economic conditions.

Could 2026 Be the Year Mortgage Rates Finally Return to the 5% Mark?

So, what we’ve seen lately feels like a breath of fresh air after a period of significant tension. The average 30-year fixed mortgage rate is currently sitting at a promising 6.06%. This is a welcome drop from the peaks we saw above 7% last year, and it’s the lowest we’ve experienced in over three years. While climbing back to the consistent 5% averages we enjoyed before the pandemic dip feels like a distant memory, this current trend is undeniably a step in the right direction.

A Look Back: From Record Lows to Recent Hikes

To really understand where we might be headed, it’s helpful to remember how we got here. For decades, the average 30-year fixed mortgage rate hovered around 7.7%. We saw some wild spikes, like the astonishing 18.63% in 1981 fueled by high inflation. Then, rates gradually cooled, bringing us into the 2010s where they often danced between 3% and 5%. The pandemic era, with all its economic stimulus, pushed rates to historic lows, even hitting 2.65% in early 2021.

But as inflation reared its head, the Federal Reserve stepped in with interest rate hikes. This, in turn, sent mortgage rates soaring past 7% in 2023 and early 2025. This surge created a strange situation called the “lock-in effect,” where homeowners with super low-interest rates were hesitant to sell, worsening the shortage of homes for sale.

Here’s a quick look at how mortgage rates have shifted over the years:

| Year/Period | Average Rate | Key Events |

|---|---|---|

| 1981 | 16.64% | Inflation peak; Fed hikes |

| 2010 | 4.69% | Recovery from financial crisis |

| 2021 | 2.96% | Pandemic lows; stimulus effects |

| 2025 (peak) | ~7.04% | Inflation cooling; Fed pauses |

| Early 2026 | ~6.06% | Current promising trend |

As you can see, rates have been on a rollercoaster. The big question is, can we settle back into that more accessible 5% territory?

What’s Driving the Current Trend?

Several factors are at play, and they’re all pushing rates in a generally downward direction:

- Cooling Inflation: This is the big one. When inflation comes down, the Federal Reserve has less pressure to keep interest rates high. And as inflation cools, it generally pulls down the yields on government bonds, which are closely tied to mortgage rates.

- Federal Reserve Policy: While the Fed isn’t directly setting mortgage rates, its actions have a significant impact. Many experts believe the Fed will maintain a neutral policy in 2026, possibly even cutting rates if unemployment starts to climb too high. Of course, any major shift in Fed leadership could introduce some unpredictability.

- Government Support: In a move aimed at easing the market, directives have been given for agencies like Fannie Mae and Freddie Mac to purchase mortgage-backed securities. This basically injects money into the mortgage market, which can help push rates lower. This has already had a noticeable effect.

Expert Predictions: A Mixed Bag, But Hopeful

When I look at what the experts are saying, there’s a general consensus that rates will continue to ease, but the exact destination for 2026 varies.

- Some, like Fannie Mae, are calling for rates to hit 5.9% by the end of 2026.

- Others, like Zillow, see potential for rates to dip to 5.8%, especially with the ongoing government purchases of mortgage-backed securities.

