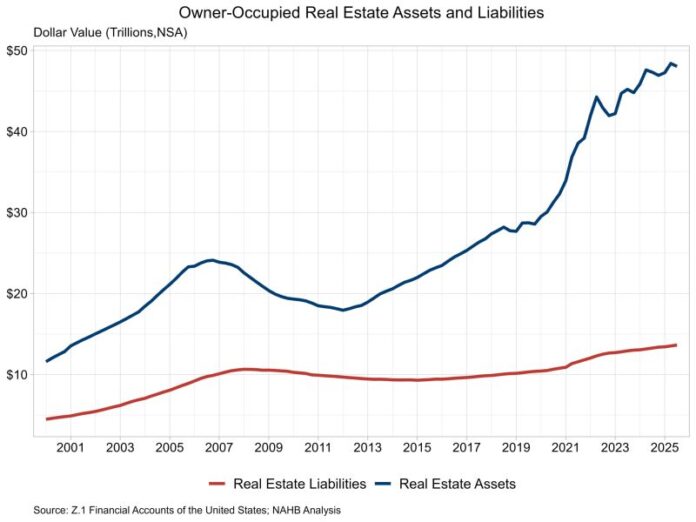

The market value of household real estate assets fell to $48.0 trillion in the third quarter of 2025, according to the most recent release of U.S. Federal Reserve Z.1 Financial Accounts. The third quarter value is 0.7% lower than the second quarter but is 1.5% higher than a year ago.

This measure of market value estimates the value of all owner-occupied real estate nationwide. The calculation combines both repeat-home sales data with estimates of additions to the housing stock, essential measuring both price changes and the change in quantity of housing assets. This approach explains why household real estate wealth can continue to rise even as other measures may show a slowing in home price growth.

Real estate secured liabilities of households’ balance sheets, i.e. mortgages, home equity loans, and HELOCs, increased 0.8% in the third quarter to $13.6 trillion. This level is 2.8% higher compared to the third quarter of 2024.

Owners’ equity share of real estate assets was 71.6% in the third quarter, slightly lower than the second quarter due to the decline in real estate asset values. The share in the third quarter of 2024 was 72.0% and has been above 70% for 15 consecutive quarters, the longest stretch since the 1950s. Owners’ equity in real estate was $34.4 trillion in the third quarter.