As we look toward the end of 2025, the Federal Reserve’s upcoming December meeting is a major point of focus for nearly everyone involved in the economy. Will the Fed cut interest rates again? My best prediction, looking at the current signals and expert opinions, is that the Fed will likely implement another rate cut in December 2025, though it’s not a sure thing. The Federal Reserve is expected to consider another rate cut in December 2025, but uncertainty remains as policymakers weigh cooling inflation against persistent economic risks.

Fed Interest Rate Predictions Ahead of Its Final Meeting in December 2025

It’s a complex puzzle, and I find myself constantly sifting through the economic data, listening to what Fed officials are saying, and trying to piece together what might happen. It feels less like a guaranteed outcome and more like a carefully calibrated decision on a tightrope. As a seasoned observer of these markets, I’ve seen how small pieces of data can swing major decisions, and December 2025 looks to be no different.

What’s on the Fed’s Mind for December?

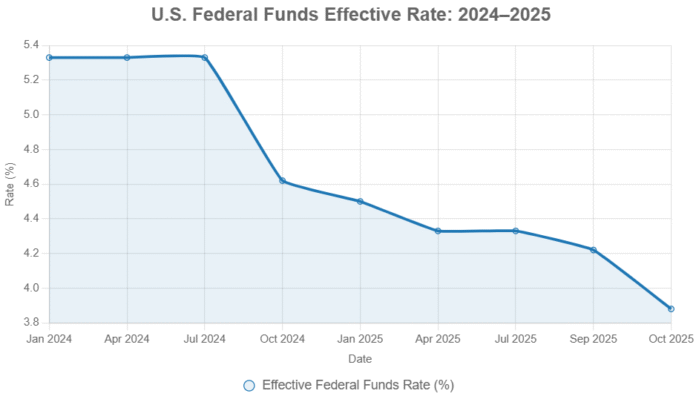

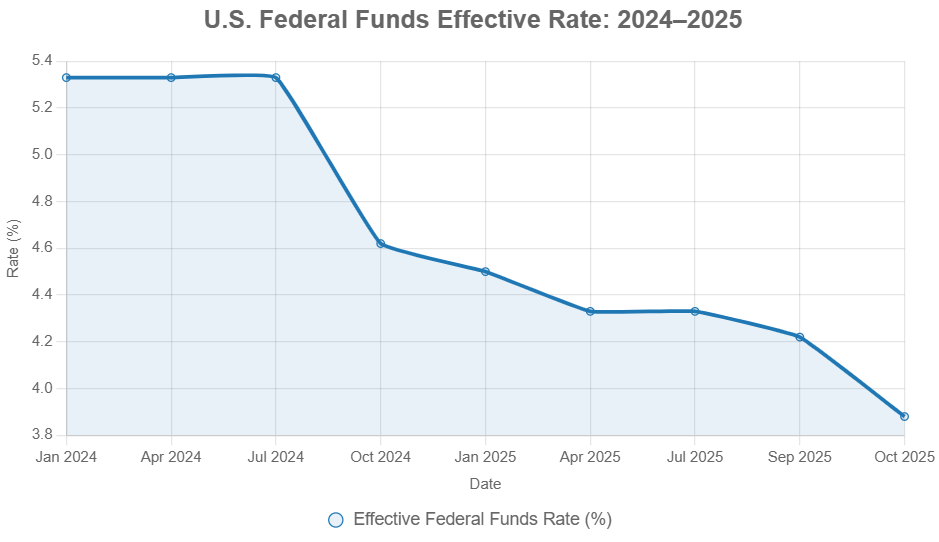

The Federal Reserve’s policy meeting on December 9–10, 2025, is the one everyone’s got circled on their calendar. Just coming off a 25 basis point rate cut in October, which landed the federal funds target range at 3.75%–4.00%, the big question is what comes next. Will they keep the momentum going with another decrease, or will they hit the pause button to see how things are shaking out?

My take is that the October cut was a clear signal that the Fed is paying attention to the economy’s signals. Inflation has been coming down, the job market is showing signs of cooling (which isn’t necessarily bad news, depending on how you look at it), and credit isn’t as easy to get as it used to be. However, Fed Chair Jerome Powell himself has cautioned that further cuts are “far from guaranteed.” This isn’t just Fed speak; I believe it reflects genuine caution. They don’t want to accidentally overstimulate the economy and send inflation roaring back.

A Peek Inside the Fed: Diverging Views

What makes these meetings so fascinating, and frankly, so hard to predict, is that there isn’t always a single, unified voice within the Fed. Take, for example, Governor Stephen Miran. He actually dissented in October, pushing for a more aggressive 50 basis point cut. In a recent conversation, he mentioned that another cut in December would be “a reasonable action.” His reasoning? He sees inflation coming down nicely and employment data that suggests the economy can handle a bit more easing.

This kind of disagreement isn’t a sign of weakness; it’s a sign of a healthy debate. Some policymakers are clearly more focused on the risks of inflation, while others are more concerned about the economy slowing down too much. It’s like a tug-of-war between wanting to keep prices stable and wanting to keep people employed and businesses growing. December’s decision will depend on which side of that rope has more pull.

📊 The Economic Signposts We’re Watching

For me, and I imagine for the Fed too, it all comes down to the numbers. Here are the key economic indicators that I’ll be scrutinizing closely as we head into December:

- Inflation Trends: We’ve seen core inflation nearing the Fed’s 2% target, and that’s a huge factor. We need to be sure this cooling isn’t just a temporary blip.