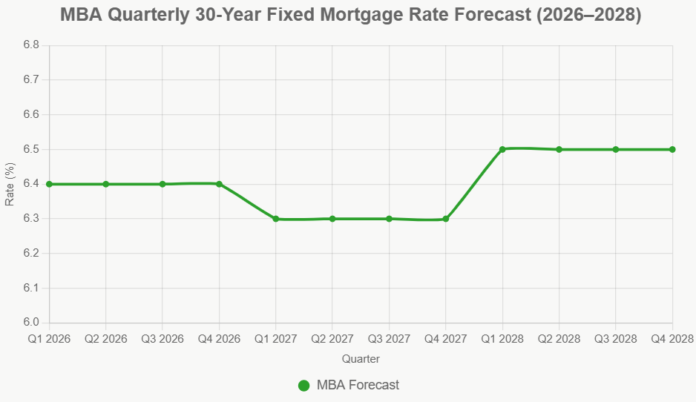

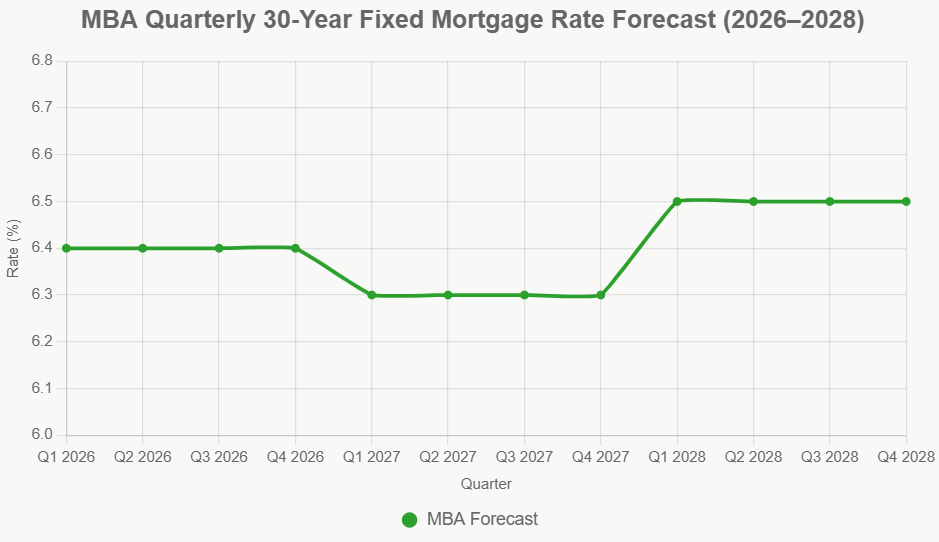

- However, organizations like the Mortgage Bankers Association (MBA) are a bit more conservative, predicting rates closer to 6.4%, citing concerns about persistent inflation.

- A few optimistic forecasts, like Morgan Stanley’s, suggest rates could even touch 5.75% early in the year.

It’s important to note that uncertainties still exist. Global events, unexpected shifts in the job market, or persistent government deficits could all put upward pressure on rates. Think of it as a tug-of-war between forces trying to push rates down and those trying to keep them elevated.

Here’s a quick overview of some predictions:

| Organization | 2026 Average Rate (Outlook) | Notes |

|---|---|---|

| Bankrate | ~6.1% | Possible low of 5.5% with Fed cuts. |

| Fannie Mae | ~5.9% (Q4) | Gradual drop expected. |

| MBA | ~6.4% | Higher if inflation remains sticky. |

| Zillow | ~5.8% (with MBS buys) | Below 6% is psychologically significant for buyers. |

| Redfin/Realtor.com | ~6.3% | Affordability will improve, but slowly. |

| Morgan Stanley | ~5.75% | Potential for an earlier drop, then a slight rise. |

| S&P Global | ~5.77% | Linked to the growth in mortgage originations. |

What Could This Mean for You?

If mortgage rates do indeed ease further, particularly if they get close to that 5% mark, it could significantly impact the housing market and individual buyers and sellers.

- For Buyers: This is where the excitement lies. Lower rates mean lower monthly payments. If rates drop by just 1%, it could make homeownership affordable for millions more households. This would likely lead to an increase in home sales.

- For Sellers: As the “lock-in effect” lessens, we might see more homes come onto the market, which could help ease the tight inventory we’ve been experiencing. However, with more competition, prices might not skyrocket as they have in recent years, potentially rising at a more modest pace.

- Refinancing Opportunities: For those who bought or refinanced at higher rates in the last couple of years, a dip back towards 5% could open the door to significant savings through refinancing.

The Bottom Line: Hope, But Stay Realistic

So, could 2026 be the year mortgage rates return to the 5% mark? It’s certainly looking more possible than it has in a long time. The current trend is encouraging, with rates already well below last year’s peaks. Falling inflation, a steady Federal Reserve, and supportive government policies are all working in favor of lower mortgage costs.

However, I always advise caution. The economy is a complex beast, and unexpected events can always shift the trajectory. While a return to consistent 5% rates isn’t a guarantee, I believe we’ll see a continued gradual decline, with many forecasts placing us in the high 5% to low 6% range. This is a much more manageable environment for buyers than we’ve seen recently.

My advice to anyone looking to buy or sell? Keep a close eye on the economic news, work with a trusted mortgage lender to understand your options, and be prepared to act when the right opportunity arises. 2026 offers a hopeful outlook for the housing market, and for many, it could finally bring that coveted 5% mortgage rate within reach.

🏡 Two Amazing Properties Available for Investors

Port Charlotte, FL

🏠 Property: Aldridge Ave

🛏️ Beds/Baths: 3 Bed • 2 Bath • 1548 sqft

💰 Price: $339,900 | Rent: $2,195

📊 Cap Rate: 5.8% | NOI: $1,643

📅 Year Built: 2025

📐 Price/Sq Ft: $220

🏙️ Neighborhood: A+

Punta Gorda, FL

🏠 Property: Oceanic Rd

🛏️ Beds/Baths: 6 Bed • 4 Bath • 3032 sqft

💰 Price: $639,900 | Rent: $4,895

📊 Cap Rate: 6.9% | NOI: $3,685

📅 Year Built: 2025

📐 Price/Sq Ft: $212

🏙️ Neighborhood: B+

Florida’s A+ affordable rental vs Punta Gorda’s larger high‑yield property. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Talk to a Norada investment counselor (No Obligation):

(800) 611-3060