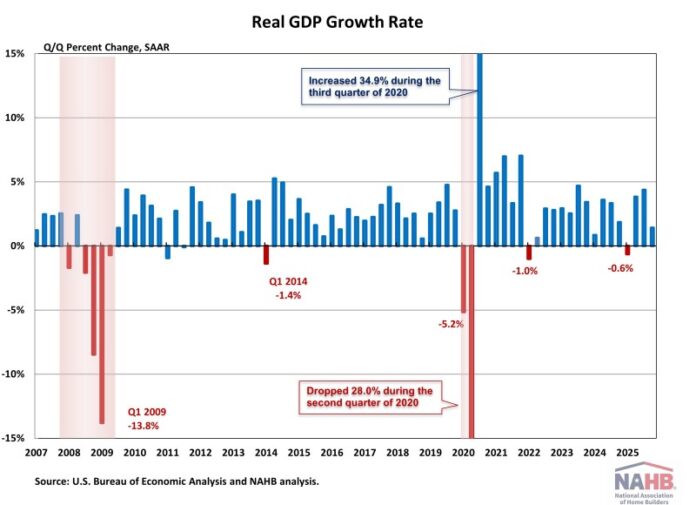

Real GDP growth slowed sharply in the fourth quarter of 2025 as the historic government shutdown weighed on economic activity. While consumer spending continued to drive growth, federal government spending subtracted over a full percentage point from overall growth.

According to the “advance” estimate released by the Bureau of Economic Analysis (BEA), real gross domestic product (GDP) expanded at an annual rate of 1.4% in the final quarter of 2025, a notable deceleration from a 4.4% increase in the third quarter. This growth rate was below the NAHB forecast for the quarter.

Furthermore, the latest data from the GDP report indicates that inflationary pressures intensified over the quarter. The price index for gross domestic purchases rose 3.7%, up from a 3.4% increase in the third quarter of 2025. The Personal Consumption Expenditures Price (PCE) Index, which measures inflation (or deflation) across various consumer expenses and reflects changes in consumer behavior, increased 2.9% in the fourth quarter. This is slightly higher than a 2.8% rise in the previous quarter.

For the full year, real GDP grew 2.2% in 2025. It marks a slowdown from the 2.8% increase in 2024 and stands as the weakest annual growth rate since the pandemic. The annual gain matched NAHB’s forecast and primarily reflected continued strength in consumer spending and gains in investment.

Breaking down the fourth-quarter data further, the increase in real GDP primarily reflected increases in consumer spending and investment, partially offset by decreases in government spending and exports. Imports, which are a subtraction in the calculation of GDP, decreased during the quarter as tariffs had measurable effects.

Consumer spending, the backbone of the U.S. economy, rose at an annual rate of 2.4% in the fourth quarter, the slowest pace since the first quarter of 2025. Spending on services remained solid, increasing at a 3.4% annual rate, while spending on goods edged down 0.1%.

Gross private domestic investment added 0.66 percentage points to headline GDP growth in the fourth quarter. The gain in investment was primarily driven by increases in intellectual property products, private inventory investment, and equipment spending.

Government spending fell, reflecting the effects of a prolonged federal government shutdown.

Nonresidential fixed investment increased 3.7% in the fourth quarter. The increases in equipment (+3.2%) and intellectual property products (+7.4%) offset the decrease in structures (-2.4%). Meanwhile, residential fixed investment (RFI) declined 1.6% in the fourth quarter, marking the fourth consecutive quarterly decline. Within the residential category, single-family permanent site structures fell 5.2% at an annual rate, multifamily permanent site structures declined 3.6%, and spending on home improvements dropped 3.2%.

For the common BEA terms and definitions, please access bea.gov/Help/Glossary.