Are you dreaming of a 4% mortgage rate next year? If you’re like many, you’re probably wondering whether you hold off on buying a home or refinancing, hoping those super-low rates from the pandemic will make a comeback. The short and honest answer is no, experts aren’t predicting mortgage rates will drop to 4% next year (2026). While there might be some small fluctuations, the general consensus is that rates will likely stay in the mid-6% range. Let’s dive into why that’s the case and what it means for you.

Mortgage Rates Predictions for Next Year: Will Rates Go Down to 4%?

Current Mortgage Rate Reality

Right now, as of late July 2025, if you go to get a 30 year fixed mortgage (the most common type), you’re looking at an average interest rate of around 6.85%. Of course, this isn’t set in stone– it depends on your credit score, the size of your down payment, and which lender you go through.

To give you some perspective, here’s a quick snapshot of where things stand:

- 30-Year Fixed Mortgage Rate: Approximately 6.85%

- 15-Year Fixed Mortgage Rate: Around 5.87%

Now, I know what you’re thinking: “That’s way higher than the 2.65% we saw during the peak of COVID-19!” And you’re right. Those rates were truly exceptional, driven by emergency measures to prop up the economy during an unprecedented crisis. It was a unique situation, unlikely to be repeated any time soon.

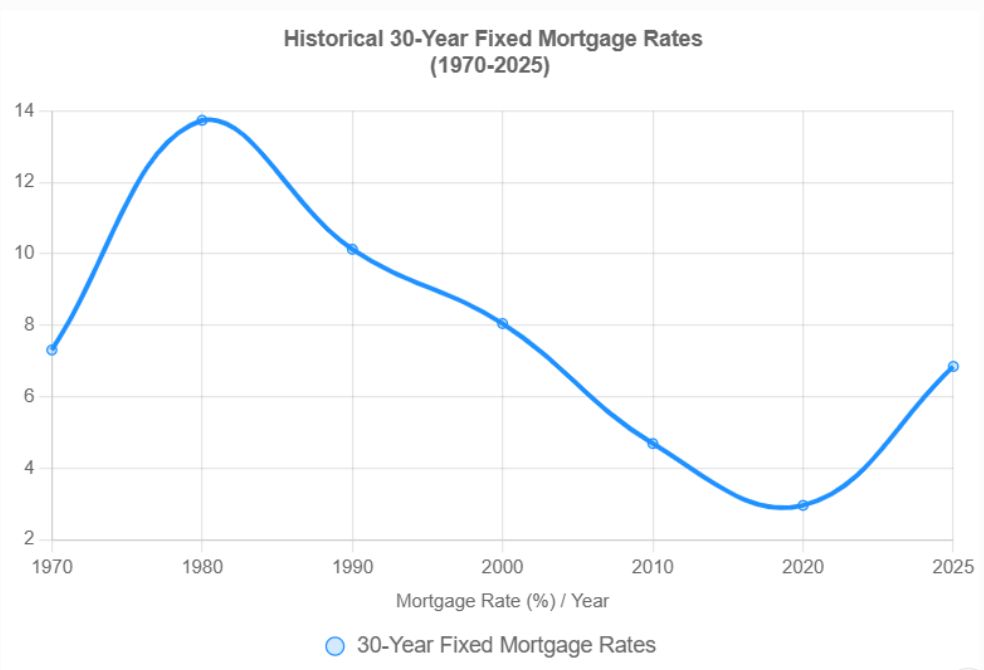

It’s also worth noting that sub-3% rates are not typical. For many decades, interest rates ranged from 6%-18.36% from 1971 to 2024. In the 1980s it was common to pay over 10% for a mortgage.

Expert Predictions: What the Forecasters Are Saying

Since the future is in no one’s hands, let’s examine some predictions made by the experts.

So, who are these magical forecasters, and what are they saying about 2026? I’ve gathered predictions from some major players in the real estate and finance game:

| Organization | 2025 Average Forecast | 2026 End Forecast |

|---|---|---|

| National Association of Realtors (NAR) | 6.4% | 6.1% |

| Fannie Mae | 6.7% | 6.1% |

| Mortgage Bankers Association (MBA) | 6.8% (Q3), 6.7% (Year-End) | 6.6% (Q1) |

| Wells Fargo | 6.66% | Not Provided |

| Realtor.com | 6.3% | 6.2% |

| National Association of Home Builders (NAHB) | 6.75% | ~6.62% (End of 2025) |

As you can see, there’s a consensus: no one is expecting a return to 4%. Most experts predict rates will hover in the low-to-mid 6% range throughout 2026. While there is some variation, for the most part, they all say the same thing.

Key Factors Shaping Mortgage Rates

Why aren’t rates expected to plummet? A variety of economic forces are at play. Here are some of the biggest influences:

- Inflation: This is the big one. When prices rise too quickly, the Federal Reserve (the Fed) tends to raise interest rates to cool things down. While inflation has come down significantly from its peak in 2022, it’s still above the Fed’s target of 2%. As long as inflation remains elevated, mortgage rates are likely to stay higher as well.

