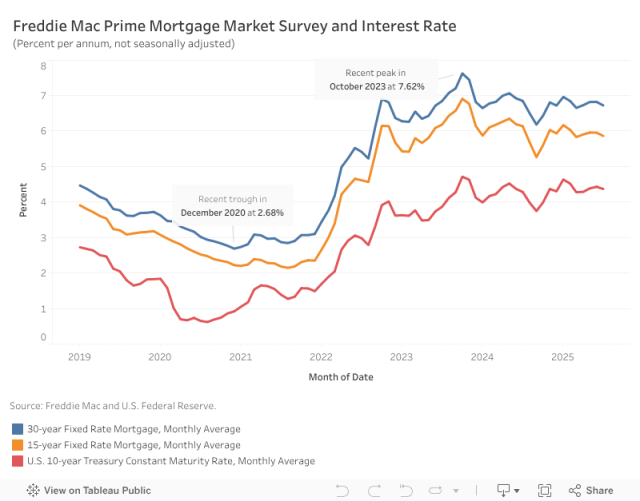

Average mortgage rates in September trended lower as the bond market priced in expectations of rate cuts by the Federal Reserve. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.35%, 24 basis points (bps) lower than August. Meanwhile, the 15-year rate declined 21 bps to 5.50%. Despite the recent drop, rates remain higher than a year ago as last September saw the lowest levels in about two years. The 30-year rate is currently higher by 17 basis points (bps), and the 15-year rate is higher by 24 bps, year-over-year.

The 10-year Treasury yield, a key benchmark for long-term borrowing, averaged 4.14% in September – a 15 bps decrease from the previous month. Markets began pricing in rate cuts from the Fed at the start of the month, particularly after news that jobless claims rose while inflation remained modest. On September 17, the Federal Reserve announced a 25 bps cut to the federal funds rate, bringing the target range to 4.00% – 4.25%.

Falling mortgage rates have already shown an impact on housing activity. New single-family home sales in August jumped 20.5% from the previous month, although we believe that estimate will be revised lower. Furthermore, according to the latest Mortgage Bankers Association (MBA) report, mortgage application activity strengthened, with refinancing applications rising and purchase applications remaining solid.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.