- Labor Market Health: Job growth has definitely slowed down. Wage increases are also starting to moderate. These are cues that the economy is cooling, which gives the Fed room to maneuver.

- Consumer Spending Habits: People are still spending, but it’s not as robust as it was. We’re seeing softness, especially in areas where people can choose whether or not to buy something, like new gadgets or pricey dinners out.

- Global Concerns: Things happening around the world can’t be ignored. Geopolitical tensions or ongoing trade disputes, like those between the U.S. and China, can create unpredictability. The Fed has to consider these external risks when setting policy.

🔮 What the Experts Are Saying (and What We Should Expect)

The smart folks at Goldman Sachs Research are still leaning towards the Fed cutting rates in December. They point to real signs of weakness in the job market and steady inflation as reasons for their forecast. This aligns with what a lot of people in the financial world are thinking, though Powell’s cautious words have certainly made some investors sit up and take notice.

Beyond the big banks, independent analysts are also weighing in. Their projections suggest that the federal funds rate could end up around 3.50% by the end of December. However, they often throw out a range, like 3.25% to 4.00%, because, as I’ve said, those incoming economic numbers can really change things at the last minute. This illustrates the inherent uncertainty.

Putting the Data in Context: Is This a Real Trend?

Looking back, this isn’t the first time the Fed has cut rates after raising them. They went through a significant period of hiking rates from 2022 to 2023 to fight off the high inflation we saw post-pandemic. Those hikes brought the federal funds rate all the way up to between 5.25% and 5.50%. Now, they are in an easing cycle.

The table below shows how previous rate cut cycles have played out historically. Notice how the market’s reaction can vary widely depending on the economic environment.

| Cycle Start | Total Easing (Basis Points) | Duration (Months) | S&P 500 12-Month Return Post-First Cut | Recession Occurred? | Key Driver |

|---|---|---|---|---|---|

| Jul 1990 | 275 | 15 | +12.5% | Yes (1990–1991) | Gulf War, S&L Crisis |

| Jul 1995 | 75 | 11 | +28.4% | No | Pre-Asian Financial Crisis Softness |

| Sep 1998 | 75 | 5 | +21.0% | No | LTCM Collapse, Emerging Markets |

| Jan 2001 | 475 | 13 | -15.2% | Yes (2001) | Dot-Com Bust |

| Sep 2007 | 525 | 17 | -38.5% | Yes (2007–2009) | Housing Bubble Burst |

| Jul 2019 | 75 | 3 | +17.1% | No | Trade Wars, Inverted Yield Curve |

| Mar 2020 | 1500 (To Zero) | 1 | +47.2% (Post-QE) | Yes (Brief COVID) | Pandemic Shutdowns |

| Sep 2024* | 50 (Ongoing) | 14 (To Date) | +18.2% (As of Oct 2025) | No (Projected) | Post-Inflation Soft Landing |

*2024–2025 cycle; returns through October 30, 2025. Sources: Federal Reserve, S&P Dow Jones Indices.

What this table suggests is that when the Fed cuts rates during a period of economic growth (like what we are seeing now), the stock market often performs well. The current S&P 500 performance, continuing to hover around record highs, echoes some of these positive historical precedents.

💼 So, What Does This Mean for You?

The Fed’s decision has ripple effects, and I want to break down what it might mean for different people:

- For Bond Investors: If the Fed does cut rates, we could see bond prices go up and yields go down. This is especially true for shorter-term bonds. It’s a classic response to lower interest rates.

- For Homebuyers: Lower interest rates generally mean lower mortgage rates. However, it’s not always a direct one-to-one translation. Lenders sometimes add extra charges (spreads) to account for their own risks, which can keep rates from falling as much as you might expect. But, continued easing could offer some relief.

- For Stock Market Enthusiasts: Typically, rate cuts are good for stocks because borrowing becomes cheaper, and economic activity tends to pick up. But, as we’re seeing with the mixed signals from the Fed, there could be more ups and downs (volatility) in the market than usual.

- For the U.S. Dollar: If the Fed decides to hold steady or makes a smaller cut, it could help stabilize the dollar. A larger cut, however, might weaken it. The dollar’s strength affects everything from vacation costs to the price of imported goods.

🧠 My Final Thoughts

The Federal Reserve’s December 2025 rate decision is shaping up to be a really critical moment for the economy. While another rate cut is definitely on the table and seems likely based on current trends and expert opinions, it’s far from a done deal. The Fed is walking a fine line, and their decision will be heavily influenced by the economic data that comes out between now and then.

My advice? Keep a close eye on those economic reports. For borrowers, especially those thinking about big loans like a mortgage, it might be wise to consider locking in current rates soon. For investors, be prepared for the possibility of data-driven volatility as the market reacts to every new piece of information and, ultimately, to the Fed’s final pronouncement. It’s a fascinating time to be watching the economy, and December’s meeting will give us plenty to talk about.

Invest in Real Estate While Rates Are Dropping — Build Wealth

With the Federal Reserve cutting rates again in 2025, investors have a window of opportunity to lock in better financing and expand their portfolios before demand accelerates. Lower rates mean improved cash flow and stronger returns.

Work with Norada Real Estate to find turnkey, income-generating properties in stable markets—so you can capitalize on this easing cycle and grow your wealth confidently.

NEW TURNKEY DEALS JUST ADDED!

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More?

Explore these related articles for even more insights: