The question on many potential homebuyers’ minds is: will Trump lower mortgage interest rates? The short answer is, it’s highly unlikely that a second Trump presidency would lead to a significant, sustained drop in mortgage rates. While some of his policies might have a minor, temporary impact, the bigger picture involves complex economic forces that are largely outside any president’s direct control. Let’s dive into what’s really at play and why I’m leaning towards a more cautious outlook.

Will Trump Lower Mortgage Interest Rates?

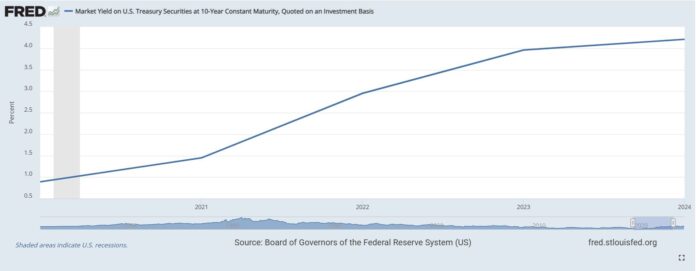

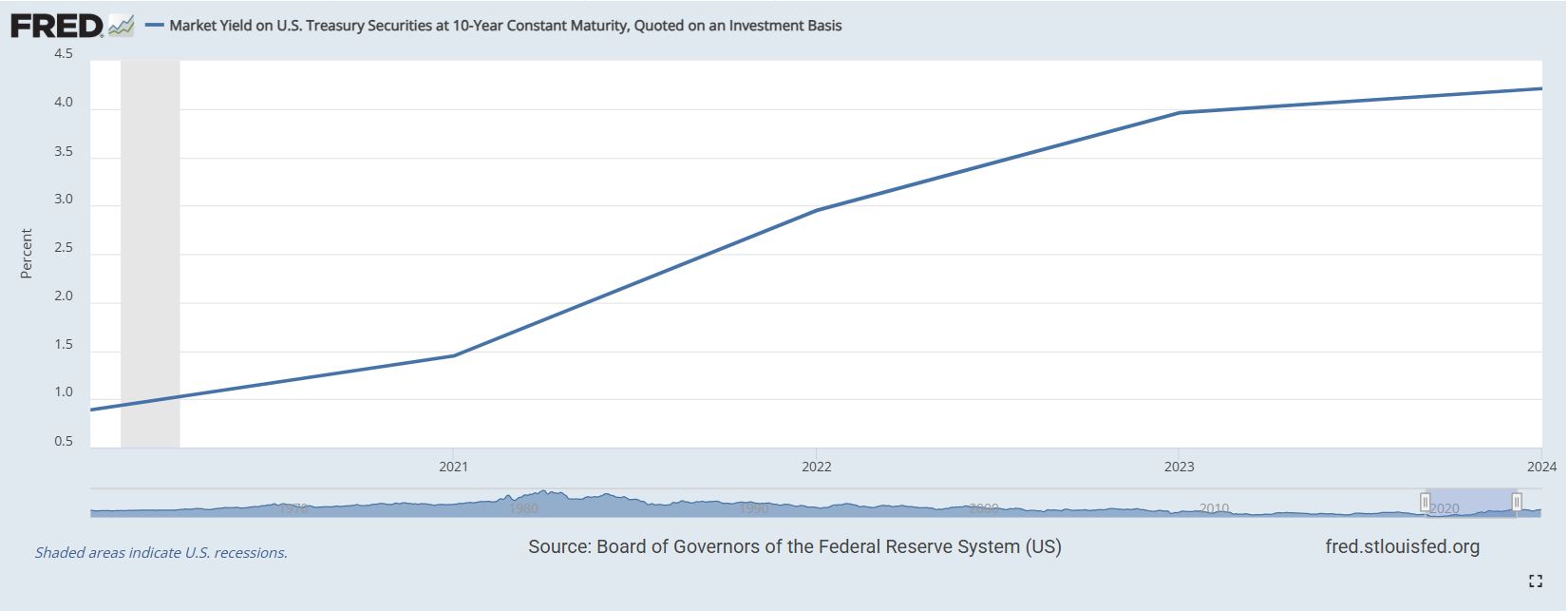

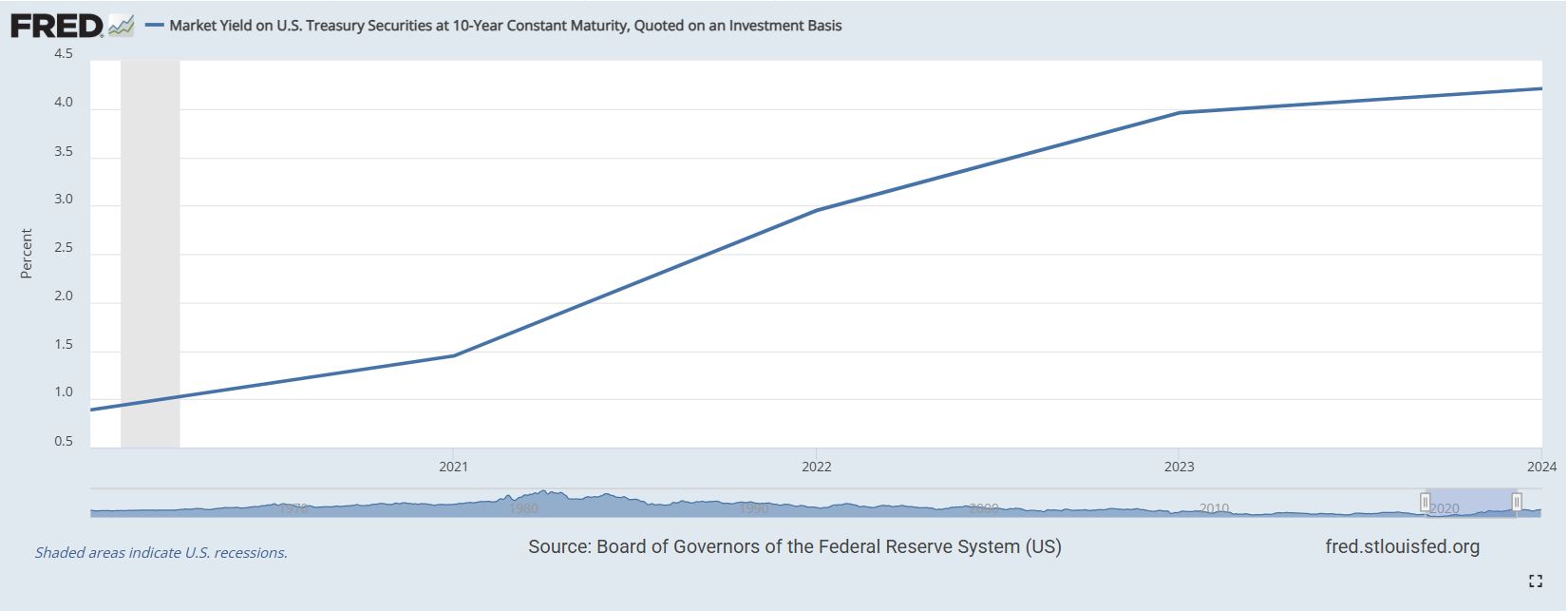

Okay, so, mortgage rates aren’t just some number plucked out of thin air. They’re influenced by a bunch of factors, the most important being the 10-year Treasury yield. Think of the Treasury yield as the temperature gauge of the bond market. When investors are feeling good about the economy and low inflation, the demand for these safe-haven bonds drops, yields go up and, unfortunately, mortgage rates follow suit. It’s like a seesaw, and this is where things get interesting with Trump’s proposed economic moves.

Understanding the Connection: Treasury Yields, Spreads, and Mortgage Rates

It’s important to understand that the correlation between the Treasury yield and mortgage rates is not a one-to-one ratio. There is also a ‘spread’ between the two, which is essentially the lender’s profit and also a measure of the perceived risk involved. The table below demonstrates how these figures have fluctuated over recent years:

| Year | Avg 30-Yr Mortgage Rate | 10-Yr Treasury Yield | Spread |

|---|---|---|---|

| 2020 | 3.11% | 0.89% | 2.22% |

| 2021 | 2.96% | 1.45% | 1.51% |

| 2022 | 5.34% | 2.95% | 2.39% |

| 2023 | 6.81% | 4.25% | 2.56% |

| 2024 | 7.12% | 4.50% | 2.62% |

Source: Freddie Mac, Federal Reserve.

As you can see, even when treasury yields were low, the spread remained significant. This is crucial as it implies that simply bringing down treasury yields may not significantly reduce mortgage rates. Economic uncertainty is likely to increase that spread.

Trump’s Policies: A Mixed Bag for Mortgage Interest Rates

Now, let’s unpack Trump’s policy proposals and see how they might affect this delicate balance:

1. The Tariff Tightrope: Inflation’s Potential Comeback

Trump’s known for his stance on trade, with talk of a 10% universal tariff on all imports and even higher tariffs—over 60%–on Chinese goods. Now, on the face of it, this might sound like it will help American businesses, and it could. But it also brings a whole host of inflationary concerns. The Peterson Institute, a well respected think tank, projects that a 10% tariff on all imports could increase consumer prices by about 1.3%. That’s not nothing. It means your everyday goods could get more expensive, and that’s where the Federal Reserve gets involved.

| Policy | Inflation Risk | Mortgage Rate Impact |

|---|---|---|

| 10% universal tariff | +1.3% CPI | +0.5–1.0% |

| 25% tariff on Canadian lumber | +5–10% homebuilding costs | Neutralizes deregulation benefits |

| 60% tariff on Chinese goods | Supply chain disruptions | +0.3–0.7% (long-term) |

If inflation goes up, the Fed is likely going to keep interest rates higher for longer to try and cool the economy down, which translates to higher mortgage rates. This is a very important point to grasp: tariffs can often be counterproductive to lower interest rates. Also, the 25% tariff on Canadian lumber is concerning, as it could increase the cost of homebuilding material, and any attempts to cut regulations would be easily negated.

2. Tax Cuts: A Double-Edged Sword

Next up, tax cuts. Trump’s plan to reduce corporate taxes from 21% to 15% and extend existing individual tax cuts is aimed at boosting economic activity. However, the Penn Wharton Budget Model projects this could add a staggering $5.3 trillion to the national deficit by 2033. How does that affect mortgage rates? Well, to cover these deficits, the government will have to issue more Treasury bonds. This is like adding more supply of something – more supply usually means less demand, thus yields might rise, and as you know, when yields rise, mortgage rates tend to climb as well. This is basic supply/demand economics.

3. Deregulation: A Possible Silver Lining?

Here’s where Trump’s policies could be beneficial for homebuyers. He’s looking at cutting regulations that add costs to home building. We’re talking about things like environmental reviews, zoning laws, and labor rules. The National Association of Home Builders (NAHB) estimates that these regulations account for about 24.3% of single-family home costs. Less regulation could mean less expensive homes. The key is to see if federal deregulation can cut through the red tape of state and local level bureaucracy. The unfortunate thing is, these deregulation benefits are easily offset by the tariffs, as seen above.

The Federal Reserve’s Balancing Act on Mortgage Interest Rates

The Fed plays a crucial role in all this. They’re supposed to be apolitical, but they’re not working in a vacuum. Trump has openly criticized Fed Chair Powell for not cutting rates faster. However, the Fed’s primary job is to keep inflation in check. As of June 2024, inflation sits stubbornly above the Fed’s target at 3.3% and, the Fed is most likely going to continue to hold the line, as a result, if inflation remains sticky. Here’s a quick look at different expert forecasts of where the Fed funds rate is headed in 2024 and how that impacts mortgage rates in 2025.

| Source | 2024 Fed Rate Forecast | 2025 Mortgage Rate Forecast |

|---|---|---|

| CME FedWatch | 4.75–5.00% | 6.4–6.8% |

| Goldman Sachs | 4.25–4.50% | 6.0–6.3% |

| Moody’s Analytics | 3.75–4.00% | 5.8–6.1% |

It’s clear, based on various expert predictions, that nobody is expecting a dramatic fall in rates. The Fed is unlikely to dramatically lower the Federal funds rate, unless inflation is brought down, and as I mentioned previously, Trump’s policies, such as universal tariffs, could exacerbate the inflationary conditions.

The Housing Affordability Crisis: It’s Not Just About Interest Rates

Now, interest rates are a big factor, but they’re not the only piece of the puzzle. Home prices have surged by 47% since 2020, while wages have only grown by 18%. Let that sink in for a second. This has dramatically reduced housing affordability. According to the National Association of Realtors, monthly payments for a median-priced home now take up 41% of a typical person’s income, compared to 29% pre-pandemic. That’s a huge jump!

| Metric | 2020 | 2024 |

|---|---|---|

| Median Home Price | $295,000 | $412,000 |

| Avg 30-Yr Mortgage Rate | 3.11% | 7.12% |

| Monthly Payment (20% Down) | $1,007 | $2,201 |

| Median Household Income | $68,703 | $81,059 |

| Payment-to-Income Ratio | 29% | 41% |

Source: NAR, U.S. Census Bureau

Simply lowering interest rates is a Band-Aid solution. It doesn’t solve the larger problem of housing affordability, nor does it address the root causes of inflation or the need for increased housing stock.

Global Forces: Beyond Our Shores

The U.S. economy isn’t an island, so global factors come into play. China and Japan hold over $1.7 trillion in U.S. debt. If they were to start reducing their Treasury holdings, that could send yields soaring. Plus, geopolitical risks, like the conflict in Ukraine, can drive up demand for U.S. treasuries, thus lowering the yields and the rates. But the effect is temporary and uncertain. Central bank policies in other countries matter too. If the European Central Bank (ECB) and the Bank of Japan (BOJ) cut rates, the dollar may get stronger, and could attract foreign investors to U.S. bonds, lowering the rates, yet again. These effects, although positive, are unlikely to lead to a dramatic drop in mortgage rates.

Expert Predictions: Not Much Optimism

Experts in the industry don’t seem too optimistic about rates going down significantly anytime soon. Here’s a look at some projections for 2025-2026:

| Institution | 2025 Forecast | 2026 Forecast | Key Assumptions |

|---|---|---|---|

| National Association of Realtors | 6.3% | 6.0% | Fed cuts, mild recession |

| Mortgage Bankers Association | 5.9% | 5.5% | Soft landing, inflation cools |

| Fannie Mae | 6.6% | 6.4% | Sticky inflation, slow growth |

| Redfin | 7.0% | 6.8% | Tariffs implemented, deficits rise |

As you can see, there isn’t a single major institution projecting a return to the sub 4% days. Most economists are predicting a range between 5.5% to 7%, depending on various factors. Redfin is, admittedly, the most pessimistic in their prediction due to Trump’s proposed tariffs.

Navigating the Market: What You Should Do as a Homebuyer

So, what do you do with this information if you’re thinking of buying a home? Here’s some strategic advice:

- Don’t Bank on Big Rate Drops: Don’t wait for some magical sub-4% rate. It’s just not realistic unless we hit a significant recession, and that’s not something any of us wants.

- Consider Refinancing Later: If rates do drop below 6%, it might be a smart move to refinance your existing mortgage. On a $300k mortgage, this could save you around $200 per month if you are starting at 7%.

- Explore Adjustable Rate Mortgages (ARMs): A 5/1 ARM might offer a lower initial rate. The average rate right now, for an ARM, is around 6.02% compared to 7.12% for a 30-year fixed. Be cautious, though, because the rate can change after the fixed period ends.

- Look into FHA Loans: FHA loans have a lower down payment requirement of just 3.5% compared to the typical 20% for conventional loans, and they might help with your affordability.

- Consider Less Expensive Markets: Look for cities where the median prices are much lower. In the Midwest, like Cleveland, the average home goes for around $235,000.

The Bottom Line: A Structural Problem

In conclusion, Will Trump lower mortgage interest rates? No, not likely in a substantial and sustainable way. While Trump’s deregulation plans could provide a modest boost to the housing supply, the structural issues facing the market are too large to overcome. We’re dealing with aging populations, international trade tensions, and a massive national debt. These are long-term issues, and rates will most likely remain elevated for the foreseeable future. Unless there is a severe recession (that I do not wish for) don’t expect a dramatic shift in rates.

Mark Zandi of Moody’s is correct to caution that the 2020s will be remembered as the decade of the “housing squeeze”. Buyers will need to adjust their expectations and make the best of what’s available. It’s a long-term game.

Work with Norada in 2025, Your Trusted Source for

Real Estate Investments in the United States

With mortgage rates fluctuating, investing in turnkey real estate

can help you secure consistent returns.

Expand your portfolio confidently, even in a shifting interest rate environment.

Speak with our expert investment counselors (No Obligation):

(800) 611-3060