Challenging affordability conditions continue to act as headwinds for the housing industry, but the sector could see lower interest rates in the near future with the Federal Reserve expected to cut short-term interest rates this afternoon.

Overall housing starts decreased 8.5% in August to a seasonally adjusted annual rate of 1.31 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

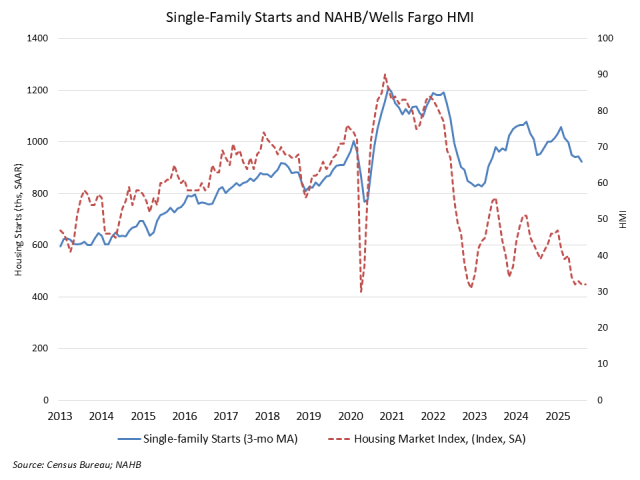

The August reading of 1.31 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts decreased 7% to an 890,000 seasonally adjusted annual rate and are down 4.9% on a year-to-date basis. This was the lowest reading since July of 2024 for single-family home building.

The multifamily sector, which includes apartment buildings and condos, decreased 11.7% to an annualized 417,000 pace. While apartment construction has declined in 2025 in larger population metropolitan areas, the apartment development sector has been solid in lower density areas including some exurban locations, per tracking from the NAHB Home Building Geography Index.

With the Fed expected to reduce the federal funds rate later today, this return to monetary policy easing will help the mortgage market indirectly and lead to lower interest rates for building and land development loans, which will help builders to boost housing production. The September NAHB/Wells Fargo Housing Market Index (HMI) shows builders reported an increase for future market expectations as mortgage rates have posted a modest decline in recent weeks.

On a regional and year-to-date basis, combined single-family and multifamily starts were 8.3% higher in the Northeast, 15% higher in the Midwest, 3.5% lower in the South and 0.1% higher in the West.

Overall permits decreased 3.7% to a 1.31-million-unit annualized rate in August. Single-family permits decreased 2.2% to an 856,000-unit rate and are down 7% on a year-to-date basis. Multifamily permits decreased 6.4% to a 456,000 pace.

Looking at regional permit data on a year-to-date basis, permits were 16.3% lower in the Northeast, 6.2% higher in the Midwest, 5.6% lower in the South and 5.2% lower in the West.

The slowing of single-family housing starts during 2025 has had a measurable impact on the number of single-family homes under construction. As of August, there were 611,000 single-family under construction, this down 4.8% from a year ago.

Due to declines for multifamily construction starts in 2024, the number of apartments under construction has fallen 20% to 706,000 units in August.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.