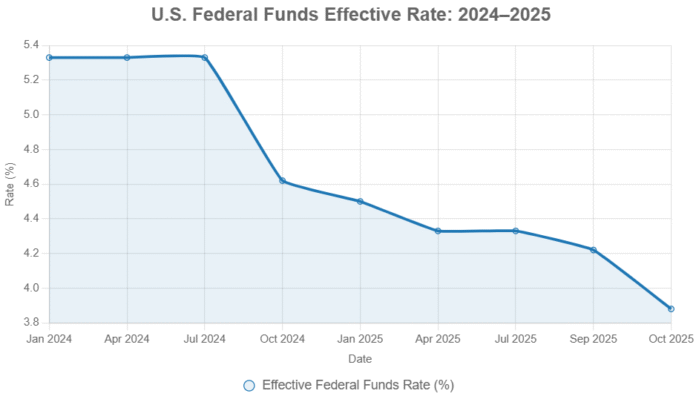

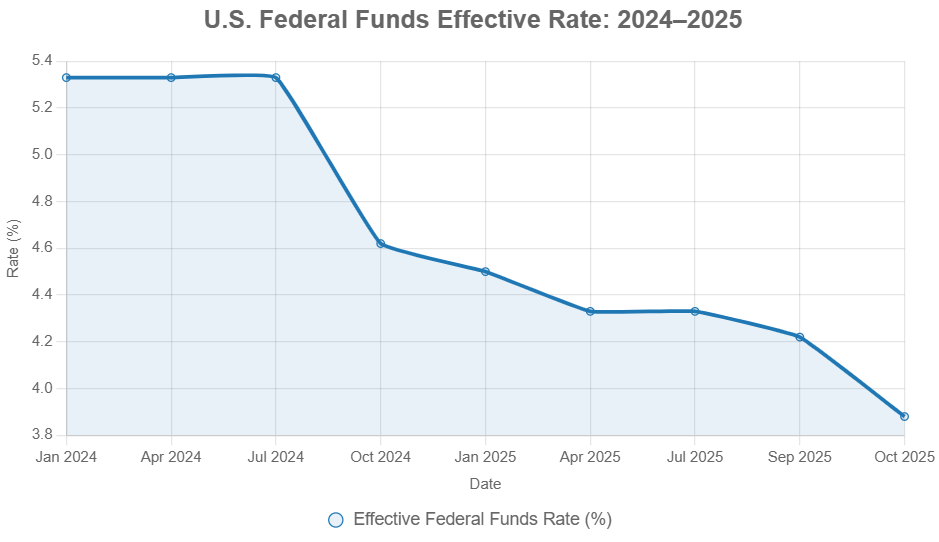

The U.S. Federal Reserve has cut its key interest rate for the second time in 2025, lowering the federal funds rate by 25 basis points to a range of 3.75%–4.00% on October 29th. This action signals a continued effort by the central bank to support the economy, particularly the job market, while still keeping a close eye on inflation. As I see it, this move is more than just a number; it’s a carefully calibrated response to a complex economic picture that’s evolving by the day.

This second reduction shows a clear intention from the Fed to proactively manage economic conditions rather than waiting for a serious problem to develop. For anyone trying to make sense of what this means for their money, their job, or the future, this is a pretty big deal.

Federal Reserve Cuts Key Interest Rate for Second Time in 2025

Key Takeaways

- The U.S. Federal Reserve lowered its benchmark federal funds rate by 25 basis points to a range of 3.75%–4.00% on October 29, 2025, marking the second rate reduction this year following a similar cut in September.

- This move reflects growing concerns over a softening labor market, with job growth slowing and unemployment edging up to 4.2%, though inflation remains “somewhat elevated” at around 2.7% core PCE.

- While the decision was widely expected, it revealed internal divisions: one official favored a larger 50 basis-point cut, and another preferred no change, highlighting the Fed’s delicate balancing act between supporting jobs and curbing price pressures.

- Markets responded with mild optimism, as the S&P 500 rose about 0.2% immediately after the announcement, though gains moderated during Chair Jerome Powell’s press conference amid cautious forward guidance.

Understanding the Fed’s Latest Move: October 29th, 2025

So, why did the Federal Reserve decide to lower rates again? The official word is that they’re seeing signs of softness in the labor market. We’ve seen job growth slow down a bit, and the unemployment rate has edged up to 4.2%. While that number might sound low to some, for the Fed, it’s a signal that things are cooling off enough to warrant some proactive easing.

At the same time, inflation is still a concern. The Fed’s favorite measure, the core PCE price index, is sitting “somewhat elevated” at around 2.7%. They’re trying to walk a tightrope: push down unemployment without letting prices get away from them. It’s a classic balancing act that central bankers perform, and it’s never easy.

This decision didn’t happen in a vacuum. The Federal Open Market Committee (FOMC), the group within the Fed that makes these rate decisions, held its regular meeting, and as is often the case, there were different viewpoints. While the majority agreed on the 25 basis point cut, one member wanted an even bigger cut of 50 basis points, suggesting they felt the economy needed a stronger boost. On the other side, another member thought it was best to hold rates steady, showing that there are definitely differing opinions on just how much intervention is needed. This internal debate highlights the tricky road the Fed is navigating.

What This Means for You, Me, and Everyone Else

Let’s break down what this rate cut can mean for everyday people and businesses:

- Borrowing Costs: When the Fed cuts rates, it often becomes cheaper to borrow money.

- Credit Cards & Auto Loans: You might start seeing slightly lower interest rates on your credit cards and car loans, especially those with variable rates. This could mean saving a bit of money each month on your payments.

- Mortgages: For those looking to buy a home or refinance, fixed-rate mortgages (like the popular 30-year ones) might see a gradual decline. However, these rates are more tied to longer-term economic outlook and bond yields, so the drops might be slower and smaller than with shorter-term loans. Right now, average 30-year rates are around 6.5%, a bit down but still higher than they were a couple of years ago. Adjustable-rate mortgages (ARMs) will likely see a more immediate decrease in their rates following this Fed move.

- Savings: On the flip side, if you’re a saver, this isn’t the best news. Interest rates on savings accounts, money market accounts, and Certificates of Deposit (CDs) tend to fall when the Fed cuts rates. So, those higher yields you might have been enjoying on your cash could start to shrink. Many savers are now looking toward investments that offer a better return, even if they come with more risk.

- Businesses: For businesses, lower interest rates can mean cheaper borrowing for expansion, investment, or managing day-to-day operations. This can encourage job creation and economic growth. However, if inflation remains sticky, businesses might face higher input costs that offset some of the benefits of cheaper borrowing.

The Bigger Picture: Economic Ripples and Future Possibilities

Beyond our personal finances, this move by the Fed has broader implications for the economy. The decision to cut rates, combined with the Fed’s plan to end “quantitative tightening” (QT) on December 1st, is designed to inject more cash, or liquidity, into the financial system. Ending QT means the Fed will stop letting its bond holdings mature and simply disappear from its balance sheet. Instead, they’ll reinvest some of those funds, which essentially puts more money back into the economy. Think of it like turning off a tap that was draining money and now turning it on just a little to let some flow back in.

The Fed’s statement explicitly mentioned that the risks to employment have risen. I find this wording significant. It tells me they’re not just looking at current numbers but also anticipating potential future challenges in the job market. However, they also remain committed to their goal of keeping inflation at 2%. This delicate dance is crucial for long-term economic stability.

One factor that could make things complicated is the possibility of new tariffs under the incoming administration. If new tariffs are put in place, they could make imported goods more expensive, which might in turn push prices up for consumers on things like clothes and furniture. This could make it harder for the Fed to get inflation back down to their target level.

Analyzing the Market’s Reaction

How did Wall Street react to this news? Generally, markets responded with mild positivity. The S&P 500 saw a small bump of about 0.2% right after the announcement. Bond yields, like the 10-year Treasury, held steady around 4.1%, which suggests that investors, for the moment, seem to believe the economy can avoid a sharp downturn or recession. This concept is often referred to as a “soft landing.”

