Islamabad’s real estate market in 2026 feels different. It’s calmer, more calculated, and far more mature than the speculative chaos seen a few years ago. Investors are no longer chasing rumors or flashy launches; they’re putting money where infrastructure exists, approvals are solid, and long-term livability is guaranteed. That shift in mindset has pushed Gulberg Greens Islamabad right back into the spotlight. This Gulberg Greens price index 2026 is designed as a practical decision-making tool.

If you’re a local buyer upgrading your lifestyle or an overseas Pakistani looking for a stable, sharia-compliant asset back home, understanding which block is gaining value, and why, can protect your capital and multiply your returns.

As the premier destination for farmhouse and low-density luxury living, Gulberg Greens Islamabad has recorded an estimated double-digit shift in valuation over the last 12 months, driven largely by infrastructure completion, rising occupancy, and growing commercial activity. Unlike newer societies still promising future development, Gulberg Greens is already functioning, and that makes all the difference in 2026.

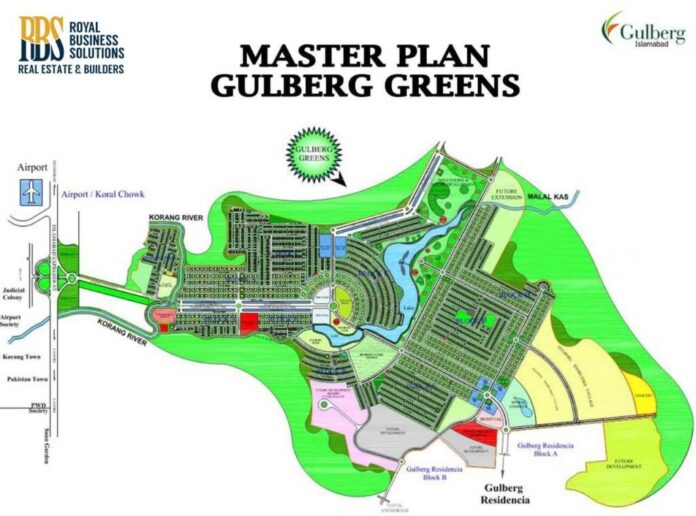

Instead of lumping Gulberg Greens into one average price, this guide breaks the society down block by block, highlights real performance drivers, and explains which areas are leading the market and which are quietly setting up for the next growth cycle.

Current Gulberg Greens Price Index 2026

Prices in Gulberg Greens don’t move randomly. Each block behaves differently based on accessibility, development maturity, commercial proximity, and buyer profile. In 2026, that gap between average blocks and premium blocks has become even more visible.

Below is a clean, investor-friendly snapshot of how the major blocks are performing, based on prevailing asking prices and closed-deal trends observed by registered dealers.

| Block | Property Size | Avg. Price 2025 | Avg. Price 2026 | Growth |

| Block A | 4 Kanal | PKR 85–90 Million | PKR 92–98 Million | +8–9% |

| Block B | 5 Kanal | PKR 75–80 Million | PKR 84–88 Million | +11–12% |

| Executive Block | 4 Kanal | PKR 95–100 Million | PKR 110–115 Million | +15% |

| Block C | 4 Kanal | PKR 62–66 Million | PKR 68–72 Million | +9% |

| Block D | 4 Kanal | PKR 58–62 Million | PKR 63–67 Million | +8% |

What stands out immediately is that Executive Block has pulled away from the rest of the market. While overall appreciation across Gulberg Greens remains healthy, premium positioning and buyer confidence are clearly rewarding certain locations more than others.

This divergence is exactly why a price index like this matters. Investors who understand these patterns early tend to outperform those who buy purely on budget.

Top Performing Blocks for 2026

The following are the best performing blocks in 2026.

Block A

Block A has always been the face of Gulberg Greens, and in 2026, it continues to justify that reputation. Its biggest advantage isn’t hype, it’s location certainty.

Situated closest to the Islamabad Expressway, Block A enjoys seamless connectivity to the Blue Area, Saddar, and Rawalpindi without forcing residents to navigate internal society traffic. For buyers who actually intend to build and live, this convenience translates into daily time savings, something increasingly valuable in Islamabad’s growing urban sprawl.

Another critical factor driving Block A’s steady appreciation is established residency. Unlike partially occupied blocks where prices fluctuate with speculation, Block A has a visible community. Built homes, landscaped farmhouses, and ongoing construction signal stability. For investors, that reduces risk. For end users, it creates confidence.

Buyers here prioritize asset protection over aggressive flipping, which is why prices rise steadily rather than spiking unpredictably.

Executive Block

If Block A represents stability, the Executive Block represents momentum. This block has emerged as the top performer of 2026, and the reasons are layered. First, the Executive Block benefits from planned premium zoning, wider roads, controlled density, and proximity to upcoming commercial corridors. Second, buyer psychology plays a huge role. In a cautious market, premium buyers gravitate toward areas that feel exclusive and future-proof.

What’s particularly interesting is the buyer mix. In 2026, the Executive Block is attracting:

- Overseas Pakistanis

- Business owners

- High-net-worth individuals shifting from urban sectors

These buyers aren’t price-sensitive. They’re quality-sensitive. As a result, demand pressure keeps prices firm even when the broader market slows. For investors chasing higher ROI rather than just land holding, the Executive Block currently sits at the top of Gulberg Greens’ value curve.

Blocks C & D

Blocks C and D often get overlooked, and that’s exactly why smart long-term investors keep them on their radar. These blocks offer lower entry prices, making them accessible to first-time investors or buyers with medium-term horizons. While they don’t enjoy the same immediacy of access as Block A or the prestige of the Executive Block, they benefit from spillover demand as premium areas price out new buyers.

In 2026, Blocks C and D are no longer “undeveloped.” Basic infrastructure is in place, construction activity is visible, and resale liquidity has improved. For investors who can hold for 3–5 years, these blocks function as compounding assets, quietly appreciating without headline noise.

Why are prices rising in Gulberg Greens

Price growth doesn’t happen in isolation. Gulberg Greens’ appreciation in 2026 is driven by structural improvements, not speculation.

Commercial development & business activity

The rise of commercial landmarks like Magnus Mall and D-82 commercial zones has transformed Gulberg Greens from a residential concept into a mixed-use destination. Retail activity brings footfall. Footfall brings services. Services increase livability, and livability drives prices.

Infrastructure & accessibility

New access points, improved service roads, and smoother connectivity with the Islamabad Expressway have reduced travel friction. In real estate, every minute shaved off a commute adds value.

CDA approval & IBECHS trust factor

In a market crowded with unapproved launches, Gulberg Greens’ CDA-approved status under IBECHS continues to act as a safety net. Investors in 2026 are risk-aware, and approval matters more than ever.

Buying Tips for Overseas Pakistanis

For overseas Pakistanis, Gulberg Greens remains one of the easiest societies to transact in, if done correctly. Always verify:

- Original allotment letters

- Seller CNIC matching IBECHS records

- Transfer eligibility status

The good news? In 2026, the transfer process is smoother and faster, with clearer documentation and registered dealer oversight. Avoid unofficial middlemen and always transact through recognized channels.

Frequently Asked Questions (FAQs)

Q1: Is Gulberg Greens a safe investment in 2026?

Ans. Yes, due to CDA approval and IBECHS management.

Q2: Which block has the highest ROI?

Ans. Executive Block currently leads in appreciation.

Q3: Are farmhouses still in demand?

Ans. Yes, especially among overseas buyers.

Q4: Can overseas Pakistanis transfer plots easily?

Ans. Yes, the process of transferring plots in Guberg Greens has improved significantly.

Q5: Is now a good time to buy?

Ans. For long-term investors, 2026 offers stable entry points.

Conclusion

Gulberg Greens in 2026 is no longer about speculation; it’s about strategic positioning. While the overall market remains stable, blocks like the Executive Block are delivering stronger ROI, while Block A continues to offer unmatched security.

Ready to explore specific plots? View our updated listings on our Gulberg Greens Islamabad page or contact our real estate experts today.