What Happens When Hot Real Estate Markets Cool?

Even the best housing markets in the US, the hottest real estate markets, eventually cool off. It can happen gradually, or it can happen (relatively) suddenly, such as we saw in the housing bubble collapse after 2008.

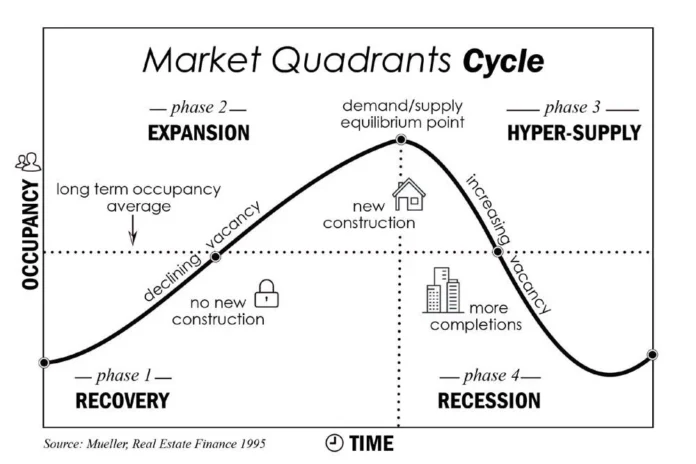

Housing markets go through predictable cycles. A dearth of housing supply spurs more new home construction. Home builders gradually build up a head of steam, as the process from finding sites through pulling permits to building the home to marketing and selling them all takes time. At a certain point, housing developers start building more homes than the local demand actually needs or wants, but by the time they discover that, they still have months or even years to go in order to finish existing construction projects.

At that point, supply exceeds demand, and you see a housing market correction. Developers stop building, and eventually supply gets pinched again, and the cycle repeats itself.

Here’s a handy visual aid for good measure:

Is the US in a Housing Bubble Currently?

While parts of the US clearly experienced a short but intense real estate bubble (I’m looking at you Boise), they’ve since corrected. Fewer cities are dropping in value now than earlier in 2023, indicating that many markets seem to have found their bottom and started recovering.

I didn’t see a nationwide real estate bubble in 2022, and I certainly don’t see one in 2023. To begin with, supply — particularly of starter homes — remains insufficient to cover demand, to put it mildly. Building material and labor costs hover around record highs, putting additional upward pressure on home prices.

Meanwhile, millennials have reached the “settle down in the suburbs and pop out some kids” phase in their lives. See above about the increase in first-time homebuyers supercharging demand for housing.

So no, I don’t see a real estate bubble, at least for most markets in the US.

Final Thoughts

At the moment, I see a great reshuffling of the deck taking place in real estate markets. While the largest, most expensive cities like New York and LA will never become irrelevant, even before the pandemic we saw rents and demand dipping. The rise in telecommuting should exacerbate that trend even after the pandemic is in the rearview mirror.

I see continued hot housing markets in areas with natural charm. Areas with beautiful beaches or lakes, with great skiing and hiking, with history and culture. Post-industrial cities will need to reinvent themselves if they want to retain high-income residents after they discover they can live anywhere and telecommute to work.

Keep an eye on all of the hottest real estate markets in 2023 showcased in the maps above. And note that the best housing markets in the US are mostly satellite towns, seeing astronomical growth.♦

Where are you currently investing in real estate? What do you consider the best housing markets in the US?