Are you thinking about buying a home, refinancing your mortgage, or just keeping an eye on the market? Then you’re probably wondering: what’s going to happen with mortgage rates in the next couple of months? Good news! All indications suggest that mortgage rates are expected to modestly decline between September and October 2025.

With 30-year fixed mortgage rates currently around 6.56% as of late August 2025, anticipate the potential for slight easing due to anticipated Federal Reserve rate cuts. Let’s dive into the details and explore what factors are shaping this forecast, and what it means for you.

I know, reading about economic forecasts can be overwhelming. But I’m here to break it down in a way that’s easy to understand, even if you’re not an economist. Together, we’ll look at what’s happening right now, what could change things, and how you can make smart decisions based on what we know.

Mortgage Rates Predictions Next 60 Days: September to October 2025

Current Mortgage Rate Landscape

Let’s start with where we are today. As of August 28, 2025, the average 30-year fixed mortgage rate is sitting at 6.56%. That’s according to Freddie Mac’s Primary Mortgage Market Survey. It’s bobbing around the 6.5% area across multiple surveys. So, what does this mean in plain terms? Well, it means you’ll pay $6.56 in interest for every $100 you borrow over 30 years, with your payments spread out.

Think of it like this: Earlier in January of 2025, rates averaged 6.91%. So you’re catching a slight break and can potentially lock in a lower rate.

- 30-year fixed: ~6.56%

- Jumbo loans: ~6.80%

- FHA rates: ~6.28%

Factors Influencing Rates in the Coming Months

Now, let’s get to the heart of the matter: what’s going to push mortgage rates up or down in September and October of 2025? A few key things are at play here:

Expert Forecasts and Variations

So, what are the experts saying? It’s important to realize that no one has a crystal ball, of course, but here’s a rundown of what some of the big players are forecasting:

- Mortgage Bankers Association (MBA): They’re predicting 6.8% for July to September 2025, and 6.7% for October to December.

- Fannie Mae: It looks like they are seeing rates ending the year close to 6.4% because they’ve revised their outlook based on better economic news.

- National Association of Realtors (NAR): They believe rates will be around 6.7% for the second part of 2025 – but keep in mind, this really relies on rates easing (dropping a little) rather than staying where they are.

- Wells Fargo: They have it at 6.65% for July to September 2025.

Now, what if these experts are wrong? It’s very possible rates will stay stagnant if inflation goes back up. The Fed could also hold back on cutting rates if the economic news looks strong!

Norada Real Estate Investments’ Prediction: A Modest Decline

Given all of this info, here’s the prediction that we would make: I believe the trend will be a slight decline in September and October 2025. If things go as expected, we’ll land around 6.4% in September and head down to 6.3% in October. This forecast assumes the Fed cuts rates by 0.25% and no big shockers happen in the stock markets.

Impacts on Homebuyers, Sellers, and Investors

Okay, so what does this all mean for you?

- Homebuyers: Rates between 6.3 – 6.4% could make your monthly payments a bit less. This could help with affordability and make it easier to purchase a home.

- Sellers: If rates drop, some people who’ve felt “stuck” might list their homes.

- Investors: If you’re in the market for rental properties, cheaper financing can improve your returns.

But don’t get too excited just yet! If rates are closer to 6.5%, affordability will still be an issue. Remember that home prices do go up every year! Refinancing will only make sense if your rate is above 7%.

Advice for Navigating September and October 2025

Ready to plan your next move? Here’s some advice, no matter what your situation:

- Buyers: If you want to purchase a house, lock in a rate early! You might also consider adjustable-rate mortgages (ARMs). While rates can change, they may provide short-term savings.

- Refinancers: Pay close attention to news from the Fed! If they cut rates in September, take action!

- Investors: Keep an eye out for areas where demand is strong.

- Everyone: Stay educated! Read articles, and read financial news. The more you know, the better you can make decisions.

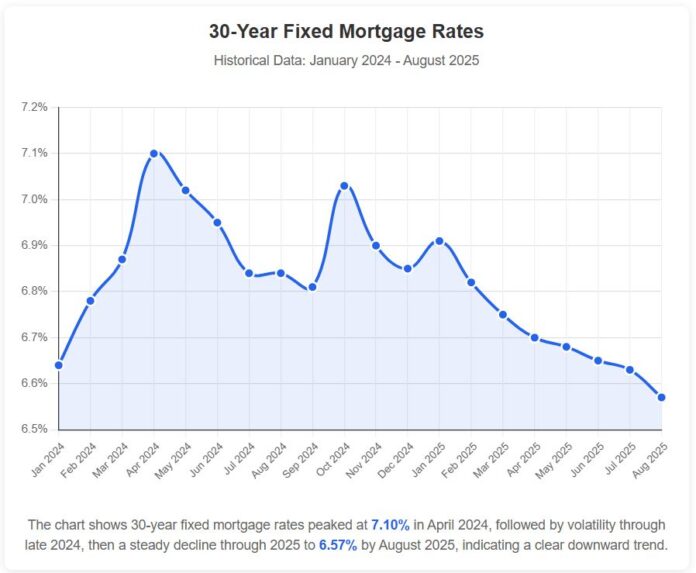

A Look At History

A look at the past always helps to understand the present and future.

Let’s take a look at a simple chart that indicates recent historical data for 30-year fixed rates:

| Month/Year | Average Rate (%) |

|---|---|

| Jan 2024 | 6.64 |

| Feb 2024 | 6.78 |

| Mar 2024 | 6.87 |

| Apr 2024 | 7.10 |

| May 2024 | 7.02 |

| Jun 2024 | 6.95 |

| Jul 2024 | 6.84 |

| Aug 2024 | 6.84 |

| Sep 2024 | 6.81 |

| Oct 2024 | 7.03 |

| Nov 2024 | 6.90 |

| Dec 2024 | 6.85 |

| Jan 2025 | 6.91 |

| Feb 2025 | 6.82 |

| Mar 2025 | 6.75 |

| Apr 2025 | 6.70 |

| May 2025 | 6.68 |

| Jun 2025 | 6.65 |

| Jul 2025 | 6.63 |

| Aug 2025 | 6.57 |

I’ve even created a very simplistic line chart for easy understanding:

Final Thoughts

To wrap it up, while no one can say for sure what will happen, things are pointing to at least a slight easing in mortgage rates over the next couple of months. The Fed’s decisions, inflation levels, and overall employment rates will be the biggest indicators. It’s time to stay alert and make sure you’re ready to make smart choices!

Capitalize Amid Rising Mortgage Rates

With mortgage rates expected to remain high in 2025, it’s more important than ever to focus on strategic real estate investments that offer stability and passive income.

Norada delivers turnkey rental properties in resilient markets—helping you build steady cash flow and protect your wealth from borrowing cost volatility.

HOT NEW LISTINGS JUST ADDED!

Speak with a seasoned Norada investment counselor today (No Obligation):

(800) 611‑3060