- Federal Reserve Policies: The Fed directly controls the federal funds rate, which is the interest rate banks charge each other for overnight lending. While mortgage rates are technically different, they tend to loosely follow the trends set by the Fed. If the Fed continues to raise or maintain the federal funds rate, mortgage rates typically follow suit.

- Economic Growth: A strong economy can actually put upward pressure on interest rates. Here’s why: when the economy is booming, demand for goods and services increases, which can lead to inflation. To keep things in check, the Fed may raise interest rates, indirectly impacting mortgage rates.

- Global Events: Trade wars, political instability, and other global events can create economic uncertainty, which can then impact interest rates. It’s like a ripple effect – problems overseas can affect how much you pay for your mortgage here at home.

A Look Back: Mortgage Rate History

To really understand where we are, it helps to take a trip down memory lane. Here’s a condensed history of mortgage rates in the US:

- 1970s-1980s: Think double-digit rates! Inflation was rampant, and mortgage rates soared, peaking at a whopping 18.63% in 1981. Can you imagine paying almost 19% on your mortgage?

- 1990s-2000s: A period of more moderate rates between 6-8%, as inflation started to cool off.

- 2010s: After the 2008 financial crisis, rates dipped to the 4-5% range, reflecting a recovering economy.

- 2020-2021: The pandemic era saw record-low rates below 3%, thanks to the Fed’s efforts to stimulate the economy.

- 2022-2023: As inflation spiked, rates jumped to a 23-year high, climbing above 7%.

As you can see, today’s rates, while higher than the pandemic lows, are actually pretty average when you zoom out and look at the bigger picture. Those super-low rates from 2020-2021 were a blip in the timeline, not the norm.

Deconstructing the Unlikelihood of 4% Mortgage Rates in 2026

Based on what we’ve seen so far, there are a few reasons why expecting rates to plummet to 4% next year is overly optimistic:

- Inflation’s Staying Power: As long as inflation remains above the Fed’s target, significant rate cuts are unlikely.

- The Fed’s Cautious Approach: The central bank is likely to take a measured approach to easing monetary policy, so drastic rate cuts are off the table.

- Still relatively High Treasury Yields: The 10-year Treasury yield, a key benchmark for mortgage rates, is hovering around 4.42% . This yield has to decrease substantially to translate into meaningful mortgage rate reduction.

- Economic Stability: A stable economy doesn’t necessarily need ultra-low rates to keep things humming.

Could Rates Go Lower? Possible Scenarios

While a drop to 4% is unlikely, here are a few possible scenarios that could lead to lower rates (though these are less probable):

- A Sharp Decline in Inflation: If inflation were to suddenly plummet well below the Fed’s 2% target, the central bank might feel more comfortable cutting rates aggressively.

- An Economic Recession: A significant economic downturn could force the Fed to slash rates to stimulate growth.

- Global Stability: Reduced trade tensions and more political stability could ease economic uncertainty.

Keep in mind, these are just hypothetical situations. Most economists aren’t expecting any of these scenarios to play out.

What This Means for Homebuyers

Higher mortgage rates undeniably impact your wallet. They translate to higher monthly mortgage payments, which can make it more challenging to afford a home.

Here are some tips to navigate today’s higher rate environment:

- Boost Your Credit Score: A higher credit score can qualify you for a lower interest rate.

- Increase Your Down Payment: A larger down payment can lower your loan-to-value ratio, potentially resulting in a better rate.

- Consider an Adjustable-Rate Mortgage (ARM): ARMs often have lower initial rates, but keep in mind that the rate can adjust in the future.

- Shop Around: It’s essential to compare rates from multiple lenders to find the best deal.

- Don’t Wait Endlessly: Waiting for lower rates could mean missing out on your dream home and paying even more if housing prices continue to rise.

The Bottom Line

Hope is not a strategy, according to many experts out there. I understand wanting rates to fall to 4% or lower, but from the research I’ve done, I think this is unlikely. This highlights the importance of being realistic about your expectations and focusing on what you can control. Improve your credit, save for a larger down payment, and shop around for the best rates.

While it’s always good to be informed, don’t let interest rates scare you too much. As mentioned previously, these rates are not out of the norm and similar to some historical rates.

Based on current economic conditions and expert forecasts, I don’t believe mortgage rates will plunge to 4% in 2026. The consensus is that rates will likely stay in the mid-6% range. Homebuyers should focus on taking steps now to secure the best possible rates.

Invest Smarter in a High-Rate Environment

With mortgage rates remaining elevated this year, it’s more important than ever to focus on cash-flowing investment properties in strong rental markets.

Norada helps investors like you identify turnkey real estate deals that deliver predictable returns—even when borrowing costs are high.

HOT NEW LISTINGS JUST ADDED!

Connect with a Norada investment counselor today (No Obligation):

(800) 611-3060