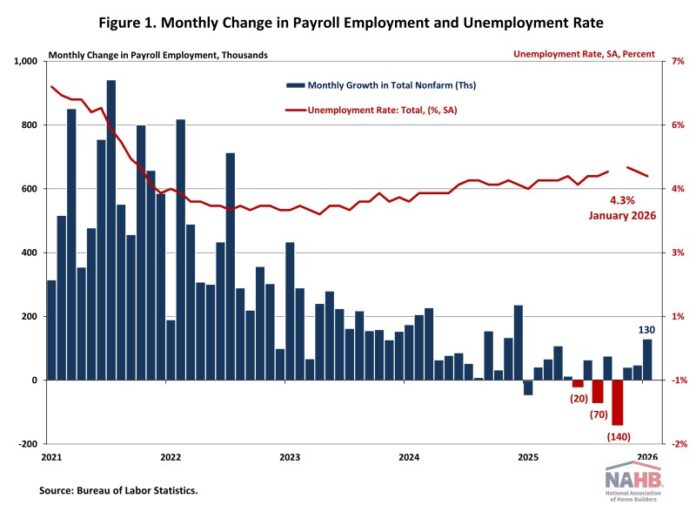

The U.S. labor market began 2026 at a surprisingly strong pace, while newly released benchmark revisions show that job growth in 2025 was considerably weaker than previously reported. Nonfarm payrolls increased by 130,000 jobs in January, and the unemployment rate edged down to 4.3%. January’s job gains were concentrated on health care, social assistance, and construction, while federal government and financial activities experienced job losses.

The establishment survey data released today were benchmarked to reflect comprehensive counts of payroll jobs for March 2025. This annual benchmark process results in revisions to seasonally adjusted data from January 2021 forward. The updated figures show the labor market added only 181,000 jobs in 2025, down sharply from the previously reported 584,000. The revised job gains for 2025 are far fewer than the 1.46 million jobs added in 2024. Excluding recession years (2008, 2009, and 2020), 2025 now stands as the weakest year of employment growth since 2003.

Wage growth was unchanged in January, with average hourly earnings rising 3.7% year-over-year. This pace is 0.3 percentage points lower than a year ago. Importantly, wage growth has been outpacing inflation for nearly two years, which typically occurs as productivity increases.

National Employment

According to Employment Situation Summary reported by the Bureau of Labor Statistics (BLS), total nonfarm payroll employment rose by 130,000 in January, marking the strongest monthly gain since December 2024.

The unemployment rate edged down to 4.3% in January, following 4.4% in December. Over the month, the number of persons unemployed declined by 141,000, while the number of persons employed increased by 528,000.

Meanwhile, the labor force participation rate—the proportion of the population either looking for a job or already holding a job—edged up 0.1 percentage points to 62.5%. This remains below its pre-pandemic level of 63.3% recorded at the beginning of 2020. Among prime working-age individuals (aged 25 to 54), the participation rate rose to 84.1%, the highest level since 2001, reflecting strong engagement in the core workforce.

In January, industry trends remained mixed. Health care added 82,000 jobs in January, and social assistance increased by 42,000. In contrast, federal government jobs declined by 34,000 and financial activities shed 22,000 jobs.

Construction Employment

Employment in the overall construction sector increased by 33,000 jobs in January, after an upwardly revised loss of 4,000 in December. Within the industry, residential construction added 5,900 jobs, while non-residential construction added 27,900 positions. Overall construction employment was essentially flat in 2025, compared with a gain of 176,000 jobs in 2024.

Residential construction employment now stands at 3.3 million in January, including 952,000 workers employed by builders and remodelers and nearly 2.4 million residential specialty trade contractors.

The six-month moving average of job gains for residential construction remains negative, at a loss of 2,083 per month, reflecting losses in three of the past six months. Over the last 12 months, residential construction has seen a net loss of 43,600 jobs, marking the eleventh consecutive annual decline and the longest stretch of annual losses since the Great Recession. Since the low point following the Great Recession, residential construction has gained 1,312,900 positions.

In January, the unemployment rate for construction workers edged down slightly to 4.7% on a seasonally adjusted basis, remaining relatively low compared with historical norms.