Even cryptocurrencies like Bitcoin saw a slight uptick, as increased liquidity from the Fed’s actions can sometimes make riskier assets more attractive.

Historical Context: Is This a Trend?

Looking back, this isn’t the first time the Fed has cut rates after raising them. They went through a significant period of hiking rates from 2022 to 2023 to fight off the high inflation we saw post-pandemic. Those hikes brought the federal funds rate all the way up to between 5.25% and 5.50%. Now, they are in an easing cycle.

The table below shows how previous rate cut cycles have played out historically. Notice how the market’s reaction can vary widely depending on the economic environment.

| Cycle Start | Total Easing (Basis Points) | Duration (Months) | S&P 500 12-Month Return Post-First Cut | Recession Occurred? | Key Driver |

|---|---|---|---|---|---|

| Jul 1990 | 275 | 15 | +12.5% | Yes (1990–1991) | Gulf War, S&L Crisis |

| Jul 1995 | 75 | 11 | +28.4% | No | Pre-Asian Financial Crisis Softness |

| Sep 1998 | 75 | 5 | +21.0% | No | LTCM Collapse, Emerging Markets |

| Jan 2001 | 475 | 13 | -15.2% | Yes (2001) | Dot-Com Bust |

| Sep 2007 | 525 | 17 | -38.5% | Yes (2007–2009) | Housing Bubble Burst |

| Jul 2019 | 75 | 3 | +17.1% | No | Trade Wars, Inverted Yield Curve |

| Mar 2020 | 1500 (To Zero) | 1 | +47.2% (Post-QE) | Yes (Brief COVID) | Pandemic Shutdowns |

| Sep 2024* | 50 (Ongoing) | 14 (To Date) | +18.2% (As of Oct 2025) | No (Projected) | Post-Inflation Soft Landing |

*2024–2025 cycle; returns through October 30, 2025. Sources: Federal Reserve, S&P Dow Jones Indices.

What this table suggests is that when the Fed cuts rates during a period of economic growth (like what we are seeing now), the stock market often performs well. The current S&P 500 performance, continuing to hover around record highs, echoes some of these positive historical precedents.

Divergent Views Within the Fed

It’s really interesting to see the different opinions within the FOMC. As I mentioned, one official wanted a larger cut. They likely looked at the slowing job growth and thought, “We need to act more decisively to keep things on track.” On the other hand, the official who voted against a cut likely focused on the inflation numbers and worried that cutting rates too much could reignite price pressures.

This disagreement reminds me of past debates within the Fed. It shows that economic forecasting isn’t an exact science. The Chair, Jerome Powell, really emphasized the data-dependent nature of their policy. He said things like “patience remains our policy,” which tells me they’re not going to rush into further aggressive cuts. They are watching all the incoming economic reports very closely.

What’s Next?

Looking ahead, the market is still trying to figure out what the Fed will do in December. The odds of another rate cut were high, but some of the cautious language from Powell might have tempered those expectations a bit. The Fed’s own projections, known as the “dot plot,” suggest they might make a total of 75 basis points in cuts for the year, which means perhaps two more 25 basis-point cuts by the end of 2025.

For all of us, the key is to stay informed. The economic picture is constantly changing, and the Fed’s actions are a crucial part of that. Whether you’re a saver, a borrower, a business owner, or just trying to navigate the economic news, understanding these moves can help you make better financial decisions. The Fed’s latest move is a signal that they are actively trying to guide the economy toward a stable future, and it will be fascinating to watch just how successful they are.

Invest in Real Estate While Rates Are Dropping — Build Wealth

With the Federal Reserve cutting rates again in 2025, investors have a window of opportunity to lock in better financing and expand their portfolios before demand accelerates. Lower rates mean improved cash flow and stronger returns.

Work with Norada Real Estate to find turnkey, income-generating properties in stable markets—so you can capitalize on this easing cycle and grow your wealth confidently.

NEW TURNKEY DEALS JUST ADDED!

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More?

Explore these related articles for even more insights: