J.P. Morgan Chase has thrown a curveball into the financial world, predicting that the Federal Reserve won’t be lowering interest rates anytime soon. In fact, they’re saying no rate cuts at all throughout 2026. This is a pretty big deal because it means the cost of borrowing money for things like mortgages and car loans could stay higher for longer than many people were expecting.

J.P. Morgan Predicts No Fed Rate Cuts Until At Least 2027

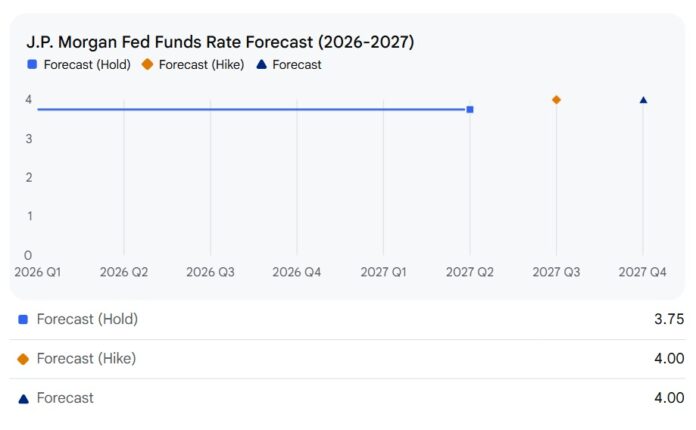

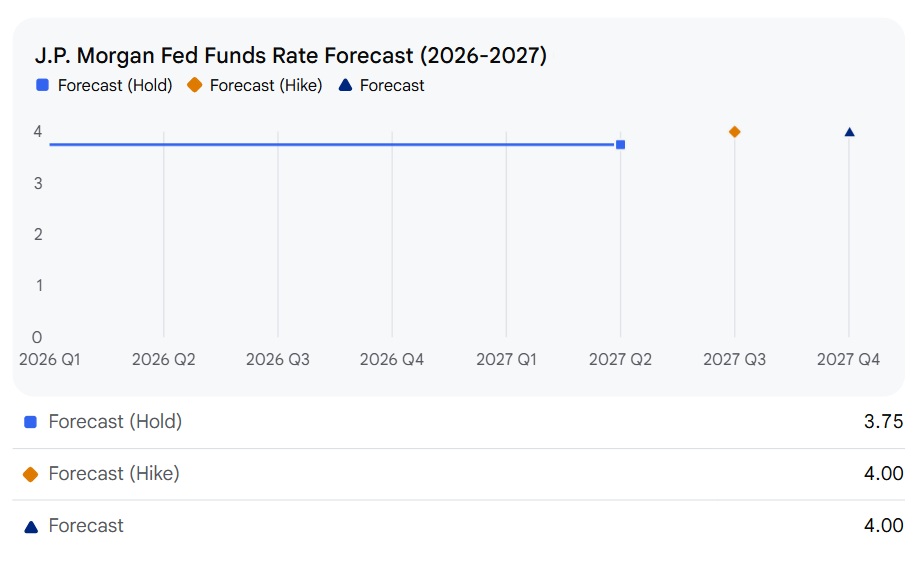

I’ve been following the economy and how the Federal Reserve makes its decisions for a while now, and I have to say, J.P. Morgan’s take is certainly a contrarian one. Most of the chatter out there, and what many other big banks are saying, is that we should expect some rate cuts next year. But J.P. Morgan’s chief U.S. economist, Michael Feroli, has painted a different picture. He believes the Fed will keep rates steady at their current range of 3.5%–3.75%. And get this – their next move? It might not be a cut, but a hike of 25 basis points in the third quarter of 2027.

Why such a drastic shift in thinking? Well, it boils down to a few key things that J.P. Morgan is seeing in the economic picture.

Why the Long Pause? J.P. Morgan’s Reasoning

1. A Stubbornly Strong Economy

One of the main reasons the Fed might not rush to cut rates is that the economy is showing more resilience than many predicted. We’re not seeing the widespread job losses that usually signal a need for lower borrowing costs. In fact, the labor market has been surprisingly stable. The December unemployment rate was at a respectable 4.4%. This suggests that businesses are still hiring and people are still earning money, which reduces the immediate pressure on the Fed to stimulate things by making borrowing cheaper.

From my perspective, a strong job market is fantastic news for most people. It means greater job security and more opportunities. However, for the Fed, it can be a double-edged sword. If the economy is running hot, they worry about inflation picking up again.

2. Inflation Isn’t Going Away (According to Them)

This is a big one. J.P. Morgan economists believe that core inflation – which is inflation excluding volatile food and energy prices – will stay above 3% for all of 2026. They point to government spending (fiscal stimulus) and the ripple effects of tariffs as reasons for this. If inflation is stubbornly high, the Fed’s main tool to fight it is by keeping interest rates elevated. Lowering rates when inflation is high would be like pouring gasoline on a fire.

I find this point particularly interesting. We’ve seen inflation come down from its peaks, but getting it all the way back to the Fed’s target of 2% has been a challenge. The persistence of services inflation – things like haircuts, car repairs, and rent – is something I’ve been watching closely. If those costs keep climbing, it definitely makes a case for the Fed to stay on the sidelines.

3. Reaching a “Neutral” Stance

Another idea thrown around is that the current interest rate level is getting close to what economists call a “neutral rate.” This is the rate that neither stimulates nor cools down the economy. J.P. Morgan thinks we’re approaching that point, meaning the Fed might shift its focus from actively trying to manage risks (like a potential recession) to simply letting the economy run at a steady, sustainable pace. It’s about “normalization,” which simply means getting back to a more typical economic environment.

How Does J.P. Morgan’s View Compare to Others?

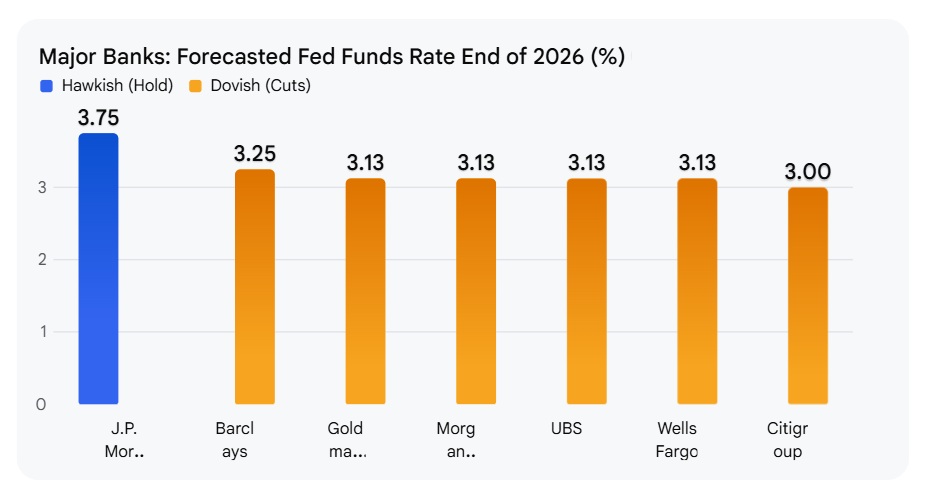

This is where things get really interesting. J.P. Morgan’s prediction is definitely on the more cautious, or some might say hawkish (meaning they favor higher rates), side.

- Market Expectations: If you look at tools like the CME FedWatch Tool, which tracks what traders are betting on, they are still pricing in at least one or two rate cuts in 2026, with many expecting a move as early as June.

- Other Big Banks: While other major institutions like Goldman Sachs and Barclays have also pushed back their forecasts for rate cuts, they still anticipate the Fed will lower rates. They’re just saying it will happen later in 2026 and not as aggressively as previously thought. For example, Goldman Sachs is now thinking two 25-basis-point cuts in June and September 2026.

- The Fed Itself: Even the Federal Reserve’s own projections, known as the “Dot Plot,” have indicated a median expectation of one 25-basis-point cut in 2026.

It’s clear that there’s a division of opinion among financial experts. This disagreement is what makes forecasting so challenging but also so crucial.

What J.P. Morgan’s Prediction Means for You

If J.P. Morgan’s forecast is accurate, it has some real-world implications for everyday people and businesses:

- Mortgage Rates Stay High: For anyone looking to buy a home or refinance, this means that 30-year fixed mortgage rates are likely to remain above 6% throughout 2026. This makes affording a home more challenging, as the monthly payments are higher.

- Housing Market Slowdown: With borrowing costs staying elevated, fewer people will be able to afford to buy homes. J.P. Morgan predicts that national home prices will likely stall, with 0% growth in 2026. This isn’t necessarily a crash, but it means the rapid price increases we’ve seen in some areas might cool off significantly.

- Business Borrowing Costs: Businesses that need to borrow money for expansion or operations will also face higher interest costs, which can slow down investment and hiring.

A Word on Fed Leadership

It’s also worth noting an interesting political wrinkle. Jerome Powell’s term as Fed Chair expires in May 2026. Who is nominated to take over can introduce a significant amount of political uncertainty into these forecasts. Different presidents might prefer different economic philosophies, and that could influence how the Fed operates. This adds another layer of complexity when we try to predict what the Fed will do in the coming years.

My Take on the Matter

I lean towards believing that the Fed will likely eventually cut rates in 2026 out of necessity, but perhaps not as early or as much as many expect. J.P. Morgan’s view is a stark reminder of the uncertainties we face. They are highlighting the possibility that the fight against inflation might require more patience and higher rates for longer than the optimistic market sentiment suggests.

The key takeaway for me is that while many are hoping for a return to lower interest rates soon, it’s wise to prepare for a scenario where rates remain elevated for an extended period. This means being more careful with debt, focusing on savings, and making informed decisions about big purchases.

Strong Returns With Turnkey Rentals Despite Fed Uncertainty

The Fed’s rate decisions can create market volatility, but turnkey rentals continue to deliver reliable cash flow and appreciation. Investors in 2026 are focusing on real estate as a hedge against uncertainty.

Norada Real Estate helps you secure turnkey properties designed for immediate income and long‑term growth—so your portfolio stays strong regardless of Fed policy shifts.

🔥 HOT INVESTMENT LISTINGS JUST ADDED! 🔥

Speak with an Investment Counselor Today (No Obligation):

(800) 611-3060

Or Request a Callback / Fill Out the Form Online

Want to Know More?

Explore these related articles for even more insights: